REITs to Watch for Q2 Earnings on Jul 23: ADC, ACC and ELS

Though the Q2 reporting cycle already kicked off last week, only a handful of REITs have reported their quarterly figures, so far. However, the next week will be eventful for REITs, with a number of firms queued for their earnings releases. Among those, Equity Lifestyle Properties ELS, American Campus Communities ACC and Agree Realty Corporation ADC are slated to report their earnings figures on Jul 23.

Going by numbers, the latest report from the real estate technology and analytics firm, RealPage, Inc. RP, suggests that rent growth in the U.S. apartment market is slowing down. In fact, with several markets witnessing flat rents, U.S. apartment rents increased at an annual pace of just 2.3%, as of mid-2018, denoting the slowest pace in eight years. While a mid-2018 occupancy level of 95.0% is still healthy, the deceleration in rent growth suggests that a competitive leasing environment is fast building up amid elevated supply, and curbing landlords’ pricing power.

Moreover, another report from RealPage states that the student housing sector, which is part of the residential REIT industry, has been experiencing a slowdown in leasing velocity and compression in rent growth, of late, amid demand supply imbalances. Specifically, properties away from campuses are feeling the brunt. Effective rent growth of 1.4% marked a minor compression from recent years, while more than 50% of properties are witnessing a drop in year-over-year leasing velocity.

In the retail real estate space, store closures and retailers bankruptcies continue to rule the market. Nevertheless, retail landlords are making concerted efforts to boost productivity of retail assets by trying to grab attention from new and productive tenants, and disposing the non-productive ones. Also, retail REITs are now avoiding dependence on apparel and accessories, and rather expanding their dining options, opening movie theaters, offering recreational facilities and opening fitness centers in particular.

Amid these, the national retail vacancy rate marginally increased to 10.2% in the second quarter, underlining store closures of bankrupt toy retailer, Toys “R” Us Inc., per data form Reis, while national average asking rents edged 0.2% higher.

Let us take a look at how the above-mentioned REITs are placed ahead of their quarterly releases.

Equity Lifestyle Properties is engaged in the ownership and operation of manufactured home communities, RV resorts and campgrounds in North America, offering housing options as well as vacation opportunities. The company’s results will likely reflect growth in funds from operations (FFO) per share in the to-be-reported quarter. The Zacks Consensus Estimate for FFO per share is 90 cents, reflecting year-over-year increase of 11.1%. However, the Zacks Consensus Estimate for revenues of $223.2 million indicates nearly 0.9% increase from the prior-year quarter.

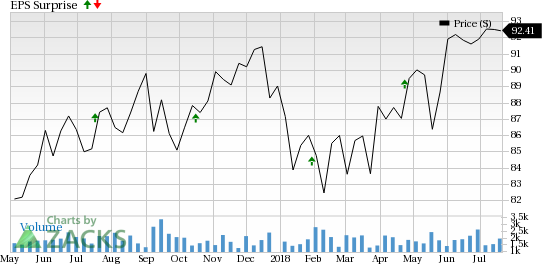

Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate in one occasion and met in the other three, delivering an average positive surprise of 0.3%. This is depicted in the graph below:

Equity Lifestyle Properties, Inc. Price and EPS Surprise

Equity Lifestyle Properties, Inc. Price and EPS Surprise | Equity Lifestyle Properties, Inc. Quote

This Zacks Rank #3 (Hold) stock has an Earnings ESP of 0.00%. Therefore, according to our quantitative model, it cannot be conclusively predicted whether or not Equity Lifestyle will likely beat the Zacks Consensus Estimate in the quarter. In fact, though a favorable Zacks Rank increases the predictive power of Earnings ESP, we also need to have a positive ESP to be confident of an earnings beat.

(You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.)

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

American Campus Communities is engaged in the ownership, management and development of student housing communities in the United States. The company’s Q2 FFO per share is expected to remain unchanged year over year at 53 cents. However, the company’s results are expected to display growth in total revenues from the prior-year period. The Zacks Consensus Estimate for the same is currently pegged at $203.8 million. This indicates an improvement of nearly 13.9% from the year-ago quarter.

Nonetheless, the company surpassed estimates in only one occasion and missed in the rest three quarters, resulting in an average negative surprise of 1.62%. This is depicted in the graph below:

American Campus Communities Inc Price and EPS Surprise

American Campus Communities Inc Price and EPS Surprise | American Campus Communities Inc Quote

Moreover, this Zacks Rank #4 (Sell) company has an Earnings ESP of -1.52%. Therefore, according to our quantitative model, the combination of a sell rating and a negative ESP lowers chances of any positive surprise for American Campus Communities in the upcoming results.

Agree Realty Corporation is mainly engaged in the acquisition and development of properties net leased to retail tenants. Notably, the Zacks Consensus Estimate for FFO per share for the quarter is 71 cents, reflecting year-over-year rise of 5.97%. The consensus estimate for revenues of $35.5 million indicates 26.4% year-over-year growth.

The company met the Zacks Consensus Estimate in three occasions and beat in the other, recording an average positive surprise of 0.73%. This is depicted in the graph below:

Agree Realty Corporation Price and EPS Surprise

Agree Realty Corporation Price and EPS Surprise | Agree Realty Corporation Quote

Currently, the company has an Earnings ESP of -0.88% and a Zacks Rank of 3. Therefore, we can’t conclusively predict a likely earnings beat.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RealPage, Inc. (RP) : Free Stock Analysis Report

Agree Realty Corporation (ADC) : Free Stock Analysis Report

Equity Lifestyle Properties, Inc. (ELS) : Free Stock Analysis Report

American Campus Communities Inc (ACC) : Free Stock Analysis Report

To read this article on Zacks.com click here.