Reasons to Add Consolidated Edison (ED) to Your Portfolio Now

Consolidated Edison Inc.’s ED strong fundamentals and solid financial position with favorable growth estimates make it a good investment choice.

Consolidated Edison currently carries a Zacks Rank #2 (Buy).

Growth Projections

The Zacks Consensus Estimate for 2023 earnings is pegged at $4.85 per share, suggesting an increase of 0.2% in the past 60 days.

Dividend Yield & Long-Term Earnings Growth

Consolidated Edison’s current dividend yield is 3.42%, which is better than the Zacks S&P 500 composite’s average yield of 1.76%.

ED’s long-term (three- to five-year) earnings growth rate is currently projected at 2%.

Financial Position

Consolidated Edison’s debt to capital is 49.76%, comparing favorably with the industry’s 54.63%. Its times interest earned (TIE) ratio also improved to 4.3 at the end of the first quarter of 2023 from 3.5 at the end of the fourth quarter. This strong TIE ratio reflects the company’s ability to meet its debt obligations in the near future.

Strong Long-term Growth Plan

Consolidated Edison continues to follow a systematic capital investment plan for infrastructure development and maintains the reliability of its electric, gas and steam delivery systems. The company has a robust capital expenditure plan of $14.6 billion for the 2023-2025 period. In the next ten years, the company plans to invest $72 billion. With Consolidate Edison’s planned capital expenditures and timely rate revisions from regulatory authorities, the company’s rate base is projected to expand, witnessing a CAGR of 6.2% in the 2023-2025 period.

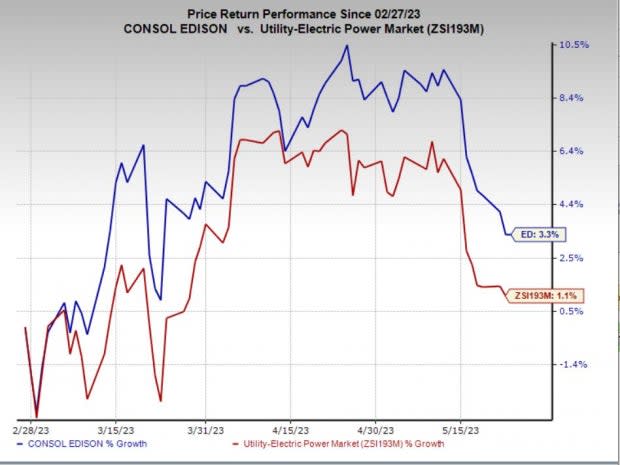

Price Performance

In the past three months, the stock has gained 3.3% compared with the industry’s growth of 1.1%.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same sector are IDACORP IDA, NiSource NI and NewJersey Resources NJR, each carrying a Zacks Rank #2.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term earnings growth of IDACORP, NiSource and NewJersey Resources is projected at 3.7%, 6.9% and 6%, respectively.

In the past 60 days, the Zacks Consensus Estimate for IDACORP and NiSource’s 2023 earnings has moved north by 1% and 1.3%, respectively. In the same frame, the Zacks Consensus Estimate for NewJersey Resources’ fiscal 2023 earnings has moved up by 0.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

IDACORP, Inc. (IDA) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report