How RH Turned Furniture Shopping Into a Luxury Experience

RH (NYSE: RH) sells luxury furniture in self-branded retail stores, but it wants to be more than a furniture retailer -- it wants to be a lifestyle brand.

To differentiate itself from the competition, RH has integrated a hospitality experience at several of its new locations by constructing stores featuring beautiful architecture, luxury cafes, wine vaults, barista bars, and entertainment spaces. This significant departure from the typical retail business model has made RH more than a store and lifted the company's financial results in the process.

RH's New York Meatpacking District store. Image source: RH. Image source: https://www.restorationhardware.com/content/category.jsp?context=NewYork

A luxury experience ...

In 2015, RH opened its first hospitality design concept in Chicago's affluent Gold Coast neighborhood. RH has operated various retail formats over the past 40 years, but the hospitality design gallery is something wholly unique in both scale and function. The Chicago location is a 70,000-square-foot "store" located inside the historic Three Arts Club building. In addition to six floors of selling space, the site features a grand courtyard with a restaurant run by an award-winning chef, a rooftop garden with a performance space, an espresso and pastry bar, and a wine vault with regular tastings.

Inside RH's Chicago Design Gallery. Image source: RH. Image source: http://3artsclubcafe.com/

The new store concept blurs the lines between retail and hospitality, akin to a branded entertainment experience. Visitors to the design galleries can enjoy the architecture and interior design while indulging in fine cuisine or drinks. During the visit, customers can also shop for furniture at any time. Essentially, RH has given customers, regardless of their furniture needs, a reason to regularly visit its stores, which is great for brand building and advertising new items.

The Three Arts Club store has been a runaway success. In 2016, the first full year of operation, the store counted more than 50 wedding proposals and was reported to be the seventh most shared cafe in the country on Instagram. This success led the company to open an additional five design galleries featuring the integrated hospitality experience. Chicago was no one-hit wonder -- RH's New York design gallery opened in 2018 and is already on track for annualized revenue in excess of $100 million.

At a time when many retail brands are closing stores, RH has innovated with a fresh concept that's transforming RH into a luxury experience, in addition to a luxury furniture brand.

... that hasn't come cheap

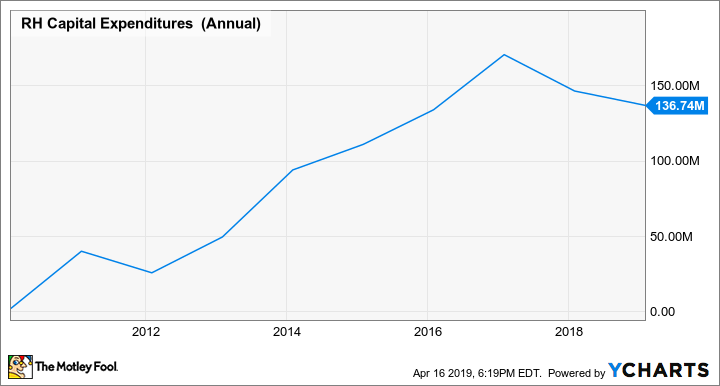

RH couldn't launch this effort overnight. Significant time and capital went into building out the current footprint of six hospitality design galleries. These massive stores are not only 5 to 10 times the size of legacy RH stores, they also require costly investments in amenities and fixtures. As a result, RH's capital expenditures have soared in recent years.

Data by YCharts.

While some of the company's capital investment has gone toward maintaining existing stores as well, most has been spent on the construction of design galleries. The cost of each new project varies widely but can run into the tens of millions. For example, RH's New York store required around $50 million in upfront investment.

The significant spending on new stores will be well worth it if these locations are profitable and result in meaningful revenue growth. RH's management is confident that will be the case. During a Sept. 2018 industry conference, CEO Gary Friedman commented:

So with only 19 of our new galleries, we're in early innings of our transformation potential for 60 to 70 in North America; remain confident in our long-term goal of reaching $4 billion to $5 billion in North America, with industry-leading operating margins and return on invested capital. I believe we can grow revenues 8% to 12% and earnings 15% to 20% for the next 10 years.

In those figures, Friedman is lumping in new galleries that don't include the full suite of hospitality services, but the company has committed to opening as many as seven hospitality design gallery stores per year, beginning in 2019. Investors should expect this to result in an additional step-up in capital expenditures.

Strong results

RH has seen a noticeable bump in its top-line growth and earnings since it introduced the first hospitality design gallery in 2015. The results have been choppy due to an uneven rollout of the new stores and weakness in the company's catalog business, but the overall financial trends are encouraging.

RH Metrics | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

Total revenue growth | 13% | 1% | 14% | 3% |

Adjusted EBITDA | $273.4 million | $186.2 million | $268.3 million | $400.8 million |

Data Source: RH financial reports.

The most impressive statistic is the 46.6% growth in adjusted EBITDA between 2015 and 2018. Adjusted EBITDA represents earnings before interest depreciation and amortization and provides a picture of earnings normalized for nonrecurring expenses. Looking at this figure over the long term provides a good sense of the health of its core operating business, and RH's EBITDA growth is a very encouraging sign.

At the project level, RH has disclosed that it expects the New York Meatpacking District store to generate upwards of $28 million in annual cash flow. Given that the company has invested approximately $50 million into this project, the cash flow projection implies a 50%+ cash return on invested capital and a pay-back period of less than two years. These are extremely attractive returns for any business, but especially a retail business.

RH's strong financial results are within the context of a fairly weak brick-and-mortar retail environment that has seen several brands go bankrupt. Furthermore, the increased earnings as conveyed above in adjusted EBITDA should be measured against the capital investment required to generate the earnings growth. Despite those caveats, it is hard to argue that RH's business is on a strong upward trajectory.

Taking stock

RH has successfully innovated in a mature industry, and as a result, has further differentiated itself from the competition and elevated its brand. The company's stores are a destination for people interested in a fun night out on the town as well as those interested in browsing the company's catalog of furniture. Increased foot traffic to stores has ultimately resulted in earnings growth, and the success of the retail hospitality concept has also provided the company with a reason to open more stores to capitalize on the growth opportunity.

More From The Motley Fool

Luis Sanchez has no position in any of the stocks mentioned. The Motley Fool recommends RH. The Motley Fool has a disclosure policy.