Reasons to Retain ExlService (EXLS) Stock in Your Portfolio

ExlService Holdings, Inc. EXLS is currently seeing growing demand across its client base for data-led solutions that help enhance the quality of business decisions, enable intelligent workflows and streamline operations.

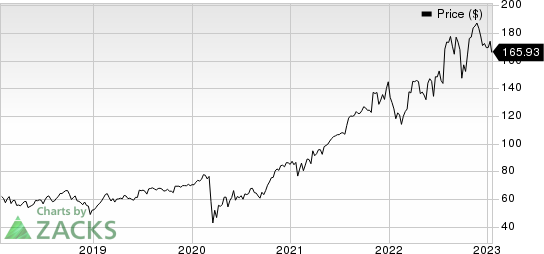

The company’s shares have had an impressive run over the past year. The stock gained 32.6%, significantly outperforming the 1.8% rally of the industry it belongs to. EXLS’ fundamentals indicate the potential to sustain this momentum in the near term.

ExlService’s earnings for 2022 and 2023 are expected to increase 22.8% and 11.7%, respectively. Revenues are expected to grow 24.6% and 13.6%, respectively, in 2022 and 2023.

ExlService Holdings, Inc. Price

ExlService Holdings, Inc. price | ExlService Holdings, Inc. Quote

One estimate for 2023 moved north in the past 90 days versus no southward revision. The Zacks Consensus Estimate for the company's 2023 earnings has moved up 3.1% in the past 90 days.

EXLS has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in all the trailing four quarters, delivering an average beat of 9.1%.

Some Risk

ExlService’s current ratio (a measure of liquidity) at the end of the September quarter was 2.02, lower than the September 2021 current ratio of 2.45. A decline in the current ratio is not desirable as it indicates that the company may have problems meeting its short-term debt obligations.

Zacks Rank and Stocks to Consider

ExlService currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Zacks Business Services sector are DocuSign, Inc. DOCU and Sprinklr,Inc. CXM.

DocuSign currently sports a Zacks Rank #1 (Strong Buy). DOCU has a long-term earnings growth expectation of 13.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DOCU delivered a trailing four-quarter earnings surprise of 6.6% on average.

Sprinklr carries a Zacks Rank #2 (Buy) at present. CXM has a long-term earnings growth expectation of 30%.

Sprinklr delivered a trailing four-quarter earnings surprise of 102.8% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ExlService Holdings, Inc. (EXLS) : Free Stock Analysis Report

DocuSign (DOCU) : Free Stock Analysis Report

Sprinklr, Inc. (CXM) : Free Stock Analysis Report