Record Bearish Bets Hit Bilibili Even After 90% Dive

(Bloomberg) -- A Chinese technology company has emerged as a prime target for short sellers in the US even after the stock tumbled almost 90% over the past 18 months, a sign of how pessimistic some investors are about the economic outlook.

Most Read from Bloomberg

Apple Ditches iPhone Production Increase After Demand Falters

MacKenzie Scott Files for Divorce From Science Teacher Husband

Germany Suspects Sabotage Hit Russia’s Nord Stream Pipelines

S&P 500 Roars Back From Six-Day Slide; Bonds Surge: Markets Wrap

Short interest in Bilibili Inc. jumped to a record last week, with bearish positions accounting for almost half of shares outstanding, IHS Markit Ltd. data show. That makes the live-streaming platform operator among the most shorted US stocks among companies with market values of $2 billion or more.

The bets show just how wary -- and selective -- investors have become as it relates to putting money into the Chinese tech sector as the Nasdaq Golden Dragon China Index sinks about 30% this year. The stock is under pressure even after Beijing’s yearlong regulatory clampdown eased, in part because investors are concerned that Bilibili won’t become profitable any time soon given that advertising spending is weakening along with the slowing economy. Bilibili closed 1.6% lower on Friday.

“This market reaction makes sense in the current environment where cost of capital is rising and investors are no longer willing to assume these companies turn profitable and grow profits in the distant future, especially with regulatory tightening and difficult economic conditions in China,” said Louis Lau, a portfolio manager at Brandes Investment Partners LP.

Bilibili stands out when it comes to Chinese firms traded in the US. In 2021, it reported the biggest net loss among the 65 members of the Nasdaq Golden Dragon China Index. During the second quarter, it was one of the few Chinese internet companies that missed analyst expectations. That prompted brokerages including Citigroup Inc., Morgan Stanley and Deutsche Bank AG to slash target price forecasts, citing the impact of a slowing economy on the bottom line.

The firm is among a slew of unprofitable Chinese companies in the social media and entertainment sectors. These high cash burners have expanded aggressively thank to years of cheap capital. Now, the weakening economy isn’t just hurting the ability to raise cash, it’s also slowing consumer spending and hurting online advertising, which contributed one-quarter of Bilibili’s revenues last year.

“The pace of profitability could be slower than the market expects, with weaker cost discipline and slower growth for ads and games,” Morgan Stanley analysts including Alex Poon wrote in a Sept. 9 note on Bilibili. The brokerage also slashed its price target by 12%, citing high cash burn.

Beyond Bilibili, investors are also counting some other Chinese firms as good short bets. Short bets on online property agent platform Ke Holdings Inc. and social media platform Zhihu Inc. spiked this month. Both firms have been unprofitable for the last two years, and fund managers are now turning to companies that are stronger financially.

“During a market downturn, we would prefer companies that have high-quality, good cash flow and earnings certainty, because they have some buffer to offer dividends and share buybacks to support shares,” said William Fong, head of Hong Kong China equities at Barings.

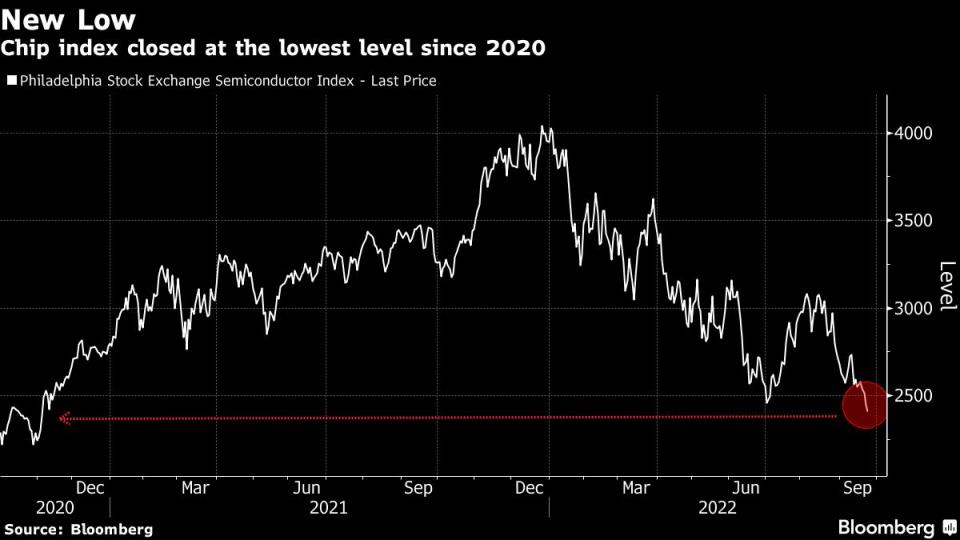

Tech Chart of the Day

Chip stocks fell for a second week in the wake of the Federal Reserve’s third straight 75-basis-point interest rate increase and amid mounting concerns of a global recession. The Philadelphia semiconductor index sank 6% this week and closed at the lowest level since 2020. The benchmark has now fallen 39% in 2022.

Top Tech Stories

Ericsson, still reeling from a cash-for-access probe in Iraq, has been plunged into a fresh governance scandal over applications to provide services and software in Russia. The Swedish 5G network maker was granted seven out of 12 applications to circumvent export sanctions against Russia since the start of the war in Ukraine through mid-August, Radio Sweden reported.

Apple Music will become the title sponsor of the Super Bowl halftime show, taking over from PepsiCo Inc., which has had its name on the star-studded intermission program since 2013.

Charlie Collier, head of the Fox broadcast network, is leaving to become the president of Roku Inc.’s media division, where he’ll oversee programming of the streaming TV company’s channels.

A former Twitter Inc. employee who was convicted of spying for Saudi Arabia by turning over personal information of platform users said he deserves a new trial because prosecutors didn’t tell him about a whistle-blower’s report on security lapses at the company.

Salesforce Inc. Co-Chief Executive Officer Marc Benioff said the company will continue to make acquisitions, while focusing more immediately on integrating companies it already bought.

(Updates with closing share price moves throughout.)

Most Read from Bloomberg Businessweek

As Home Prices Surge, Americans Are Moving to Cheaper Places

Mental Health Crisis Leads Hospitals to Create a New Type of ER

The Supreme Court Is About to Display Its Power Imbalance Again

©2022 Bloomberg L.P.