Retail ETFs in Focus on JC Penney Woes

JC Penney (JCP) shares were down nearly 20% Thursday morning on dreadful quarterly results but the sell-off didn’t spill over too much into ETFs tracking retail and consumer discretionary stocks.

The sector ETFs were able to sidestep the damage because no one fund has more than 1% in JC Penney.

The retail fund with the largest position in JCP is SDPR S&P Retail ETF (XRT), which was flat in early trading Thursday. The ETF has just under 1% in the stock.

The consumer discretionary sector has been a standout in recent years as the economy gets back on its feet after the financial crisis.

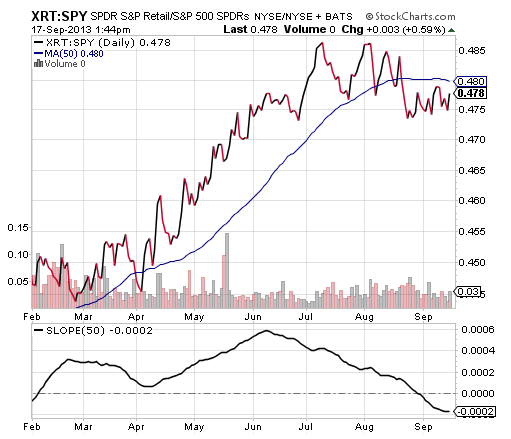

For example, the retail ETF is trading near all-time highs. XRT has posted a three-year annualized return of 23.3%, compared with 13.4% for SPDR S&P 500 ETF (SPY), according to Morningstar.

SDPR S&P Retail ETF

Full disclosure: Tom Lydon’s clients own SPY.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.