Real Estate Industry Trends And Its Impact On China HGS Real Estate Inc (NASDAQ:HGSH)

China HGS Real Estate Inc (NASDAQ:HGSH), a USD$57.21M small-cap, is a real estate company operating in an industry which remains the single largest sector globally, and has continued to play a key role in investor portfolios. Real estate analysts are forecasting for the entire industry, negative growth in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the US stock market as a whole. Below, I will examine the sector growth prospects, as well as evaluate whether China HGS Real Estate is lagging or leading in the industry. Check out our latest analysis for China HGS Real Estate

What’s the catalyst for China HGS Real Estate’s sector growth?

Over the past couple of years, as yields for high quality real estate investments have become under pressure, investors have swung towards more niche and diversified buildings such as medical offices, student housing and data storage facilities. Over the past year, the industry saw growth in the twenties, beating the US market growth of 10.83%. China HGS Real Estate lags the pack with its negative growth rate of -74.92% over the past year, which indicates the company will be growing at a slower pace than its real estate peers. As the company trails the rest of the industry in terms of growth, China HGS Real Estate may also be a cheaper stock relative to its peers.

Is China HGS Real Estate and the sector relatively cheap?

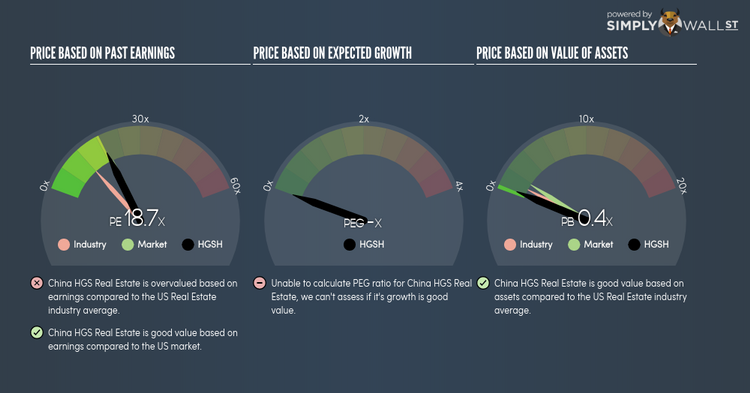

The real estate sector’s PE is currently hovering around 12x, below the broader US stock market PE of 20x. This illustrates a somewhat under-priced sector compared to the rest of the market. Though, the industry returned a similar 9.13% on equities compared to the market’s 10.47%. On the stock-level, China HGS Real Estate is trading at a higher PE ratio of 19x, making it more expensive than the average real estate stock. In terms of returns, China HGS Real Estate generated 1.93% in the past year, which is 7% below the real estate sector.

What this means for you:

Are you a shareholder? China HGS Real Estate has been a real estate industry laggard in the past year. In addition to this, the stock is trading at a PE above its peers, meaning it is more expensive on a relative earnings basis. This may indicate it is the right time to sell out of the stock, if your initial investment thesis is around the growth prospects of China HGS Real Estate, since there are other real estate companies that have delivered higher growth, and are possibly trading at a cheaper price as well.

Are you a potential investor? If China HGS Real Estate has been on your watchlist for a while, now may be the best time to enter into the stock. Its lagging growth rate compared to its real estate peers in the near term doesn’t build up its investment thesis, and in addition to this, it is also trading at a PE above these companies. If growth and mispricing are important aspects for your investment thesis, there may be better investments in the real estate sector.

For a deeper dive into China HGS Real Estate’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other real estate stocks instead? Use our free playform to see my list of over 100 other real estate companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.