Reliance Steel (RS) Tops Earnings, Revenue Estimates in Q1

Reliance Steel & Aluminum Co. RS saw its profits jump in the first quarter of 2018. It posted a profit of $169 million or $2.30 per share in the quarter, a roughly 51% surge from $111.7 million or $1.52 per share a year ago. Earnings per share for the reported quarter exceeded the Zacks Consensus Estimate of $2.01.

The company benefited from positive demand environment and higher year over year pricing levels in the quarter, which contributed to its earnings. It saw continued strong demand across aerospace and automotive markets in the quarter.

Reliance Steel recorded net sales of $2,757.1 million, up 14% year over year. It surpassed the Zacks Consensus Estimate of $2,704 million.

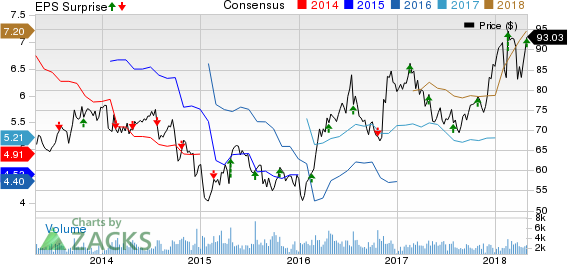

Reliance Steel & Aluminum Co. Price, Consensus and EPS Surprise

Reliance Steel & Aluminum Co. price-consensus-eps-surprise-chart | Reliance Steel & Aluminum Co. Quote

Volumes and Pricing

Overall sales volume rose 3.6% year over year to record 1.6 million tons. Average prices per ton sold went up 10.3% from the prior-year quarter to $1,724.

Financials

Reliance Steel ended the quarter with cash and cash equivalents of $145.4 million, up roughly 9% year over year. Long-term debt was essentially flat year over year at $1,947.1 million. Cash flow from operations was $13.3 million for the first quarter.

Reliance Steel repurchased shares worth $50 million during the first quarter and had roughly 7.5 million shares available for repurchase under its share repurchase program at the end of the quarter. The company also paid $38.5 million in dividends in the first quarter.

Outlook

Reliance Steel is optimistic about business activity levels in second-quarter 2018 and sees continued improvement in the end markets in which it operates. However, it expects shipment levels to be affected by the pre-buying activity that took place in the first quarter.

Reliance Steel expects tons sold to be down 1% to up 1% in the second quarter of 2018 on a sequential comparison basis. Average selling prices are projected to be up 5% to 8% in the second quarter compared with the first. Additionally, the company expects earnings per share to be in the band of $2.60 to $2.70 for the second quarter.

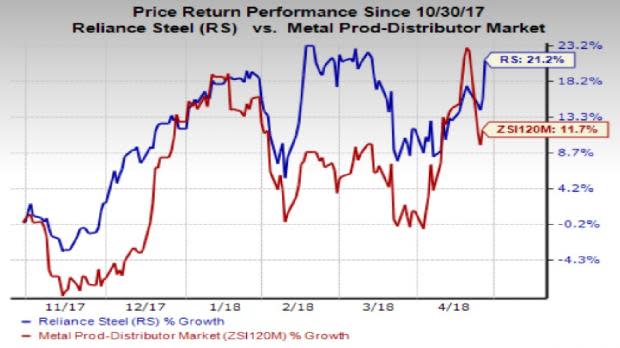

Price Performance

Reliance Steel’s shares have moved up 21.2% in the last six months, outperforming the industry’s 11.7% gain.

Zacks Rank & Stocks to Consider

Reliance Steel currently carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the basic materials space are Kronos Worldwide Inc. KRO, Celanese Corporation CE and Methanex Corporation MEOH.

Kronos has an expected long-term earnings growth rate of 5% and flaunts a Zacks Rank #1. The company’s shares have moved up around 36% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Celanese has an expected long-term earnings growth rate of 8.9% and flaunts a Zacks Rank #1. Its shares have gained roughly 26% over a year.

Methanex has an expected long-term earnings growth rate of 15% and carries a Zacks Rank #2 (Buy). Its shares have roughly 38% over a year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research