RH Tops Q2 Earnings, Lags Sales Estimates, Revises '18 View

RH RH reported mixed second-quarter fiscal 2018 results, with earnings surpassing the Zacks Consensus Estimate but revenues lagging the same. In spite of a fiscal 2018 earnings guidance raise, the company’s shares declined 13.1% on Sep 5 as investor sentiments were hurt by a soft revenue view.

RH reported second-quarter earnings per share of $2.05 as compared with 65 cents in the prior-year quarter. Also, earnings beat the Zacks Consensus Estimate of $1.74 by 17.8%.

Adjusted revenues (including recall accrual) increased 3.8% year over year to $642.7 million but missed the consensus mark of $661 million. RH’s comparable brand revenues rose 5% year over year compared with a 7% increase in the prior-year quarter. The company’s direct revenues increased 5% and store revenues rose 3%.

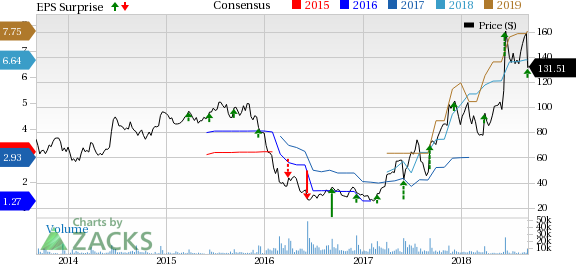

Restoration Hardware Holdings Inc. Price, Consensus and EPS Surprise

Restoration Hardware Holdings Inc. Price, Consensus and EPS Surprise | Restoration Hardware Holdings Inc. Quote

Margins

Adjusted operating income of $79 million in the reported quarter improved from the prior-year quarter’s $39.9 million. Adjusted operating margin expanded 590 basis points to 12.3%.

Adjusted gross profit was $270.4 million, up 28.2% year over year. Adjusted gross margin improved 800 bps to 42.1% owing to robust full price selling, lower outlet revenues, efficient distribution channel as well as reverse logistics network.

Store Update

As of Aug 4, 2018, RH operated 85 retail galleries. These include 44 legacy galleries, 18 design galleries, two RH Modern Gallery and six Baby & Child galleries in the United States and Canada, respectively, along with 15 Waterworks showrooms in the United States and the U.K. The company operated 36 outlet stores compared with 28 a year ago.

Balance Sheet

RH had cash and cash equivalents of $22.2 million as of Aug 4, 2018, compared with $21.6 million as of Jul 29, 2017. The company ended the second quarter with merchandise inventories worth $551.3 million compared with $608 million as on Jul 29, 2017.

Q3 Outlook Issued

Revenues are projected in the range of $624-$636 million, reflecting an increase of 5-7% year over year.

Adjusted gross margin is projected in the band of 40-40.5%.

Adjusted operating margin is expected in the range of 8-8.9%.

Adjusted SG&A, as a percentage of revenues, is estimated in the 31.6-32% band.

Adjusted earnings per share are projected between $1.15 and $1.33.

2018 Guidance Revised

Net revenues are now expected in the $2.48-$2.52 billion range, representing growth of 4-5% year over year. Earlier, the company had projected revenue grow in the range of 5-7% year-over-year.

Adjusted gross margin is projected in the 40-40.2% range (39.3%-39.6% expected earlier).

Adjusted operating margin is now expected in the 11.2-11.7% band, up from the previous estimate of 10.4-11%.

Adjusted SG&A, as a percentage of revenues, is expected in the 28.6-28.7% range (28.6-28.9% expected earlier).

Adjusted earnings per share are expected in the $7.35-$7.75 range ($6.34-$6.83 expected earlier).

Free cash flow is projected in excess of $260 million, same as the previous estimate.

Zacks Rank & Other Key Picks

RH carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Retail-Wholesale sector are Amazon.com, Inc AMZN, carrying a Zacks Rank #1 (Strong Buy), along with Darden Restaurants, Inc. DRI and DineEquity, Inc DIN carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amazon has an expected current-year earnings growth rate of 288.8%.

Darden Restaurants reported better-than-expected earnings in the trailing four quarters, the average beat being 3.1%.

DineEquity has reported better-than-expected earnings in the last four quarters, with the average beat being 8.1%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

DineEquity, Inc (DIN) : Free Stock Analysis Report

Restoration Hardware Holdings Inc. (RH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research