Reasons Why You Should Bet on Charles River (CRAI) Stock Now

The stock of CRA International, Inc., which conducts business as Charles River Associates CRAI, has gained 4.6% in the past three months against 13.5% decline of the industry it belongs to. The company is currently benefiting from a strong global presence, business diversification and an excellent professional team.

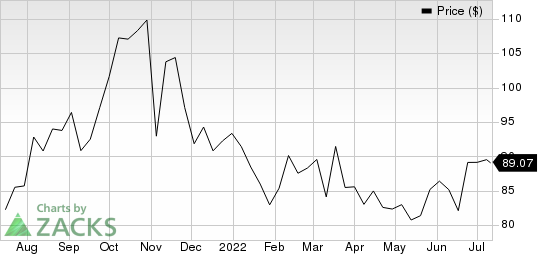

Charles River Associates Price

Charles River Associates price | Charles River Associates Quote

Let’s take a look at the factors that make the stock an attractive pick:

Solid Rank: Charles River currently carries a Zacks Rank #1 (Strong Buy). Our research shows that stocks with Zacks Rank #1 or 2 (Buy) offer attractive investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: One estimate for 2022 moved north in the past 60 days versus no southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for CRAI’s 2022 earnings has moved up 5.4% in the past 60 days.

Positive Earnings Surprise History: Charles River has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in all of the trailing four quarters, delivering an earnings surprise of 35.8%, on average.

Driving Factors: Charles River has a diversified business with service offerings across areas of functional expertise, client base and regions. Proficiency in multiple industries helps the company meet varying client needs and offer other innovative services. Further, the company gets to know about business strategies adopted worldwide. This multidisciplinary setup enables it to bring experts from all fields under one platform.

The company operates through a global network of coordinated offices spread across North America and Europe. The company’s international presence allows it to work with the world’s leading professionals on multiple issues. This helps the company enhance its knowledge base and areas of functional expertise.

In 2021, 2020 and 2019, the company repurchased shares worth $44.9 million, $13.4 million and $18.1 million, respectively. It paid $8.29 million, $7.50 million and $6.54 million in dividends during 2021, 2020 and 2019, respectively. Such moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

Other Stocks to Consider

Other stocks worth considering in the broader Zacks Business Services sector are Avis Budget Group, Inc. CAR and Genpact Limited G.

Avis Budget sports a Zacks Rank #1 at present. CAR has a long-term earnings growth expectation of 19.4%.

Avis Budget delivered a trailing four-quarter earnings surprise of 102%, on average.

Genpact sport a Zacks Rank of 1 at present. G has a long-term earnings growth expectation of 12.3%.

Genpact delivered a trailing four-quarter earnings surprise of 13.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research