Restaurant Brands (QSR) Q1 Earnings Top Estimates, Rise Y/Y

Restaurant Brands International, Inc. QSR reported strong first-quarter 2021 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Moreover. the metrics improved on a year-over-year basis. Following the results, shares of the company moved up 1.2% during trading hours on Apr 30.

Earnings & Revenues Discussion

The company’s adjusted earnings of 55 cents per share surpassed the Zacks Consensus Estimate of 50 cents by 10%. Moreover, the bottom line increased 14.6% from the prior-year quarter’s figure of 48 cents.

During the first quarter, net revenues of $1,260 million surpassed the consensus mark of $1,252 million. Moreover, the top line increased 2.9% on a year-over-year basis, owing to favorable FX movements. This along with a rise in retail sales at Tim Hortons coupled with an increase in system-wide sales at Burger King and Popeyes, added to the upside.

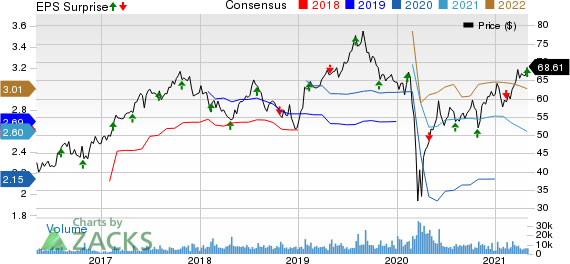

Restaurant Brands International Inc. Price, Consensus and EPS Surprise

Restaurant Brands International Inc. price-consensus-eps-surprise-chart | Restaurant Brands International Inc. Quote

Segmental Revenues

Restaurant Brands operates through three segments — Tim Hortons, Burger King and Popeye’s Louisiana Kitchen.

During first-quarter 2021, revenues in Tim Hortons totaled $710 million compared with $699 million in the prior-year quarter. System-wide sales declined 4.9% year over year compared with 9.9% fall in the prior-year quarter. Comps in the segment declined 2.3% year over year compared with 10.3% fall in the prior-year quarter. The downtick was primarily caused by temporary closures of certain restaurants, owing to the pandemic. In the quarter, net restaurant growth was recorded at 1.3% compared with 1.2% in the prior-year quarter.

Burger King’s revenues totaled $407 million in the first-quarter 2021 compared with $388 million in the prior-year quarter. The upside was primarily driven by a rise in system-wide sales along with favorable FX movements. System-wide sales in the segment increased 1.8% year over year against 3% decline in the prior-year quarter. Also, comps inched up 0.7% year over year against 3.7% fall in the prior-year quarter. In the first quarter, net restaurant growth was recorded at (0.8%) against 5.8% growth reported in the prior-year quarter.

Popeye’s Louisiana Kitchen reported revenues of $143 million in the first quarter of 2021 compared with $138 million in the prior-year quarter. System-wide sales increased 7% year over year compared with 32.3% growth recorded in the prior-year quarter. Meanwhile, net restaurant growth came in at 4.8% compared with 6.9% growth in the prior-year quarter. Comps in the segment inched up 1.5% compared with 26.2% growth in the prior-year quarter.

Operating Performance

In the quarter under review, the company’s adjusted EBITDA increased 8.2% year over year to $480 million. On an organic basis, the upside was driven by an increase in Tim Hortons, Burger King and Popeyes adjusted EBITDA.

Segment-wise, Tim Horton’s adjusted EBITDA increased 9.5% from the year-ago quarter’s tally. Burger King’s adjusted EBITDA rose 8.5% year over year. Meanwhile, Popeye’s adjusted EBITDA moved up 1.8% from the year-ago quarter’s levels.

Cash and Capital

Restaurant Brands ended first quarter with cash and cash equivalent balance of $1,563 million compared with $2,498 million in the prior-year quarter. As of Mar 31, 2020, its net debt stood at $11.4 billion compared with $10.9 billion as on Mar 31, 2020. The company’s board of directors announced a dividend payout of 53 cents per common share and partnership exchangeable unit of RBI LP for the second-quarter 2021. The dividend is payable on Jul 7, 2021, to shareholders of record at the close of business as of Jun 23, 2021.

Other Updates

As of March-end, 95% of the company’s restaurants remained open worldwide that included all restaurants in North America and Asia Pacific. Meanwhile, 92% of the restaurants remained open in Europe, Middle East and Africa and 84% of its restaurants remained open in Latin America. During the quarter, markets in Canada, Europe and Brazil witnessed re-imposed lockdowns and curfews. Going forward, the company expects the pandemic to negatively impact operations in 2021.

Zacks Rank

Restaurant Brands currently carries a Zacks Rank #4 (Sell).

Peer Releases

Yum! Brands, Inc. YUM reported strong first-quarter 2021 results, with earnings and revenues surpassing the Zacks Consensus Estimate. Both the metrics improved year over year. The company’s adjusted earnings of $1.07 beat the Zacks Consensus Estimate of 85 cents. In the prior-year quarter, the company had reported adjusted earnings of 64 cents. Quarterly revenues of $1,486 million surpassed the consensus estimate of $1,461 million. The top line also rose 17.7% year over year. The upside can be attributed to increase in company sales along with rise in franchise and property revenues.

McDonald's Corporation MCD reported first-quarter 2021 results, with earnings and revenues outpacing the Zacks Consensus Estimate. The company reported adjusted earnings of $1.92 per share, which surpassed the Zacks Consensus Estimate of $1.81. Moreover, the bottom line rose 31% year over year. Quarterly revenues of $5,124.6 million beat the Zacks Consensus Estimate of $5,047 million. Moreover, the figure rose 9% year over year. The top line benefited from increase in global comparable sales.

Starbucks Corporation SBUX reported second-quarter fiscal 2021 results, with earnings beating the Zacks Consensus Estimate and revenues missing the same. The company reported adjusted EPS of 62 cents, which beat the Zacks Consensus Estimate of 52 cents. In the prior-year quarter, the company had reported adjusted EPS of 32 cents. Meanwhile, quarterly revenues of $6,668 million missed the Zacks Consensus Estimate of $6,803 million. However, the top line increased 11.2% from the year-ago quarter’s levels. The uptick was driven by growth in comparable store sales, partially offset by the unfavorable impact of Global Coffee Alliance transition-related activities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

McDonalds Corporation (MCD) : Free Stock Analysis Report

Yum Brands, Inc. (YUM) : Free Stock Analysis Report

Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research