Reliance Steel (RS) Up 12% in 3 Months: What's Driving It?

Reliance Steel & Aluminum Co.’s RS shares have gained 12.1% over the past three months. The company has also outperformed its industry’s decline of 7% over the same time frame. It has also topped the S&P 500’s roughly 4.5% decline over the same period.

Let’s take a look into the factors that are driving this Zacks Rank #2 (Buy) stock.

Image Source: Zacks Investment Research

What’s Aiding RS?

Forecast-topping earnings performance in the third quarter of 2022 and upbeat prospects have contributed to the gain in the company's shares. Reliance Steel’s adjusted earnings of $6.48 per share for the third quarter trounced the Zacks Consensus Estimate of $6.20. Revenues went up 10% year over year to $4,247.2 million and surpassed the Zacks Consensus Estimate of $4,163.4 million.

Sales in the quarter were driven by healthy demand in many of the company’s end markets and strong operational execution. The company gained from the recovery in aerospace and energy and continued strong performance in the semiconductor market.

Reliance Steel is gaining from strong underlying demand in its major markets. It expects healthy demand trends to continue into the fourth quarter notwithstanding the current macroeconomic uncertainty, inflation, ongoing supply-chain disruptions and geopolitical factors.

The company witnessed strength in the semiconductors market in the third quarter and expects this trend to continue in the fourth quarter. It also saw sequentially higher demand for the toll processing services that it provides to the automotive market due to increased production rates by certain automotive OEMs despite the impact of supply-chain challenges.

Additionally, demand in commercial aerospace recovered during the third quarter and the company is cautiously optimistic that demand will continue to improve in the fourth quarter. It also expects demand in the energy (oil and natural gas) market to modestly improve in the fourth quarter.

The company has also been following an aggressive acquisition strategy for a while as part of its core business policy to drive operating results. Its latest acquisitions of Rotax Metals, Admiral Metals and Nu-Tech Precision Metals are in sync with its strategy of investing in high-quality businesses.

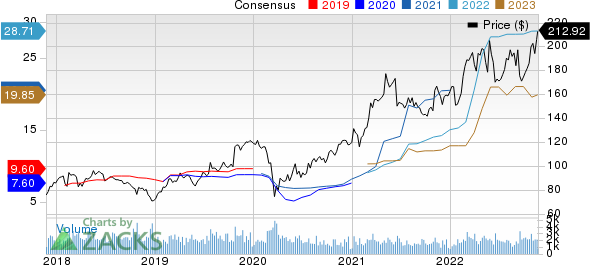

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Zacks Rank & Key Picks

Other top-ranked stocks worth considering in the basic materials space include Sociedad Quimica y Minera de Chile S.A. SQM, Olympic Steel, Inc. ZEUS and Commercial Metals Company CMC.

Sociedad has a projected earnings growth rate of 538.1% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.2% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 48% in a year. The company currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olympic Steel currently carries a Zacks Rank #1. The consensus estimate for ZEUS's current-year earnings has been revised 1.8% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 25.4%, on average. ZEUS has rallied around 53% in a year.

Commercial Metals currently carries a Zacks Rank #1. The Zacks Consensus Estimate for CMC's current-year earnings has been revised 4.1% upward in the past 60 days.

Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 19.7%, on average. CMC has gained around 43% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report