Red Robin (RRGB) Stock Down on Q1 Earnings & Revenue Miss

Red Robin Gourmet Burgers Inc. RRGB reported lower-than-expected results in first-quarter 2018. Following the quarterly results, the company’s shares tanked 15.4% in after-hour trading on May 22. However, in the past six months, the stock has gained 15.9% compared with the industry’s increase of 0.8%.

Earnings & Revenue Discussion

Red Robin’s adjusted earnings of 69 cents per share missed the Zacks Consensus Estimate of 74 cents by 6.8%. The bottom-line figure also witnessed a sharp decline of 22.5%.

Revenues came in at $421.5 million, which lagged the consensus mark of $431 million by more than 2% but witnessed a meager gain of 0.2% from the prior-year quarter. Marginal gain in revenues was driven by new restaurant openings and favorable impact of foreign currency, which overshadowed decline in comparable restaurant revenues.

Behind the Headline Numbers

Comps at company-owned restaurants were down 0.9% year over year against the prior-quarter comps increase of 2.7%. The downside can be attributed to 1% decline in average guest check, which marginally overshadowed 0.1% rise in guest counts. However, Red Robin outperformed the casual dining industry for the seventh consecutive quarter.

Restaurant-level operating profit margin contracted 130 basis points (bps) to 20%. The downturn was due to a 90-bps increase in cost of sales, 70-bps rise in other restaurant operating expenses and 40-bps surge in occupancy costs. The decline was partly offset by a 70-bps decrease in labor costs.

Adjusted earnings before interest, taxes, and amortization (EBITDA) increased 7.4% to $42.4 million from $45.8 million in the year-ago quarter.

Financial Highlights

Red Robin had cash and cash equivalents of $23.7 million as of Apr 22, 2018, compared with $17.7 million as of Dec 31, 2017. The company’s long-term debt amounted to $231.4 million as of Apr 22, 2018 compared with $266.4 million at the end of 2017.

Second-Quarter 2018 View

For second-quarter 2018, earnings per share are estimated between 55 cents and 75 cents. Meanwhile, the Zacks Consensus Estimate for the quarter is pegged at 74 cents.

2018 View

Red Robin did not provide any update on its 2018 guidance issued earlier. The company anticipates earnings in the band of $2.40-$2.80 per share, reflecting 14-33% year-over-year growth.

Red Robin projects comparable-restaurant sales growth of 50-150 bps. Operating weeks are expected to decline 1% as 2018 will have 52 weeks compared with 53 weeks in 2017. Total revenues are envisioned between a decline of 50 bps and an increase of 50 bps in 2018. Cost of sales, as a percentage of restaurant revenues, is anticipated to be up 50-100 bps. Restaurant labor costs, as a percentage of restaurant revenues, are expected to range between an increase of 25 bps and a decrease of 25 bps.

Red Robin has a Zacks Rank #3 (Hold).

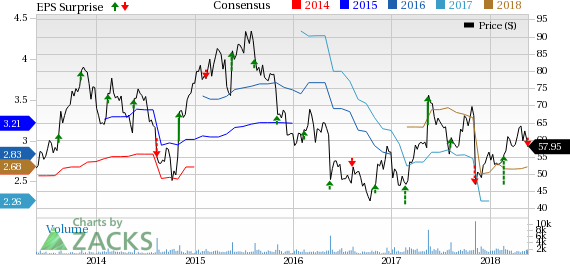

Red Robin Gourmet Burgers, Inc. Price, Consensus and EPS Surprise

Red Robin Gourmet Burgers, Inc. Price, Consensus and EPS Surprise | Red Robin Gourmet Burgers, Inc. Quote

Key Picks

Some better-ranked stocks in the same space are Wingstop Inc. WING, Dine Brands Global, Inc. DIN and Denny's Corporation DENN. While Wingstop sports a Zacks Rank #1 (Strong Buy), Dine Brands and Denny's carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Wingstop has an impressive long-term earnings growth rate of 19.5%.

Dine Brands Global reported better-than-expected earnings in the trailing four quarters, with an average beat of 7.8%.

Denny's reported better-than-expected earnings in the preceding two quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Denny's Corporation (DENN) : Free Stock Analysis Report

Red Robin Gourmet Burgers, Inc. (RRGB) : Free Stock Analysis Report

DineEquity, Inc (DIN) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research