How To Read An Options Table

With more information available and the ability to quickly trade options online, investors are becoming savvier with using options to speculate, hedge and create their own financial strategies using a combination of ETFs, options and other assets. Options are financial products that fluctuate based on an underlying asset, such as an ETF. The value of the option is determined by multiple factors, including the amount of time until the option expires, volatility in the underlying asset and the proximity of the option’s strike price to the underlying asset’s price. Option pricing models also give us “Greeks”- values used to determine how the underlying asset and option price are related. Learning to read an options table will provide more insight into these concepts and how they relate to option value.

Be sure to also read What Every ETF Investor Needs To Know About Options for an introduction to options.

Information Sources

The main source for options pricing and information is the Chicago Board Options Exchange (CBOE), the exchange through which options are traded.

To get an options quote on the www.cboe.com website click on the Quotes and Data section followed by Delayed Quotes. Enter a stock or ETF symbol and then click on the Options tab to see information on the option [see also ETF Call And Put Options Explained].

Yahoo! Finance offers options pricing information in a straight forward manner, and includes the same information available on the CBOE website. All options images were obtained from Yahoo! Finance.

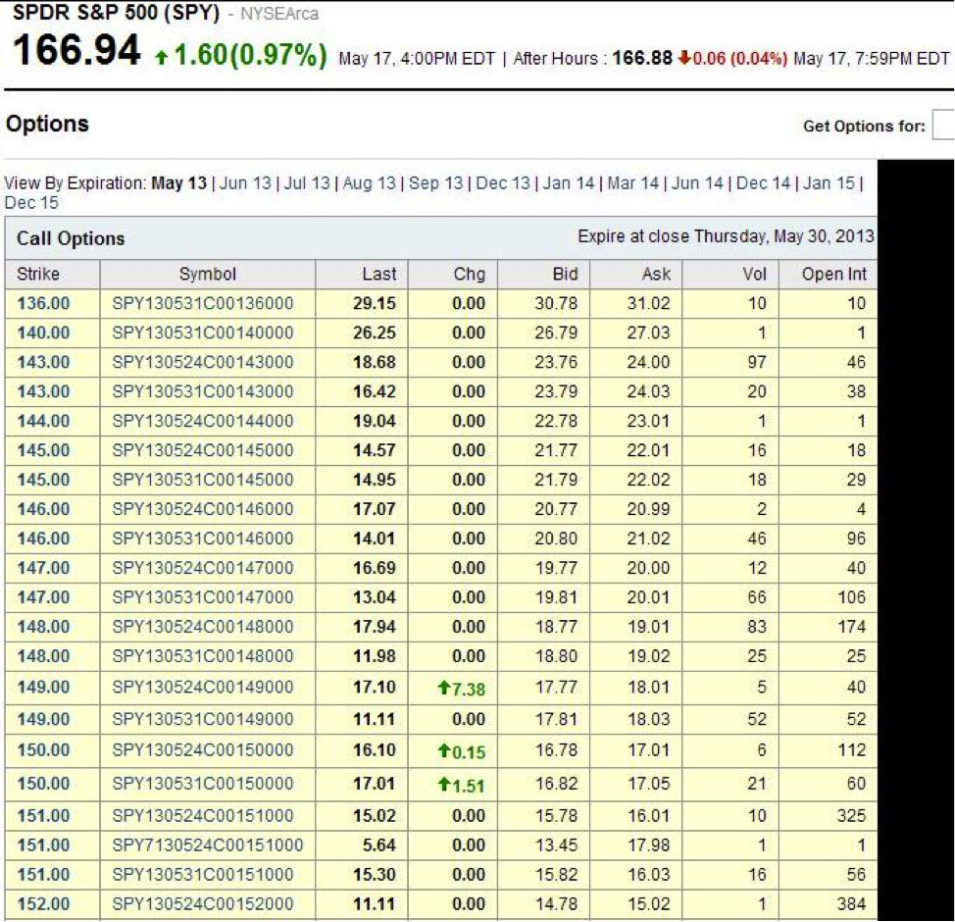

Figure 1. Call Option Pricing Information, SPDR S&P 500 ETF (SPY)

Click To Enlarge

Option Table Explained

Just below the price of the ETF, we see “View By Expiration” with a series of dates following it. Figure 1 shows May, 2013 option prices, as indicated by “May13″ being selected. If you want to see options that expire during a different month you can select it from the list, remembering that the month represents the month of expiry and the number following it represents the year of expiry. Selecting “Jan 15″ for example will show options expiring in January 2015 [see 13 ETFs Every Options Trader Must Know].

Yahoo! Finance lists call options first, followed by put options. To see put option pricing, scroll down the page until you see the section labeled Put Options.

Figure 2. Put Option Pricing Information, SPDR S&P 500 ETF (SPY) May 17, 2013

Click To Enlarge

Let’s go through what each of the columns means.

Strike (Price): This column shows the price at which a call buyer can purchase the security if the option is exercised. In the case of a put option, it’s the price at which the option buyer can sell the underlying security should the option be exercised. On the flip side, an option writer will be assigned to produce the underlying security at the strike price if an option he or she sells (writes) is exercised.

On this day the SPY closed at $166.94, so options with a strike price near $167 were very active. Figure 3 shows a quote of a SPY call option with a Strike of $167.

Figure 3. 167 Strike for SPDR S&P 500 ETF (SPY) Call Option

Click To Enlarge

Symbol: This element of the options table contains the information for which option you are looking at; it can be broken down into a few major sections. Figure 4 shows what is contained in the symbol.

Figure 4. Symbol Information

Last: The price of the last trade that went through.

Chg (Change) : Change is how much the Last price has changed since the previous close.

Bid: The price at which buyers are trying to buy the option. If you market sell an option, you’ll typically get this price assuming instant execution. This is the price for one share. Since one option is for 100 shares, to get the cost of an option you must multiply this price by 100.

Ask: The price at which sellers are trying to sell the option. If you market buy an option, you’ll typically get this price assuming instant execution. This is the price for one share. Since one option is for 100 shares, to get the cost of an option you must multiply this price by 100.

Vol (Volume): Lets you know how many contracts have been traded during the session. Options that have large volume typically have a tighter Bid-Ask spread since more traders are looking to get in and out of positions.

Open Int (Interest): The number of open positions in the contract that have not yet been offset.

Additional Data to Be Aware Of

The Greeks are a series of calculations that help determine how an options price moves relative to the underlying asset. While these figures are not shown on all options tables, a basic understanding is helpful when trading options [see also 101 ETF Lessons Every Financial Advisor Should Learn].

Delta: Represents how sensitive an options price is to the price movements in the underlying asset.

Gamma: Since Delta is not stagnant, and will constantly be changing, Gamma is the measure of how much the Delta changes as the value of the underlying security changes.

Theta: A measure of the dollar amount the option price loses each day as it approaches expiry, known as time decay.

Vega: The measure of how an options price reacts to changes in volatility in the underlying asset.

Bottom Line

Yahoo! Finance offers simple and relatively easy-to-understand options tables, although options pricing information is available from many other online sources including the CBOE website. Spend some time looking through the tables and seeing how the options are priced–using the Last price or Bid and Ask price–for varying expiry dates and strike prices. This will help you get better at reading the table and seeing how options prices are related to the other information in the table.

[For more ETF analysis, make sure to sign up for our free ETF newsletter or try a free 14-day trial to ETFdb Pro.]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Daily ETF Roundup: XLI Rallies Alongside Industrials, VOX Pops

Daily ETF Roundup: XHB Pops On Homebuilder Data, EWG Jumps On Bundesbank Outlook

Daily ETF Roundup: Stocks End Week In The Red, IXC Slumps Alongside Energy Shares

Daily ETF Roundup: FXG Pops On Safeway Acquisition, XLF Rallies