Recession Proof McKesson Corporation Worth a Look on a Pullback

- By Nathan Parsh

As I stated last week, the healthcare sector is one of my favorite sectors to find recession proof companies. Consumers will, to the best of their abilities, seek out treatments for what ails them even in a difficult economic period.

This article will examine McKesson Corporation (NYSE:MCK) to determine if now is a good time to add the stock to the portfolio.

Company background & historical performance

Since its founding in 1833, McKesson has gone from selling chemicals and pharmaceuticals wholesale in New York City to becoming one of the largest distributors of pharmaceuticals and medical supplies in the entire industry. The company is composed of three segments: U.S. Pharmaceutical and Specialty Solutions, which accounted of 84% of last year's revenues, European Pharmaceutical Solutions, 12% of revenues, and Medical-Surgical Solutions, 4% of revenues. McKesson generated more than $231 billion of revenue in fiscal 2020 (the company's fiscal year ends Mar. 31) and has a market capitalization of nearly $27.5 billion today.

McKesson has done an excellent job of growing over an extended period of time.

The last 30 years have seen excellent top-line growth for the company. Focusing nearer term, it is obvious McKesson has done well for itself. Sales have more than doubled over the last decade, which is good for a compound annual growth rate of 7.5% over this period of time.

However, McKesson's earnings per share results have increased from $5.00 per share in 2010 to $14.95 in the most recent fiscal year. This equates to a CAGR of 11.6%.

The pharmaceutical and medical distribution business is very low margin as McKesson, and its peers, largely act as a middle man between the companies that make the products and the hospitals and medical centers that require them. As such, McKesson's net profit margin has fluctuated in a tight range of 1.2% to 1.5% over the last 10 years. Net profits have also increased at a rate of 7.5% over the last 10 years.

To help boast earnings per share results, the company has repurchased a significant amount of stock. McKesson's average common shares outstanding was 161 million in its most recent fiscal year, compared to 252 million in 2010. The company has repurchased 91 million shares over this time, which breaks down to an average of 4.4% of the shares outstanding per year. This is not a trivial amount.

I am normally leery of companies that retire an enormous amount of stock as this is usually a means to mask a decline in overall profit. This isn't the case for McKesson, which has failed to grow net profits just once in the last decade (2015). The company made a new high just two years later. Given the lack of margin expansion in its history and business, I would expect share repurchases to continue to be a theme for McKesson.

Overall, McKesson has been a rather consistent performer. Dating back to 2004, the company has only had one year where EPS results declined from the previous year (2015). The company quickly made a new high the very next year.

Despite a low profit margin, McKesson scores pretty well in the area of profitability.

The company receives a 7 out 10 on its profitability rank from the GuruFocus system, scoring extremely well on its return on equity. McKesson's ROE of 38.2% outranks more than 95% of the other 66 companies in the medical distribution industry. And the company's score on this metric is on the high end of its own historical average. McKesson also scores well on return on cost, topping more than 91% of the competition. The company also receives high marks for its three-year revenue growth rate, both compared to peers and McKesson's own historical average. Where the company scores poorly is on its operating margin, which shouldn't come as a surprise due to our early discussion on its low margins.

Many companies that produced a very low profit margin would likely score poorly on many aspects of profitability, but not McKesson. The company scores relatively well even if they operate in a low margin business, an excellent sign of strength in my opinion.

Dividend analysis

McKesson has increased its dividend for 13 consecutive years. The Dividend Investing Resource Center, which maintains a database of companies that have at least five consecutive years of dividend growth, says that the company's dividend has increased by an average of:

12.2% over the past three years.

10.5% over the past five years.

12.7% over the past 10 years

McKesson has consistently provided double-digit dividend growth over a variety of periods of time. The most recent raise, though, was quite low by company standards. Shareholders received a 2.4% increase for the Oct. 1, 2020 payment. Due to the uncertainty regarding the impact of the COVID-19 pandemic, leadership can be forgiven if the most recent raise was on the low side.

Shares of McKesson offer a yield below 1%, but the stock scores decently on its dividend and buyback rating from GuruFocus.

The stock's 0.97% yield ranks lower than 81% of competitors, though this is above the median yield over the last 10 years. Where McKesson really stands out is on the dividend payout ratio, which is lower than the vast majority of peers. It is also at the low end of McKesson's historical average. McKesson also has a strong showing on the three-year average share buyback ratio which is no surprise given the company's history of buybacks.

While the current yield is on the low side relative to the company's peers, it is actually higher than the 10-year average yield of 0.85%, according to Value Line. Still, the yield is close to a two-year low.

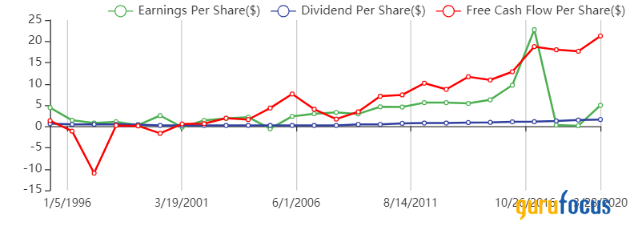

As seen in the chart above, McKesson's dividend has generally been well-covered by free cash flow and EPS in recent times. The company did have issue covering its dividend payments on either metric in the 1990s, but has generally generated more than adequate coverage recently.

Let's consider McKesson's dividend coverage over the last year.

McKesson has distributed $1.66 of dividends per share over the last four quarters while producing $15.65 of EPS for a payout ratio of 10.6%. This is just under the 10-year average payout ratio of 11.2%. For context, the highest payout ratio over the last 10 years is just 13%.

The free cash flow payout ratio is even lower. McKesson has distributed $286 million of dividends over the last year while generating free cash flow of $3.9 billion for a payout ratio of 7.3%. This is nearly identical to the payout ratio of 7.2% that the company averaged in the four previous years.

McKesson is blessed with a very low EPS payout ratio and an even lower free cash flow payout ratio. It is obvious that McKesson means to keep it that way. The lower than usual dividend increase this past fall was likely done to provide the company some margin of safety with regards to maintaining a low payout ratio. I would expect that the dividend growth would return to its double-digit norm once McKesson has more visibility past the COVID-19 pandemic.

Recession performance

I stated at the outset of this article that I believe many companies in the healthcare sector are recession proof. McKesson's performance during the last recession is an example of this. Listed below are the company's EPS results for the years before, during and after the last recession:

2006 EPS: $2.89

2007 EPS: $3.43 (18.7% increase)

2008 EPS: $4.28 (24.8% increase)

2009 EPS: $4.58 (33.5% increase)

2010 EPS: $5.00 (9.2% increase)

2011 EPS: $5.83 (16.6% increase)

McKesson's EPS growth rate actually accelerated during the financial crisis as the company's business picked up during the economic downturn. Yes, some of this growth was related to share repurchases as the company retired six million shares of stock between 2007 and 2009, but profit grew almost 31% over this period of time.

Listed below are the company's dividends paid before, during and after the last recession.

2006 dividends: $0.24

2007 dividends: $0.24 (no change)

2008 dividends: $0.48 (100% increase)

2009 dividends: $0.48 (no change)

2010 dividends: $0.72 (50% increase)

2011 dividends: $0.80 (11.1% increase)

Following a number of years where the dividend did not grow, McKesson double its payments to shareholders in 2008. Another pause occurred in 2009, but the company followed that up with a 50% increase and another double-digit raise over the next two years. McKesson's dividend compounded with an annual growth rate of 22.2% over the period listed above. That is extremely strong even when factoring in a pair of dividend pauses.

Investors looking for a return to a high dividend growth rate in the present should consider the company's past actions. I'm not sure a doubling of the dividend is in the offering, but the company showed it will deliver high rates of growth during a recovery. This could very well happen again if and when the economies of the world begin to recover from the ongoing pandemic.

Debt

In terms of financial strength, McKesson rates decently according to GuruFocus.

McKesson receives a 6 out 10. The company's cash-to-debt is lower than 69% of its peers and, perhaps more importantly, is near the low end of the company's range over the last 10 years. That said, McKesson's interest coverage is higher than almost any other point during this period of time.

The company's balance sheet is in solid shape.

McKesson ended the most recent quarter with $42.3 billion of current assets, including $3.1 billion of cash and cash equivalents. Accounts receivables totaled more than $19 billion. Current liabilities were $42.7 billion, with $36.3 billion of this falling under payables. Total debt stood at $9.6 billion, which was a decrease of 6.5% from the previous year. McKesson does have $1.8 billion of debt due within one year.

McKesson generated $50 million of interest expense in the most recent quarter, which gives the company a weighted average interest rate of just 2.1%.

Despite a low cash-to-debt ratio, McKesson's debt obligations don't appear to be a major headwind risk for the company. McKesson does have a significant portion of debt due within the next 12 months, but cash on hand is more than enough to cover this obligations and dividend payments with capital left over. Looking at this, I don't believe that debt will impair the company's ability to pay and raise its dividend.

Valuation

According to Yahoo Finance, analysts expect that McKesson will earn $16.37 in the current fiscal year. With the stock currently trading around $171, shares of the company have a forward price-earnings ratio of 10.4. This compares positively to the stock's five and 10-year average price-earnings ratios of 13.1 and 14.2, respectively.

Recently, the market hasn't been willing to pay above a low double-digit multiple for the stock. Still, the shares appear cheap compared to their historical average.

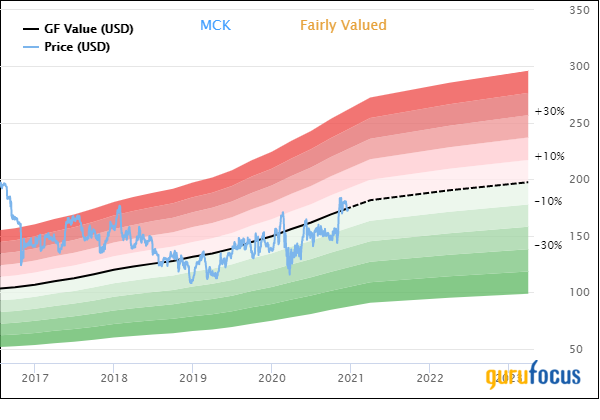

GuruFocus finds that the current share price is just below its intrinsic value.

McKesson has a GF Value of $174.75, which results in a price-to-GF Value of 0.98. Therefore, McKesson is rated as fairly valued by GuruFocus. The stock sits just 2.2% away from its GF Value, which doesn't leave much room for upside potential. The dividend yield also doesn't add much to total returns either. Were the stock to trade more in-line with its medium- or long-term average valuations, then returns could be plentiful.

Final thoughts

Healthcare companies are usually able to withstand the challenges of a recession as their products and services remain in demand regardless of the economic environment. This was true for McKesson, which saw growth tick considerably higher during the last recession.

The stock doesn't offer a high yield, but McKesson has a solid dividend growth history. Low payout ratios make it likely that dividend growth will continue into the future.

The stock trades very close to its GF Value, but the price-earnings ratio is below historical averages. The valuation looks even better when you remember that the S&P 500 index is trading with a price-earnings ratio of more than 37.

I am intrigued with McKesson as it has been able to grow at a high rate despite a very low profit margin. The company's share buybacks have been plentiful, but aren't the sole reason that EPS has grown in 14 out of the last 15 years.

From a total return perspective, there may not be much upside in McKesson at the moment, but the name would likely be a solid performer in the next recession. I would wait for a pullback before buying the stock, but investors looking for a recession proof company may find McKesson an attractive option now.

Author disclosure: the author has no position in any stock mentioned in this article.

Read more here:

3 Health Care Companies That Recently Raised Dividends

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.