Reflecting on Homology Medicines' (NASDAQ:FIXX) Share Price Returns Over The Last Year

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the Homology Medicines, Inc. (NASDAQ:FIXX) share price slid 17% over twelve months. That's disappointing when you consider the market returned 20%. Homology Medicines hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. The share price has dropped 25% in three months.

Check out our latest analysis for Homology Medicines

Homology Medicines recorded just US$2,159,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that Homology Medicines comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

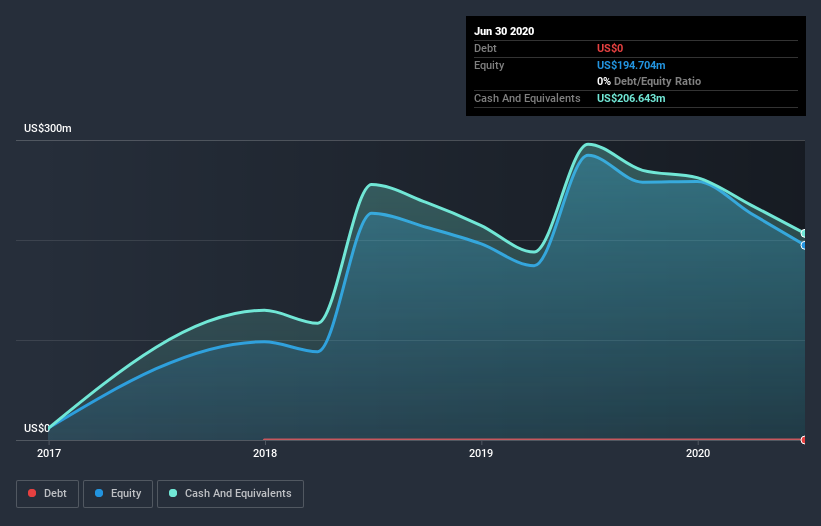

When it last reported its balance sheet in June 2020, Homology Medicines had cash in excess of all liabilities of US$143m. That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. With the share price down 17% in the last year , it seems likely that the need for cash is weighing on investors' minds. You can see in the image below, how Homology Medicines' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

Given that the market gained 20% in the last year, Homology Medicines shareholders might be miffed that they lost 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Notably, the loss over the last year isn't as bad as the 25% drop in the last three months. This probably signals that the business has recently disappointed shareholders - it will take time to win them back. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Homology Medicines is showing 5 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

But note: Homology Medicines may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.