Reduce Your Risk in Micron Technology, Inc. for Free!

Some on Wall Street are suggesting the run in shares of Micron Technology, Inc. (NASDAQ:MU) has been “nothing short of miraculous.” Personally, I beg to disagree. That being said, I still see suiting up as a Micron stock bull as a good deal more approachable using a modified fence strategy. Let me explain.

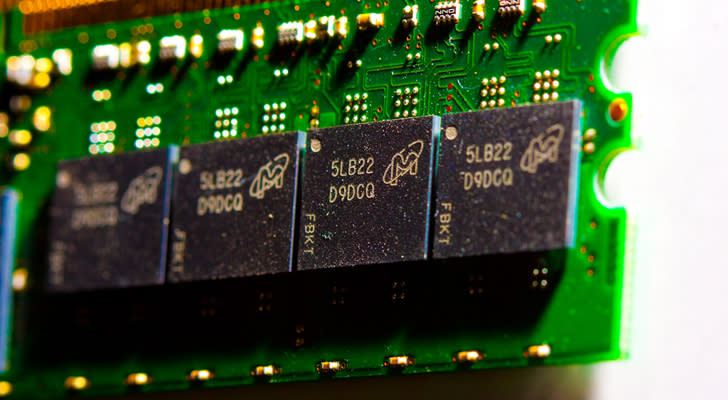

Source: Mike Deal via Flickr

What exactly makes Micron stock’s price run so spectacularly fortuitous as one CNBC writer noted Monday? I honestly don’t know, as they failed to elaborate. It’s true MU has made a favorable impression on Wall Street the past year and change. But look at the big picture for Micron stock both off and on the price chart, and I believe you’ll see conditions are still in position to ramp up.

Bottom line, Micron has pivoted away from being a volatile commodity-like producer of memory products to a company well-positioned in secular growth markets which should lead to an extended bullish business cycle.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Also backing this bullish view, the “miraculous” returns Micron stock has seen thus far not only appear well-deserved when looking at the price chart, but still priced at a discount to its potential since MU is looking much leaner than the broader market’s long-in-the-tooth bull run.

Micron Stock Daily Chart

In the week since I last wrote about Micron stock, a much needed price consolidation has occurred. Shares had aggressively rallied to fresh 17-years highs after forming a bullish hammer low to complete a “W” shaped base low.

As the daily chart also shows, while investors’ collective enthusiasm has eased, we’re not looking at a significant re-calibration of Micron stock’s animal spirits. Nonetheless, often enough momentum stocks do a fair job of keeping shares out of the reach of bulls waiting patiently for a larger pullback while shares instead continue to rally higher.

It’s our view that MU has entered this realm of momentum investing in front of Thursday’s earnings.

Since Micron stock is still well below its all-time high near $98 and with an overall increasingly supportive narrative off the price chart, I’d rather be positioned “long and wrong” and add to a position on a larger pullback if it occurs, while more preoccupied with higher prices for Micron stock.

Micron Stock Bullish Modified Fence Strategy

As we mused prior, the question for bullish investors is how to best position for a possible deeper pullback while keeping risk to a minimum and maintaining upside exposure in Micron stock if momentum is here to stay? One answer remains using a modified bullish fence strategy.

Last time I detailed buying the May $62.50/$65 bull call spread and simultaneously selling the May $52.50/$49 bull put vertical as a package for even money. With Micron stock marginally higher at $60.15 this modified fence combination is still offered for even money to perhaps a debit of 5 cents and fits in nicely with Susquehanna’s pricing forecast based on MU’s implied volatility.

The primary objective of this strategy is for the call vertical to go fully in-the-money with MU rallying above $65 and put the trader in position to capture a profit of $2.50 per spread at expiration.

Secondarily, for like-minded bulls wanting to accumulate Micron stock on a larger price decline, the limited and well-below-market risk associated with the embedded put vertical makes this an interesting way to position. On an expiration basis, the spread avoids a loss all the way down to $52.50 and one that’s capped at $3.50 or the equivalent of 5.8% of holding risk in MU if shares plunged below $49.

Investment accounts under Christopher Tyler’s management currently own positions in Micron (MU) and its derivatives. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.

More From InvestorPlace

The post Reduce Your Risk in Micron Technology, Inc. for Free! appeared first on InvestorPlace.