Reasons to Add West Pharmaceutical (WST) to Your Portfolio

West Pharmaceutical Services, Inc. WST has been gaining from its robust proprietary products business. Solid performance in the first quarter of 2021 and its successful implementation of pandemic initiatives also buoy optimism. However, information security breaches and foreign exchange fluctuations are major downsides.

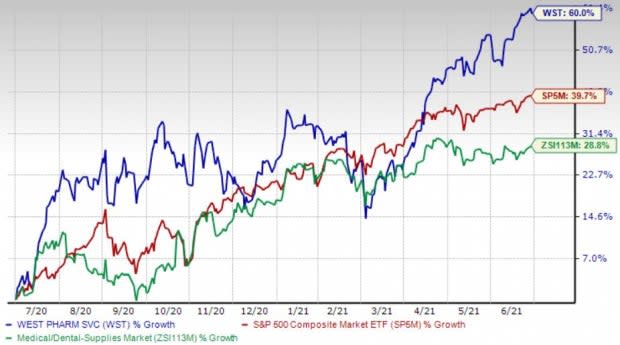

Over the past year, the Zacks Rank #2 (Buy) stock has gained 60% compared with the 28.8% growth of the industry and 39.7% rise of the S&P 500 composite.

The renowned global provider of innovative solutions for injectable drug administration has a market capitalization of $26.48 billion. The company projects 25.8% growth for the next five years and expects to witness continued improvements in its business. West Pharmaceutical surpassed the Zacks Consensus Estimates in all of the trailing four quarters, delivering an earnings surprise of 28.54%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Robust Proprietary Products Segment: We are upbeat about West Pharmaceutical’s proprietary products business, which continues to exhibit sustained strength and is an important contributor to the company’s top line. In first quarter of 2021, net sales at this segment recorded a solid uptick, where high-value products (“HVP”) represented a larger share of segmental sales and generated double-digit organic sales growth, led by strong customer demand.

Successful Implementation of Pandemic Initiatives: West Pharmaceutical’s efforts to maintain customers’ trust in the company raise our optimism. Apart from ensuring the well being and safety of team members worldwide, the company successfully maintained the continuity of manufacturing and supply of components to its customers. West Pharmaceutical also enabled vaccine makers to protect their sensitive biomolecules with trusted solutions. Expansion to existing sites was made and personnel were deployed to cater to the anticipated demand for the pandemic-related components.

Strong Q1 Results: West Pharmaceutical’s better-than-expected results in first-quarter 2021 buoy optimism. The company continues to gain from both its segments – Proprietary Products and Contract-Manufactured Products – which have been contributing to the top line for quite some time. Expansion in both margins is a positive. Further, the company’s HVPs continue to drive higher margins. Additionally, it continues to see strong uptake of HVP components, which include Westar, FluroTec, Envision and NovaPure offerings, along with Daikyo’s Crystal Zenith. A raised 2021 outlook is also encouraging.

However, downsides might result from West Pharmaceutical’s breaches in information security. The company’s systems and networks, along with those of its customers, suppliers, service providers and banks, have and might become the target of cyberattacks and information security breaches in future. Failure to comply with regulations or prevent the unauthorized access, release and/or corruption of the company’s or its customers’ confidential information can result in financial losses and also hurt its reputation.

West Pharmaceutical’s business is exposed to foreign currency exchange rate fluctuations. It is expected that sales from international operations will continue to account for a substantial portion of the company’s total sales in future. West Pharmaceutical also incurs currency transaction risks when the company itself, or one of its subsidiaries, enters into a purchase or sales transaction in a currency other than that entity’s local currency.

Estimate Trend

West Pharmaceutical has been witnessing an upward estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 16% north to $7.16.

The Zacks Consensus Estimate for second-quarter 2021 revenues is pegged at $665.6 million, suggesting a 26.2% rise from the year-ago reported number.

Other Key Picks

A few other top-ranked stocks from the broader medical space are Veeva Systems Inc. VEEV, AMN Healthcare Services Inc AMN and National Vision Holdings, Inc. EYE.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare’s long-term earnings growth rate is estimated at 6.5%. It currently flaunts a Zacks Rank #1.

National Vision’s long-term earnings growth rate is estimated at 23%. It currently sports a Zacks Rank #1.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research