Regions Financial (RF) Gains on Q4 Earnings Beat, Revenues Rise

Regions Financial Corporation’s RF fourth-quarter 2022 adjusted earnings per share of 67 cents surpassed the Zacks Consensus Estimate of 65 cents. The bottom line represents a rise of 52.3% from the prior-year quarter figure.

Shares of RF gained 1.9% in pre-market trading on better-than-expected results. A full-day trading session will depict a clearer picture.

Results have been aided by a rise in net interest income (NII) and average loan balances. However, rising expenses and provision for credit losses affected the bottom line.

Net income available to common shareholders was $660 million, up 59.4% year over year.

Adjusted earnings per share of $2.37 for 2022 missed the Zacks Consensus Estimate by a penny. The figure declined 6% from the previous year. Net income available to common shareholders was $2.15 billion, declining 10.6% from 2021.

Revenues Improve, Expenses Rise

Total quarterly revenues were $2 billion, beating the Zacks Consensus Estimate of $1.94 billion. Also, the top line rose 22.5% from the year-ago quarter’s reported number.

For 2022, revenues were $7.20 billion, beating the Zacks Consensus Estimate of $7.16 billion. The top line rose 12% from 2021.

Quarterly NII was $1.40 billion, up 37.5% year over year. Also, the net interest margin rose 116 basis points to 3.99%.

Non-interest income dipped 2.4% year over year to $600 million. The downside mainly resulted from lower service charges on deposit accounts, capital markets income, mortgage income and other income.

Non-interest expenses rose 3.5% year over year to $1.02 billion. The rise was due to an increase in salaries and employee benefits costs, equipment and software expenses, FDIC insurance assessment costs, branch consolidation, property and equipment charges, and other costs.

The efficiency ratio was 50.5% in the fourth quarter.

As of Dec 31, 2022, average loans increased 1.1% on a sequential basis to $95.75 billion. Moreover, total deposits were $133.01 billion, down 1.9% from the prior quarter.

Credit Quality: Mixed Bag

Non-performing assets (excluding 90+ past due), as a percentage of loans, foreclosed properties and non-performing loans held for sale were down to 0.53% from the prior-year quarter’s 0.54%.

However, non-performing loans, excluding loans held for sale as a percentage of net loans, were 0.52%, up from 0.51% in the prior year. Annualized net charge-offs, as a percentage of average loans, were 0.29% compared with 0.20% in the prior-year quarter. A provision for credit losses of $112 million was recorded in the quarter, up from $110 million in the prior-year quarter.

Capital Ratios Mixed

As of Dec 31, 2022, the Common Equity Tier 1 ratio and the Tier 1 capital ratio were estimated at 9.6% and 10.9%, respectively, compared with 9.6% and 11% recorded in the year-earlier quarter.

Our Viewpoint

Regions Financial put up a decent performance in the fourth quarter on higher loan balances and rising interest rates. RF’s attractive core business and revenue-diversification strategies will likely yield stellar earnings in the upcoming period.

Though a fall in fee income is concerning, we are optimistic about the bank’s branch-consolidation plan. Nevertheless, expense pressure is expected to prevail.

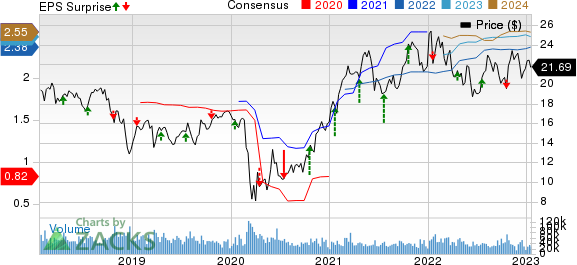

Regions Financial Corporation Price, Consensus and EPS Surprise

Regions Financial Corporation price-consensus-eps-surprise-chart | Regions Financial Corporation Quote

Currently, Regions Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Hancock Whitney Corporation’s HWC fourth-quarter 2022 earnings of $1.65 per share surpassed the Zacks Consensus Estimate of $1.63. The bottom line rose 6.5% from the prior-year quarter’s earnings of $1.55.

HWC’s results benefited from higher net interest income, supported by a rise in loan balance and increasing interest rates. However, lower non-interest income mainly due to higher mortgage rates was the undermining factor. Higher expenses and a rise in provisions were other concerns for HWC.

The PNC Financial Services Group, Inc.’s PNC fourth-quarter 2022 adjusted earnings per share of $3.49 lagged the Zacks Consensus Estimate of $3.95. Also, the bottom line declined 5.2% year over year.

PNC’s results were primarily hurt by a decline in non-interest income and higher provisions. However, an increase in net interest income, supported by higher rates and loan growth, and a decline in expenses were tailwinds for PNC.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regions Financial Corporation (RF) : Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report