RBC Bearings (ROLL) Q2 Earnings Lag Estimates, Down Y/Y

RBC Bearings Incorporated ROLL reported mixed second-quarter fiscal 2022 (ended Oct 2, 2021) results. The company’s earnings missed estimates by 15.2% whereas sales beat the same by 0.8%.

Adjusted earnings in the reported quarter were 89 cents per share, missing the Zacks Consensus Estimate of $1.05. The bottom line decreased 4.3% from the year-ago quarter’s figure of 93 cents on higher operating expenses.

Revenue Details

In the reported quarter, RBC Bearings’ net sales were $160.9 million, increasing 10% year over year. Also, the top line surpassed the Zacks Consensus Estimate of $160 million and came within the company’s projection of $158-$162 million.

ROLL’s overall aerospace business experienced a 4.4% decline in revenues. However, its business in industrial markets improved and recorded a 31.1% year-over-year increase in revenues.

Exiting the reported quarter, the company had a backlog of $456.7 million, up 13.3% year over year.

RBC Bearings reports net sales under four heads/segments that are discussed below:

Revenues in Plain bearings totaled $74.1 million, up 4.2% year over year while that for Roller bearings increased 26.4% to $27.3 million. Ball bearings’ revenues of $24.4 million were up 15.6% year over year. Revenues in Engineered products summed $35.1 million, up 7.7%.

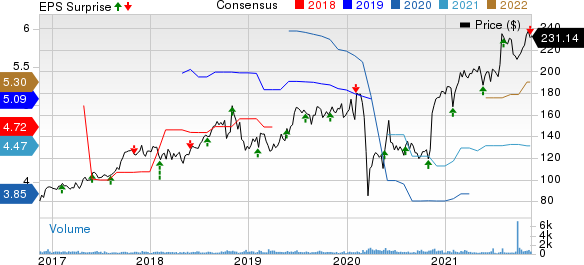

RBC Bearings Price, Consensus and EPS Surprise

RBC Bearings price-consensus-eps-surprise-chart | RBC Bearings Quote

Margin Picture

In the reported quarter, RBC Bearings’ cost of sales increased 9.7% year over year to $98.4 million, representing 61.2% of net sales compared with 61.3% a year ago. Gross profit increased 10.4% to $62.5 million. Margin grew 10 basis points (bps) to 38.8%.

Selling, general and administrative expenses of $29.7 million were up 14.2% year over year, accounting for 18.5% of net sales. Adjusted operating income increased 2% to $30.5 million. Adjusted margin declined 140 bps to 19%. Net interest expenses were $15.8 million compared with $0.3 million in the year-ago quarter.

The effective tax rate was 40.5% in the quarter under review compared with 20.9% in the prior-year quarter.

Balance Sheet and Cash Flow

Exiting the fiscal second quarter, RBC Bearings had cash and cash equivalents of $1,348.6 million, up from $175.8 million recorded at the end of the previous quarter. Long-term debt was $7.1 million, down 34.3% sequentially.

In the first six months of fiscal 2022, the company generated net cash of $93.5 million from operating activities, up 25.5% from $74.5 million in the previous-year quarter. Capital spending of $6.9 million, up 15% year over year.

In the first half of fiscal 2022, the company repurchased shares worth $6.4 million, up from $4.4 million in the previous-year period.

Important Event

On Nov 1, RBC Bearings closed the buyout of Dodge for $2.9 billion in cash. The buyout was announced in July this year.

ROLL funded the acquisition with the help of senior debt of $1.3 billion, cash worth $1.1 billion (including $605.7 million from the sale of common equity and $445.5 million from the sale of mandatorily convertible preferred stock) as well as unsecured debt of $500 million.

Outlook

For the third quarter of fiscal 2022 (ending December 2021), RBC Bearings anticipates net sales of $245-$255 million (including the impact of Dodge buyout). This represents an increase of 68-74.8% from the year-ago figure of $145.9 million.

Zacks Rank & Stocks to Consider

RBC Bearings currently carries a Zacks Rank #4 (Sell).

Some better-ranked companies in the industry are discussed below.

Helios Technologies, Inc. HLIO presently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Its earnings surprise in the last four quarters was 37.54%, on average.

In the past 30 days, Helios’ earnings estimates have increased 7.9% for 2021 and 9.8% for 2022. Its shares have gained 28.4% in the past three months.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). Its earnings surprise for the last four quarters was 26.71%, on average.

Applied Industrial’s earnings estimates increased 1.9% for fiscal 2022 (ending June 2022) and 2.2% for fiscal 2023 (ending June 2023) in the past 30 days. Its shares gained 18.9% in the past three months.

Welbilt, Inc. WBT presently carries a Zacks Rank #2. Its last four quarters average earnings surprise was 172.50%.

Welbilt’s earnings estimates have increased 3.2% for 2021 and 5.9% for 2022 in the past 30 days. Its shares have gained 2.2% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

RBC Bearings Incorporated (ROLL) : Free Stock Analysis Report

Welbilt, Inc. (WBT) : Free Stock Analysis Report

Helios Technologies, Inc (HLIO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research