Reflecting on SDX Energy's (LON:SDX) Share Price Returns Over The Last Three Years

While it may not be enough for some shareholders, we think it is good to see the SDX Energy plc (LON:SDX) share price up 18% in a single quarter. Meanwhile over the last three years the stock has dropped hard. Regrettably, the share price slid 63% in that period. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

Check out our latest analysis for SDX Energy

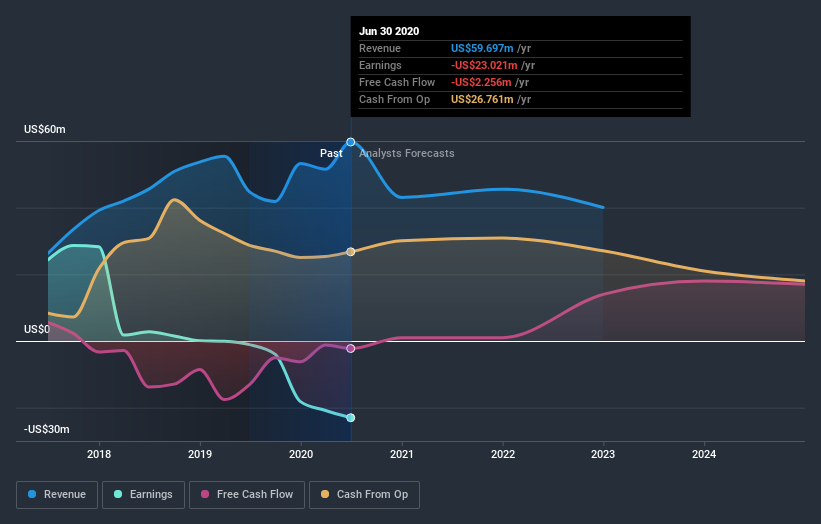

SDX Energy isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, SDX Energy grew revenue at 17% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 18% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at SDX Energy's financial health with this free report on its balance sheet.

A Different Perspective

The last twelve months weren't great for SDX Energy shares, which performed worse than the market, costing holders 21%. The market shed around 4.1%, no doubt weighing on the stock price. Unfortunately, the longer term story isn't pretty, with investment losses running at 18% per year over three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - SDX Energy has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.