Reflecting on Loma Negra Compañía Industrial Argentina Sociedad Anónima's (NYSE:LOMA) Share Price Returns Over The Last Three Years

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) shareholders should be happy to see the share price up 12% in the last month. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 77% in that time. So it's about time shareholders saw some gains. Of course the real question is whether the business can sustain a turnaround.

See our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Loma Negra Compañía Industrial Argentina Sociedad Anónima actually saw its earnings per share (EPS) improve by 49% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Loma Negra Compañía Industrial Argentina Sociedad Anónima has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

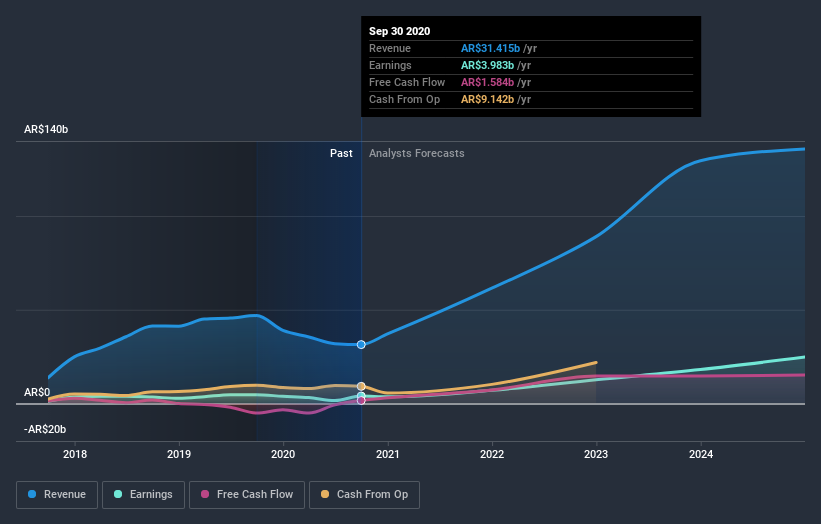

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Loma Negra Compañía Industrial Argentina Sociedad Anónima has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Over the last year, Loma Negra Compañía Industrial Argentina Sociedad Anónima shareholders took a loss of 15%, including dividends. In contrast the market gained about 22%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, the longer term story isn't pretty, with investment losses running at 21% per year over three years. We'd need clear signs of growth in the underlying business before we could muster much enthusiasm for this one. It's always interesting to track share price performance over the longer term. But to understand Loma Negra Compañía Industrial Argentina Sociedad Anónima better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Loma Negra Compañía Industrial Argentina Sociedad Anónima you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.