Reasons to Retain Graco (GGG) Stock in Your Portfolio Now

Graco Inc. GGG is gaining from accretive pricing actions and a solid backlog level, despite supply-chain woes and high labor, logistics and raw material costs. A strong customer base and product investments will also drive GGG’s top line in the near term.

Improved factory movement and upgrades, automation, technology upgrades, energy-efficiency upgrades and material changes are aiding Graco’s Industrial segment. Factory movements and upgrades, technology enhancements, energy-efficiency advancements and asset life maintenance are supporting its Process segment. The Contractor segment’s revenues are benefitting from product innovation and channel expansion, housing and new construction, and infrastructure spending.

Graco plans to invest $190 million in rolling out machinery and equipment during 2022, including $140 million in the expansion of facilities. In 2022, GGG invented products like the ES 500 Stencil rig, LineLazer ES 500 electric battery-powered airless striper et al. Its policy of investing in product innovation and capacity expansion should fuel growth in the quarters ahead.

GGG’s measures to reward its shareholders through dividend payments and share buybacks are noteworthy. It paid out dividends of $106.9 million in the first nine months of 2022 and repurchased shares worth $155.2 million in the same period. Also, the quarterly dividend rate was hiked 11.9% in December 2022.

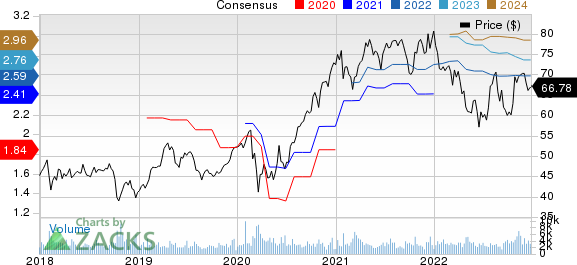

Graco Inc. Price and Consensus

Graco Inc. price-consensus-chart | Graco Inc. Quote

In light of the abovementioned positives, we believe, investors should hold on to Graco stock for now, as suggested by its current Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies from the Industrial Products sector are discussed below:

MRC Global Inc. MRC presently sports a Zacks Rank #1 (Strong Buy). MRC’s earnings surprise in the last four quarters was 103%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

In the past 60 days, MRC Global’s earnings estimates have increased 16.2% for 2022. The stock has rallied 18.8% in the past six months.

IDEX Corporation IEX presently has a Zacks Rank #2 (Buy). IEX’s earnings surprise in the last four quarters was 5.7%, on average.

In the past 60 days, IDEX’s earnings estimates have increased 0.8% for 2022. The stock has rallied 26.9% in the past six months.

EnerSys ENS delivered an average four-quarter earnings surprise of 2.1%. ENS presently carries a Zacks Rank of 2.

ENS’ earnings estimates have increased 0.6% for fiscal 2023 in the past 60 days. The stock has gained 24.2% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Graco Inc. (GGG) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Enersys (ENS) : Free Stock Analysis Report