Rayonier's (RYN) Q3 Earnings Miss Estimates, Stock Down 8.3%

Rayonier Inc. RYN reported third-quarter 2019 break-even earnings per share versus the Zacks Consensus Estimate of 3 cents. This also compares unfavorably with the prior-year quarter earnings of 18 cents per share.

Revenues were down 22.2% year over year to $156.4 million. The figure also missed the Zacks Consensus Estimate of $168 million.

Lower operating income in the New Zealand Timber segment and Real Estate segment affected Rayonier’s performance. Further, the Pacific Northwest Timber segment incurred operating loss during the quarter. Notably, the difficult export and challenging domestic market conditions across the company’s timber segments are likely to temper its growth tempo to some extent in the near term. Investors seem skeptical and therefore, following the earnings release, the stock has declined 8.3%.

Segmental Performance

During the reported quarter, operating income in the company’s Southern Timber segment came in at $9.5 million, up 3.3% year over year. This upside resulted from higher non-timber income and lower depletion rates. However, the positive were largely offset by lower volumes, lower net stumpage prices, and higher lease and other expenses.

The Pacific Northwest Timber segment reported an operating loss of $3.6 million as against the operating income of $1.9 million recorded in third-quarter 2018. This was mainly due to lower net stumpage prices, lesser volumes, and reduced non-timber income.

The New Zealand Timber segment recorded operating income of $10.1 million, down 38.4% from the year-earlier tally. Results indicate lower net stumpage prices and higher roading costs, partly offset by higher volumes and increased non-timber income.

Real Estate’s operating income of $0.4 million was significantly down from the year-ago figure of $24.7 million. This was chiefly due to a lower number of acres sold, partially muted by a significant rise in weighted-average prices.

The Trading segment reported break-even results in the quarter, as against operating income of $0.3 million posted in the year-earlier period. This suggests lower trading margins resulting from lower volumes and prices.

Share Repurchases

During the reported quarter, Rayonier repurchased shares worth $8.4 million at an average price of $26.34 per share. Further, the company has a remaining share-buyback authorization of $90.9 million.

Liquidity

Rayonier ended the third quarter with $56.9 million in cash and cash equivalents, down from $148.4 million recorded as of Dec 31, 2018. Total long-term debt was $973 million, marginally up from $972.6 million as on Dec 31, 2018.

Outlook

Rayonier’s timber segments continue to be affected by challenging export and domestic market conditions. Amid this, the company has tempered its projections for the rest of the year. The company now expects full-year adjusted EBITDA in the lower end of the prior guidance of $245-$265 million. Additionally, it anticipates the full-year harvest volumes in the Southern Timber segment to be 6-6.1 million tons. The New Zealand Timber segment is estimated to generate full-year harvest volume between 2.7 million tons and 2.8 million tons. Also, the same in the Pacific Northwest Timber segment is likely to be approximately 1.2 million tons.

Conclusion

Rayonier’s lower-than-expected performance in the third quarter is discouraging. Adverse impact of the choppy domestic market and challenging export market will keep thwarting the company’s performance. Nevertheless, it is likely to get some relief from the Real Estate segment, given its expectation of strong contribution in the fourth quarter. Such projections are backed by the number of transactions, which are in active negotiation or are under contract.

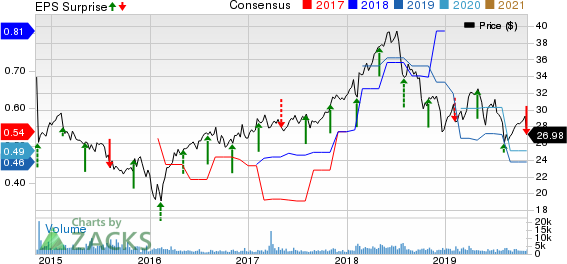

Rayonier Inc. Price, Consensus and EPS Surprise

Rayonier Inc. price-consensus-eps-surprise-chart | Rayonier Inc. Quote

Currently, Rayonier carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other REITs

Public Storage’s PSA third-quarter 2019 core FFO per share of $2.73 improved 1.1% from the prior-year figure of $2.70. However, the reported figure missed the Zacks Consensus Estimate by a penny. The company’s lower-than-expected FFO per share suggested the unfavorable impact of higher expenses in the quarter for its same-store facilities, resulting from elevated marketing expenses and property taxes.

Federal Realty Investment Trust FRT delivered quarterly FFO of $1.59 per share, in line with the Zacks Consensus Estimate. The reported figure improved from the prior-year tally of $1.58. These figures are adjusted for non-recurring items. Results reflected rise in property operating income and cash-basis rollover growth on comparable spaces.

Equity Residential EQR reported third-quarter 2019 normalized FFO per share of 91 cents, surpassing the Zacks Consensus Estimate of 88 cents. Moreover, normalized FFO per share figure came in 9.6% higher than the 83 cents reported in the year-ago quarter. Results mirror improved same-store net operating income (NOI) and lease-up NOI, and other non-same store NOI.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rayonier Inc. (RYN) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Equity Residential (EQR) : Free Stock Analysis Report

Public Storage (PSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research