Realty Income (O) to Report Q2 Earnings: What's in Store?

Realty Income Corp. O is scheduled to report second-quarter 2019 results after market close on Aug 5. The company’s results are anticipated to reflect year-over-year increase in revenues and funds from operations (FFO) per share.

In the last reported quarter, this monthly dividend-paying real estate investment trust (REIT) delivered a positive surprise of 2.5% in terms of FFO per share. The company benefited from year-over-year growth in revenues and witnessed high occupancy levels as well.

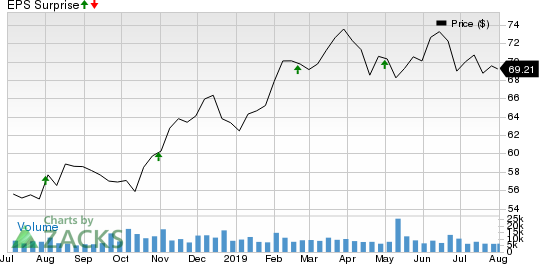

Realty Income has a decent surprise history. Over the trailing four quarters, the company surpassed estimates on each occasion, resulting in an average positive surprise of 2.91%. This is depicted in the graph below:

Realty Income Corporation Price and EPS Surprise

Realty Income Corporation price-eps-surprise | Realty Income Corporation Quote

Let’s see how things are shaping up for this announcement.

Factors to Consider

This retail REIT derives more than 90% of its annualized retail rental revenues from tenants belonging to service, non-discretionary and low-price retail businesses. Such businesses are less susceptible to economic recessions, as well as competition from Internet retailing. This is expected to be conducive to its cash flow in the second quarter.

Moreover, low unemployment, increasing wages and decent consumer sentiment are positive indicators for the retail industry. This is anticipated to have sent positive ripple effects across the industry in the to-be-reported quarter.

Furthermore, the company focuses on external growth through exploring accretive acquisition opportunities. Healthy property acquisition volume at decent investment spreads will likely aid the company’s second-quarter performance.

Notably, during the second quarter, the company announced the closing of the £429-million sale-leaseback transaction with Sainsbury's. Particularly, the move, which marks the company’s first international real estate acquisition, involved gaining of 12 properties in the U.K. under long-term net lease agreements with Sainsbury's. The move is a strategic fit as Sainsbury's is one of the top operators in the grocery industry and with this transaction, Realty Income is well poised to bank on the solid strength of the real estate fundamentals in the region.

Moreover, Realty Income’s solid underlying real estate quality and prudent underwriting at acquisition have helped the company maintain high occupancy levels consistently. Since 1996, the company’s occupancy level has not moved below 96%. This trend is likely to have continued in the quarter under review as well. Further, same-store rent growth is likely to display limited operational volatility.

In addition, the recent data from Reis shows that the vacancy rate of neighborhood and community shopping center contracted 10 basis points sequentially to 10.1% in the second quarter, denoting its first decline since first-quarter 2016. The Regional Mall vacancy rate was flat in the second quarter at 9.3%. Store closures continue to affect Regional Mall vacancy. Nonetheless, both, national average asking rent and effective rent, which nets out landlord concessions, inched up 0.4% sequentially and 1.7% from the year-ago quarter.

Obviously, the retail real estate market continues to be affected by store closures and is undergoing structural changes. However, the latest stability in the vacancy rate and rent levels underlines that the sector has been able to battle such challenges as retail landlords continued their transformation initiatives, while there is minimal construction activity in the pipeline.

Amid these, the Zacks Consensus Estimate for second-quarter revenues is pegged at $360.9 million, indicating a rise of 9.7% from the year-ago reported figure. Further, the Zacks Consensus Estimate for the second quarter FFO per share is currently pinned at 81 cents. This indicates a 1.25% increase from the year-ago quarter.

Nonetheless, despite all these efforts, the choppy retail real estate environment might limit its growth momentum to some extent as secular industry headwinds, including retailer downsizing and tenant bankruptcies are continuing to affect the industry fundamentals.

Prior to the second-quarter earnings release, there is lack of any solid catalyst. As such, the Zacks Consensus Estimate of FFO per share for the quarter remained unchanged at 81 cents over the past month.

Here is what our quantitative model predicts:

Realty Income has the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Realty Income is +0.78%.

Zacks Rank: Realty Income currently carries a Zacks Rank of 3.

A positive Earnings ESP is a meaningful and leading indicator of a likely beat in terms of FFO per share. This, when combined with a favorable Zacks rank, makes us reasonably confident of a positive surprise.

Other Stocks That Warrant a Look

Here are a few other stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

MGM Growth Properties LLC MGP, scheduled to release earnings on Aug 6, has an Earnings ESP of +0.57% and currently carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Physicians Realty Trust DOC, set to report quarterly figures on Aug 7, has an Earnings ESP of +3.41% and carries a Zacks Rank of 2, currently.

Mack-Cali Realty Corporation CLI, slated to announce second-quarter results on Aug 7, has an Earnings ESP of +1.24% and holds a Zacks Rank of 3, at present.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Realty Income Corporation (O) : Free Stock Analysis Report

MGM Growth Properties LLC (MGP) : Free Stock Analysis Report

Physicians Realty Trust (DOC) : Free Stock Analysis Report

Mack-Cali Realty Corporation (CLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.