Retail Investors Reach For Core ESG ETFs

Interest in ESG and socially responsible ETFs has grown this year, with assets in these funds rising to $116.6 billion. But according to data from VandaTrack, a product of Vanda Research that aims to track buying and selling of securities from individual-led accounts, retail interest in the space has cooled considerably since peaking at the beginning of the year.

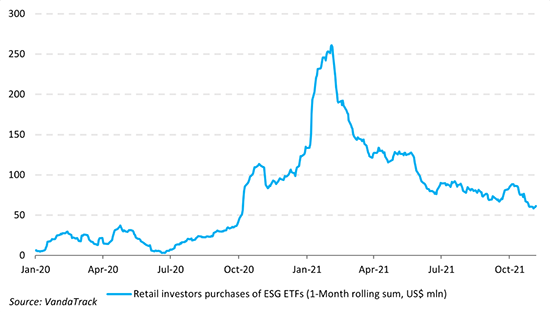

The chart below shows the one-month rolling sum of retail purchases into socially responsible ETFs, as defined by FactSet. Retail interest began to rise in July 2020, peaking in the beginning of 2021, but has been on a decline since then.

(For a larger view, click on the image above)

Looking at which ETFs saw the biggest proportion of retail flows in January and February, it is evident that retail investors were particularly interested in clean energy ETFs. One such fund, the iShares Global Clean Energy ETF (ICLN), received over half of retail net flows during this time frame.

Most Bought ESG ETFs January 2021 - February 2021 | ||

Ticker | Fund | Retail Net Flow Proportion |

51.7% | ||

8.7% | ||

8.3% | ||

6.7% | ||

6.5% | ||

Blue Wave Lifts Clean Energy ETFs

ICLN tracks a tiered index of global companies involved in clean energy businesses. Clean energy ETFs like ICLN received a performance bump after Joe Biden was elected president in November 2020.

From Nov. 3 through Feb. 1, ICLN gained 53.3%. The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) rose by 68.0% and the Invesco Solar ETF (TAN) jumped by 55.8%.

Joe Biden campaigned on a promise of a $2 trillion investment in clean energy, and his electoral win breathed new air into related stocks, lifting the performance of these ETFs.

However, the tides turned for these ETFs in the following months. Valuations for the stocks held within these ETFs looked stretched as rising interest rates weighed on investors’ minds.

Notably, the performance chart for these ETFs mirrors the flow into such ETFs. This suggests that at the start of the year, the retail crowd were “fair weather investors” chasing performance into these clean energy funds.

Shifting Focus

Although it has declined from earlier in the year, retail interest in ESG ETFs remains elevated above levels seen in early 2020. And while ICLN remains a fan favorite, retail investors are starting to turn toward broad-based core options within the ESG space.

Most Bought ESG ETFs Since October 2021 | ||

Ticker | Fund | Retail Net Flow Proportion |

20.8% | ||

13.4% | ||

13.2% | ||

10.8% | ||

8.7% | ||

Three iShares ESG Aware ETFs fall within the top five. These funds provide marketlike exposure to domestic equities, international developed equities and emerging markets.

The shift in investor focus to core funds suggests that this elevated retail interest could be more sustainable. That is, the retail crowd is no longer chasing performance, at risk of bailing should the tides turn.

Instead, they are seeking ESG exposure within their core portfolio holdings, not just thematic plays.

These iShares ETFs are only slightly more expensive relative to their vanilla counterparts, ranging from 0.15-0.25% in cost.

Performance is also in line with the market due to the index construction process, which is optimized to exhibit risk and return characteristics that are similar to the parent index.

ESG Tilt Adds Value

Over the past year, the iShares ESG Aware MSCI USA ETF (ESGU) has slightly outperformed the SPDR S&P 500 ETF Trust (SPY) in spite of the higher expense ratio, suggesting the ESG tilt can add value over time.

While time will tell whether retail interest in ESG will heat up or cool down, their shifting preference for funds like ESGU suggests investors could be looking to make socially responsible ETFs an integral part of their portfolio going forward.

Contact Jessica Ferringer at jessica.ferringer@etf.com or follow her on Twitter

Recommended Stories