Retail Earnings Roll On With Wal-Mart And Target On Calendar; Housing Data Too

Attention U.S. shoppers: Two of the country’s biggest retailers report this coming week as earnings season grinds on. Between that and some fresh housing data, there could be plenty to ponder over the next few days.

Competing with earnings is the ongoing buzz out of Washington, D.C., with many investors keeping a close eye on the situation along the Potomac. Concern arose last week about whether the administration will be able to push tax reform and infrastructure spending through Congress amid political turmoil. Some of the pressure on markets late last week arguably arose in part because Washington seems less focused on the types of pocketbook issues many investors care about.

Leaving Washington aside, the earnings trifecta ahead includes Target Corporation (NYSE: TGT) on Wednesday morning, Wal-Mart Stores Inc (NYSE: WMT) on Thursday morning, and Deere & Company (NYSE: DE) on Friday morning. WMT and TGT follow mostly disappointing results from the department store sector last week along with April retail sales that rose less than Wall Street analysts had anticipated. E-commerce sales climbed double digits, the government said Friday, but sales declined at most types of traditional stores.

In some ways, though, TGT and WMT stand apart from those other retailers, although they, too, depend a lot on brick and mortar stores. WMT saw e-commerce sales rise 29% in its prior quarter, and TGT has a heavy Internet presence as well. WMT is also performing nicely by more traditional metrics, with same-store sales up 10 quarters in a row. The question is whether WMT continued that momentum, especially when retail sales didn’t grow much nationwide the first three months of the year, according to government data.

Earnings from DE could provide investors some insight into both agriculture and construction, two key industries that help propel the economy. In its previous quarterly report, DE said results were pressured by soft conditions in the farm and construction equipment sectors. It’s also worth checking to see how DE did internationally. The company reported strong overseas sales last time out, but commodity prices remain under pressure, which conceivably could affect the most recent quarter.

Though earnings from those three behemoths might dominate as the week goes by, also keep an eye out for the latest U.S. housing data. Housing starts and building permits for April are due Tuesday morning, and housing has been a booming sector lately. Industrial production is the other major report coming out Tuesday. Later in the week, there’s less economic data on the calendar, but we do have those earnings reports to monitor.

Don’t forget the Fed, either. It’s still a few weeks until the next meeting, but Fed speakers have been on the prowl. The most recent was Friday when Chicago Fed President Charles Evans said that he’d be surprised to see more than two additional rate hikes this year. That’s in line with expectations in the futures market, but Evans’ comments may have weighed on Treasury yields Friday, according to Briefing.com. Chances of a rate hike by June stood at just under 74% as of midday Friday, futures prices showed, down from above 80% earlier in the week.

University of Michigan Consumer Sentiment data, the last major economic report of the week, came in a little above expectations, rising in early May from the April reading.

Pulling Back

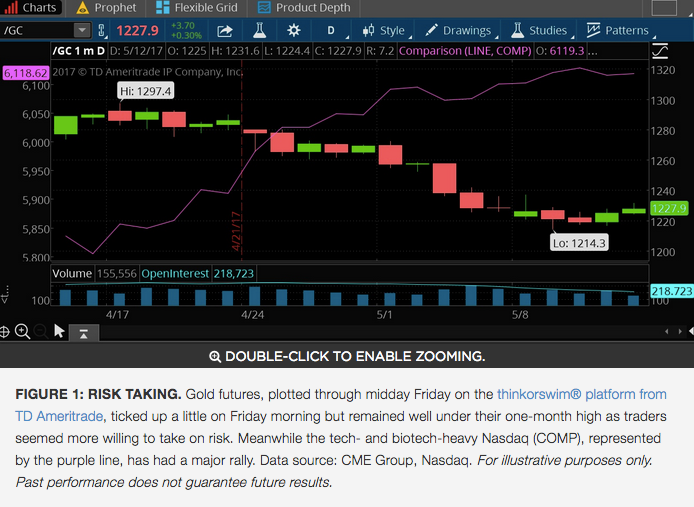

Late in the week, a few of the more positive indicators that helped light up the market a few days earlier started to retreat a little. For instance, 10-year Treasury bond yields, which touched the 2.4% level at mid-week, fell below 2.33% by late in the morning Friday. The dollar — which had reached nearly three-week highs — slipped against the euro and yen. Additionally, the stock market came under pressure after hitting new record highs earlier in the week. Meanwhile, gold bounced back a little, perhaps a sign of a more cautious tone in the market. This could all simply have been some pre-weekend profit taking, but it bears watching to see if defensive trading continues into the new week.

Mind the Gap

It may seem like markets have gone straight up this year, but there’s quite a discrepancy in performance if you look at individual sectors. The most dramatic difference is between the best- and worst-performing sectors of the year, with information technology stocks up more than 17% as of midday Friday and energy and telecom both down more than 10%. That’s an unusually high differential from a historic point of view. Consumer discretionary is the other sector with double-digit gains year to date, but most of the other sectors have gained about 5% to 7%, and the S&P 500 Index (SPX) was up approximately 7%. It’s interesting to see that financials, which helped lead the post-election charge, are up less than 2% so far this year. The failure of interest rates to gallop higher might help explain that.

Politics and the Market

There was a lot of talk about Watergate the last few days and how the current situation might or might not compare. Some analysts reminded investors about the market’s weak performance back in the mid-1970s as that scandal dominated the headlines. But Sam Stovall of research firm CFRA wrote, “We see few fundamental similarities.” He pointed out that at that time, inflation and interest rates were far higher than they are now, and the yield curve was inverted, a rather rare occurrence that often precedes recessions and isn’t the case now. Also, OPEC’s oil shock in late 1973 almost immediately tripled oil prices, whereas at this point oil remains cheap.

See more from Benzinga

Mixed Picture: Retail Sales Up, But Miss Expectations As 'Brick And Mortar' Weak

Big Retail Earnings On Display, Starting With Macy's As Season Winds Down

© 2017 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.