Reasons to Add AMN Healthcare (AMN) Stock to Your Portfolio

AMN Healthcare Services, Inc. AMN has been gaining on the back of its broad array of services. A solid performance in the fourth quarter of 2021 and its key buyouts also raise optimism regarding the stock. However, stiff competition and consolidation of healthcare delivery units are major downsides.

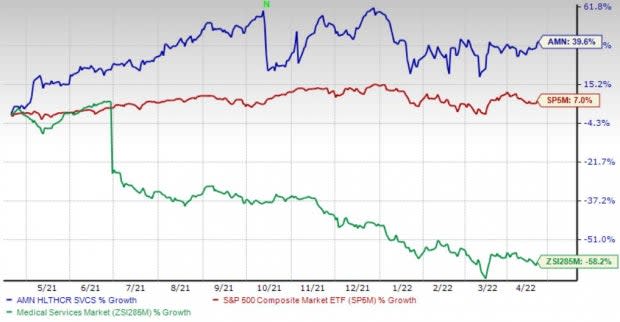

Over the past year, this Zacks Rank #2 (Buy) stock has gained 39.6% versus 58.2% fall of the industry. The S&P 500 rose 6.9% in the same time frame.

The renowned player in the healthcare total talent services space has a market capitalization of $4.95 billion. The company projects 16.2% growth for the next five years and expects to witness continued improvements in its business. AMN Healthcare surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 20%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Acquisitions: AMN Healthcare has lately been strengthening its inorganic portfolio through a string of acquisitions, raising our optimism. In May 2021, the company forayed into the post- acute-care market with the acquisition of the telehealth company, Synzi, which offers virtual care and remote patient-monitoring platforms in the home health and outpatient markets. These solutions will help AMN Healthcare conduct virtual visits and use secure messaging, texts, and emails for clinician-to-patient and clinician-to-clinician communications.

The buyouts of Stratus Video (now known as AMN Language Services) and b4health are other top performance drivers for AMN Healthcare.

Broad Array of Services: We are upbeat about its business’ gradual evolution beyond traditional healthcare staffing. The company has become a strategic total talent solutions partner for its clients. AMN Healthcare has expanded its portfolio to serve a diverse and growing set of healthcare talent-related needs. The company’s suite of healthcare workforce solutions includes Managed Services Programs, vendor management systems (“VMS”) and medical language interpretation services, among others.

AMN Healthcare has also displayed strength in digital health capabilities with its AMN Passport and AMN Cares. The company also expanded its scalable VMS solution, enabling a wide array of healthcare facilities to quickly staff and manage their entire range of contingent talent.

Strong Q4 Results: AMN Healthcare’s better-than-expected results in fourth-quarter 2021 buoy our optimism. The company recorded robust performances across each of its core segments while its earnings as well as revenues improved in the quarter under review. Expansion of operating margin bodes well for the stock. Its upbeat revenue guidance for the first quarter of 2022 is encouraging.

Downsides

Stiff Competition: In the nurse and allied healthcare staffing business, AMN Healthcare competes with a few national players besides numerous smaller, regional and local companies. Some of the leading competitors vary by segment. When recruiting for healthcare professionals, in addition to other executive search and staffing firms, AMN Healthcare also competes with hospital systems that have developed their recruitment departments.

Consolidation of Healthcare Delivery Units: Healthcare delivery organizations are consolidating, which is providing them with greater leverage in negotiating pricing for services. Consolidations may also result in AMN Healthcare losing its ability to work with certain clients because the party acquiring or consolidating with its client may have a previously established service provider they opt to maintain.

Estimate Trend

AMN Healthcare has been witnessing an upward estimate revision trend for 2022. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 40.4% north to $9.31.

The Zacks Consensus Estimate for first-quarter 2022 revenues is pegged at $1.50 billion, suggesting a 69% rise from the year-ago reported number.

Other Key Picks

Some other stocks in the broader medical space that investors can consider include Abiomed, Inc. ABMD, Patterson Companies, Inc. PDCO and West Pharmaceutical Services, Inc. WST.

Abiomed, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 20%. ABMD’s earnings surpassed estimates in the trailing four quarters, the average beat being 9.2%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Abiomed has lost 5.6% compared with the industry’s 6.7% fall over the past year.

Patterson Companies has an estimated long-term growth rate of 9.9%. PDCO’s earnings surpassed estimates in three of the trailing four quarters, the average beat being 2.7%. It currently has a Zacks Rank #2.

Patterson Companies has gained 2.3% compared with the industry’s 3.3% growth over the past year.

West Pharmaceutical has an estimated long-term growth rate of 9.6%. WST’s earnings surpassed estimates in the trailing four quarters, the average beat being 26.3%. It currently carries a Zacks Rank #2.

West Pharmaceutical has gained 14.6% compared with the industry’s 3.3% growth over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ABIOMED, Inc. (ABMD) : Free Stock Analysis Report

Patterson Companies, Inc. (PDCO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research