REIT Recap For August 18, 2014

Analysts Upgrades/Downgrades:

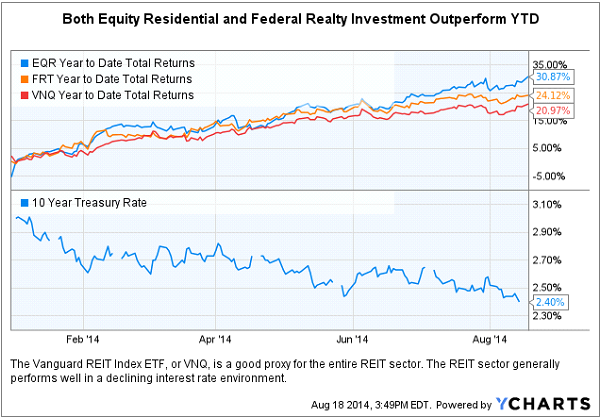

Jefferies upgraded Equity Residential (NYSE: EQR) from Underperform to Hold and raises price target to from $55 to $62 per share, which is seven percent below Monday's closing price of $66.70.

Jefferies downgraded Federal Realty Investment Trust (NYSE: FRT) from Buy to Hold with a price target of $129 up from $122 per share. Federal Realty shares closed Monday at $124.14.

REITs in the News:

Global industrial REIT giant Prologis (NYSE: PLD) announced a new 225,000 SF lease with Jaguar Land Rover in the U.K. Prologis owns and manages approximately 20 million square feet (21,000 square meters) of logistics and distribution space in the U.K. as of June 30, 2014.

Single-family for rent REIT pioneer American Residential Properties, Inc. (NYSE: ARPI) announced a $342 million offering of single-family rental certificates. These certificates represent an ownership interest in a loan secured by a portfolio of ~2,876 homes, and are priced at Libor plus 211 basis points.

Retail REIT Kimco Realty (NYSE: KIM), the largest owner of grocery anchored, community shopping centers in North America, announced the sale of three unencumbered Mexican centers for $93.5 million USD. This is Kimco's latest sale of Mexican shopping center assets -- totaling a gross sales price of $1.5 billion since May 2013 -- resulting in proceeds of $660 million USD for the company.

Notable Real Estate News:

On Monday, August 18, 2014, Home Loan Servicing Solutions (NASDAQ: HLSS), part of the Ocwen Financial (NYSE: OCN) family of companies, announced the filing of restated financial statements: 10-K 2013 Annual Report and 10-Q Quarterly Report for the period ended March 31, 2014. The company also filed its Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2014.

Ocwen Financial is the largest servicer of non-performing U.S. real estate loans and has been under investigation by the New York Department of Financial Services regarding transactions between related companies.

See more from Benzinga

Morgan Stanley Recommends 'Adding To Positions' On iWatch, iPhone Launches

Vimicro Announces Winning Of Competitive Bid In Wanbolin District In Taiyuan City Of Shanxi Province

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.