Raymond James (RJF) Q1 Earnings Beat, Revenues & Costs Up Y/Y

Raymond James’ RJF first-quarter fiscal 2021 (ended Dec 31) adjusted earnings of $2.24 per share comfortably surpassed the Zacks Consensus Estimate of $1.71. Also, on a year-over-year basis, the bottom line increased 19%.

Results benefited from robust Capital Markets segment performance, which majorly supported revenue growth. Further, a rise in assets balance and strong balance sheet position were the tailwinds. However, higher operating expenses and drastic increase in loan loss provisions acted as undermining factors.

Net income (GAAP basis) was $312 million, up 16% from the prior-year quarter.

Revenues & Costs Rise

Net revenues were $2.22 billion, increasing 11% year over year. The rise was largely driven by higher total brokerage revenues and investment banking income. The top line also beat the Zacks Consensus Estimate of $2.05 billion.

Segment wise in the reported quarter, RJ Bank registered a decline of 23% from the prior year in net revenues. Nonetheless, Private Client Group and Asset Management recorded 4% and 6% rise in revenues, respectively.

Further, Capital Markets’ top line surged 69% from the year-ago quarter. Others recorded net revenues of $4 million, which improved from negative revenues of $10 million.

Non-interest expenses were up 10% to $1.82 billion. The increase was mainly due to higher compensation, commissions and benefits, and communications and information processing, and bank loan loss provision. Additionally, acquisition and disposition-related expenses were incurred during the quarter.

As of Dec 31, 2020, client assets under administration were $1.02 trillion, up 14% from the end of the prior-year quarter. Financial assets under management were $169.6 billion, up 12%.

Strong Balance Sheet & Capital Ratios

As of Dec 31, 2020, Raymond James reported total assets of $53.7 billion, up 13% sequentially. Total equity increased 8% from the fiscal fourth quarter to $7.4 billion.

Book value per share was $53.59, up from $49.26 as of Dec 31, 2019.

As of Dec 31, 2020, total capital ratio was 24.6% compared with 25.4% as of the Dec 31, 2019 level. Tier 1 capital ratio was 23.4% compared with 24.8% as of December 2019-end.

Return on equity (annualized basis) was 17.2% at the end of the reported quarter compared with 16.0% in the comparable prior-year period.

Share Repurchase Update

In the reported quarter, Raymond James repurchased approximately 0.1 million shares for $10 million. Under the previously announced share repurchase authorization, $740 million remained available as of Jan 26, 2020.

Our Take

Raymond James’ global diversification efforts, strategic buyouts and strength in investment banking business are expected to keep supporting top-line growth. However, continuously mounting operating expenses and lower interest rates remain near-term concerns.

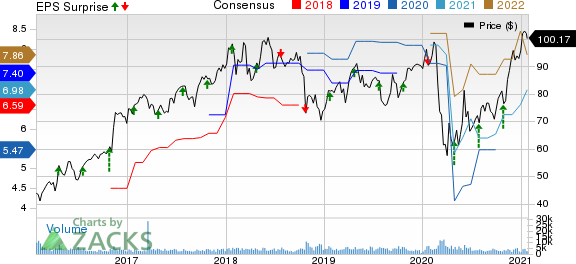

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. price-consensus-eps-surprise-chart | Raymond James Financial, Inc. Quote

Currently, Raymond James carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance & Earnings Date of Other Brokerage Firms

Charles Schwab’s SCHW fourth-quarter 2020 adjusted earnings of 74 cents per share beat the Zacks Consensus Estimate of 70 cents. Also, the bottom line grew 17% from the prior-year quarter, as the company reported first full-quarter results after closing TD Ameritrade deal in October 2020.

Interactive Brokers Group’s IBKR fourth-quarter 2020 adjusted earnings per share of 69 cents outpaced the Zacks Consensus Estimate of 59 cents. Also, the bottom line reflects growth of 19% on a year-over-year basis.

LPL Financial Holdings Inc. LPLA is slated to announce quarterly numbers on Feb 4.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research