Can Rent-A-Center (RCII) Break the Jinx This Earnings Season?

Rent-A-Center, Inc. RCII is slated to release first-quarter 2018 results on Apr 30, after market close. Now, the question that has been plaguing the minds of investors is whether this leading rent-to-own store operator will be able to deliver a beat after the string of misses in the trailing three quarters.

Nevertheless, this Plano, TX-based company has adopted strategic plans to bring itself back on the growth trajectory. The company’s preliminary results for the quarter are quite upbeat, courtesy of the endeavors taken by management to strengthen the Core U.S. segment.

Let’s Analyze Further

Rent-A-Center, which has been exploring strategic and financial alternatives, stated that preliminary same-store sales growth in the Core U.S. segment showed an uptick of 0.3% in the quarter under review. Same-store sales showed a pick-up of 1.6% in March 2018. Notably, the same at the Acceptance Now segment reflected a 3.3% improvement.

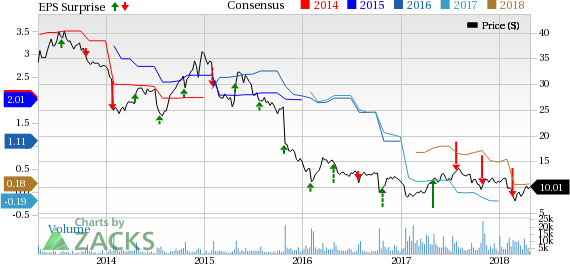

Rent-A-Center, Inc. Price, Consensus and EPS Surprise

Rent-A-Center, Inc. Price, Consensus and EPS Surprise | Rent-A-Center, Inc. Quote

Per analysts polled by Zacks, same-store sales are expected to increase 1.4% in the yet-to-be-reported quarter. The company is optimizing product mix, increasing the average ticket price and focusing on lowering delinquency rates. Earlier this year, Rent-A-Center realized cost-saving opportunities through the collaboration with AlixPartners. Also, the company is rationalizing store base and lowering debt load.

We note that in the last reported quarter, same-store sales at the Core U.S. segment declined 3.6%, while the same at the Acceptance Now segment increased 6.7%. In the final quarter of 2017, same-store sales dropped 2%.

Meanwhile, the company received bids from different parties for a possible sale. The company informed that it expects to finalize the deal in the second quarter of 2018.

How Are Estimates Shaping Up?

For the past eight quarters, the company has been witnessing a year-over-year decline in the bottom line. However, the trend is likely to reverse in the first quarter of 2018. The Zacks Consensus Estimate for the quarter under review stands at 8 cents compared with 4 cents in the year-ago quarter.

However, the top-line performance may continue to hurt investor sentiments. Analysts polled by Zacks now project revenues of $700.8 million, down from $742 million in the year-ago quarter. This would be the ninth straight quarter of revenue decline. We note that net sales declined 3.7% in the preceding quarter.

Revenues from the Core U.S. and Acceptance Now segments are expected to decline 3.2% and 5.3% to $475 million and $222 million, respectively. However, the Mexico segment’s revenues are expected to come in at $11.2 million, incing up 0.6% year over year. Finally, total Franchising revenues are expected to increase 5.5% to $5.7 million in the yet-to-be-reported quarter.

What Does the Zacks Model Unveil?

Our proven model shows that Rent-A-Center is not likely to beat estimates this quarter. A stock needs to have both — a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Rent-A-Center has a Zacks Rank #3 and an ESP of -23.47%.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Guess', Inc. GES has an Earnings ESP of +16.18% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Michael Kors Holdings Limited KORS has an Earnings ESP of +6.69% and a Zacks Rank #2.

Ralph Lauren Corporation RL has an Earnings ESP of +2.92% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rent-A-Center, Inc. (RCII) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Michael Kors Holdings Limited (KORS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research