Reasons to Retain DocuSign (DOCU) Stock in Your Portfolio

DocuSign, Inc. DOCU has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of quality and sustainability of its growth. The company’s earnings and revenues for fiscal 2022 are expected to improve 86.7% and 39.4% respectively, year over year.

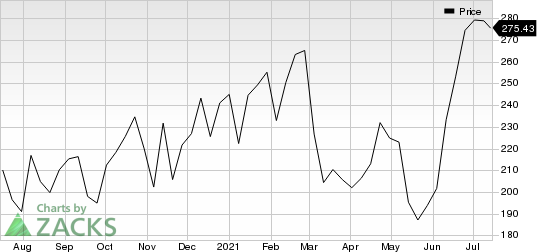

The stock has gained 42.8% in the past year against 19.9% decline of the industry it belongs to.

DocuSign Inc. Price

DocuSign Inc. price | DocuSign Inc. Quote

What’s Supporting the Rally?

The company’s top line is significantly benefiting from continued customer demand for eSignature. Despite this rising demand, the market for eSignature remains largely untapped, and this keeps DocuSign in a position to expand the same across businesses around the world.

DocuSign has a set of business growth strategies. The company remains focused on continuously acquiring eSignature customers, expanding eSignature use cases within existing customers, improving its offerings and popularizing other Agreement Cloud products to new and existing customers, and expanding internationally. The company continues to invest in sales, marketing and technical expertise across a number of industry verticals.

DocuSign's cash and cash equivalent balance of $781 million at the end of first-quarter fiscal 2022 was above its total debt level $756 million, underscoring that the company has enough cash to meet its debt burden. A strong cash position allows the company to pursue opportunities that exhibit true potential.

Headwinds

DocuSign is seeing increase in expenses as it continues to invest in sales, marketing and technical expertise. Total operating expenses of $1.3 billion increased 36.6% year over year in fiscal 2021. Hence, the company's bottom line is likely to remain under pressure going forward.

DocuSign has never declared, and neither does currently have any plan to pay cash dividends on its common stock. So, the only way to achieve return on investment on the company’s stock is share price appreciation, which is not guaranteed. Investors seeking cash dividends should avoid buying DocuSign’s shares.

Zacks Rank and Stocks to Consider

DocuSign currently carries a Zacks Rank #3 (Hold).

Some top-ranked stocks in the broader Zacks Business Services sector are Accenture ACN, Cross Country Healthcare CCRN and Paychex PAYX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The long-term expected earnings per share (three to five years) growth rate for Accenture, Cross Country Healthcare and Paychexis pegged at 10%, 10.5% and 8%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

DocuSign Inc. (DOCU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research