Richard Pzena Boosts Halliburton, Wells Fargo Holdings

Pzena Investment Management leader Richard Pzena (Trades, Portfolio) bought shares of the following stocks during the second quarter.

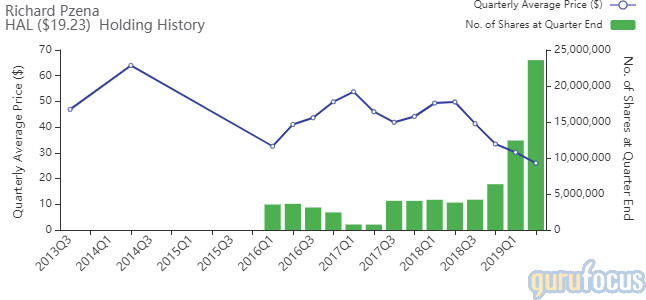

The guru boosted his Halliburton Co. (NYSE:HAL) stake by 89.83%. The trade had an impact of 1.34% on the portfolio.

The oilfield services company has a market cap of $16.90 billion and an enterprise value of $27.02 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 14.27% and return on assets of 5.05% are outperforming 61% of companies in the Oil & Gas - Services industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.34.

The company's largest guru shareholder is Dodge & Cox with 3.28% of outstanding shares, followed by Pzena with 2.69% and Sarah Ketterer (Trades, Portfolio) with 1.08%.

Pzena added 46.87% to his Lear Corp. (NYSE:LEA) position. The trade had an impact of 0.90% on the portfolio.

The company, which manufactures automotive seating and electrical systems, has a market cap of $7.25 billion and an enterprise value of $8.48 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -20.83% and return on assets of 7.17% are outperforming 70% of companies in the Autos industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.55 is above the industry median of 0.49.

Another notable guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.22% of outstanding shares, followed by Joel Greenblatt (Trades, Portfolio) with 0.20%.

The investor increased his holding of National Oilwell Varco Inc. (NYSE:NOV) by 45.86%. The portfolio was impacted by 0.89%.

The provider of oil and gas drilling rig equipment and products has a market cap of $8.22 billion and an enterprise value of $10.47 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -42.37% and return on assets of -29.07% are underperforming 100% of companies in the Oil and Gas - Services industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.34.

Another notable guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 6.06% of outstanding shares, followed by Dodge & Cox with 4.36%, Hotchkis & Wiley with 2.60% and Bill Nygren (Trades, Portfolio) with 1.55%.

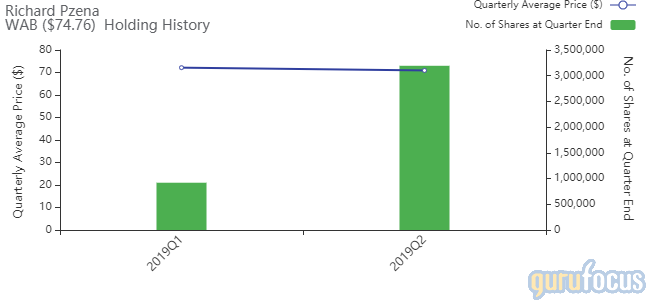

The guru boosted his Westinghouse Air Brake Technologies Corp. (NYSE:WAB) stake by 45.86%. The portfolio was impacted by 0.89%.

The company, which provides products and services for the rail industry, has a market cap of $13.76 billion and an enterprise value of $17.86 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 3.94% and return on assets of 1.79% are underperforming 80% of companies in the Transportation and Logistics industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.27.

The company's largest guru shareholder is Barrow, Hanley, Mewhinney & Strauss with 2.09% of outstanding shares, followed by Chris Davis (Trades, Portfolio) with 0.09%, Pioneer Investments (Trades, Portfolio) with 0.08% and Greenblatt with 0.06%.

Pzena beefed up his Wells Fargo & Co. (NYSE:WFC) position by 247.35%. This trade impacted the portfolio by 0.86%.

The bank has a market cap of $206.78 billion and an enterprise value of $62.87 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of 11.29% and return on assets of 1.28% are outperforming 64% of companies in the Banks industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.46 is below the industry median of 1.14.

The largest guru shareholder of the company is Warren Buffett (Trades, Portfolio) with 9.12% of outstanding shares, followed by Dodge & Cox with 1.82% and PRIMECAP Management (Trades, Portfolio) with 1.02%.

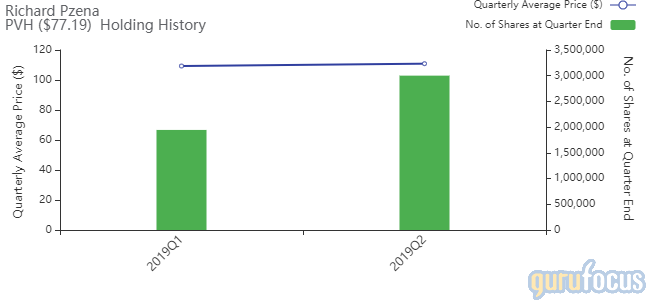

The guru added 54.25% to his PVH Corp. (NYSE:PVH) holding. The portfolio was impacted by 0.53%.

The apparel company, which owns the Tommy Hilfiger, Calvin Klein and Izod brands, has a market cap of $5.83 billion and an enterprise value of $10.26 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 11.43% is outperforming the sector, the return on assets of 5.37% is underperforming 52% of companies in the Manufacturing, Apparel and Furniture industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.10 is below the industry median of 0.72.

The largest guru shareholder of the company is Pzena with 3.96% of outstanding shares, followed by Simons' firm with 1.73%, Pioneer Investments with 0.82% and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.37%.

Disclosure: I do not own any stocks mentioned.

Read more here:

6 Stocks Outperforming the S&P 500

Tom Gayner Sells Chipotle, Trims Facebook

9 Stocks Mario Gabelli Keeps Buying

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.