Rio Tinto (RIO) Reports 4% Increase in Q2 Iron Ore Production

Rio Tinto RIO iron ore shipments in the second quarter of 2022 rose 5% year over year to 79.9 million tons (Mt). Iron ore production was up 4% year over year to 78.6 Mt. Despite the impact of higher-than-average rainfall in May, continued focus on mine pit health and commissioning of Gudai-Darri supported production during the quarter under discussion. RIO announced that its most technologically advanced mine, the Gudai Darri mine in the Pilbara region, Western Australia, delivered its first ore in June. It marked the delivery of its first greenfield mine in more than a decade. The mine’s ramp-up is expected to increase iron ore production volumes and improve the product mix from Pilbara in the second half of this year.

The total iron ore shipped by the company is 151.4 Mt for the first half of 2022, which reflects a 2% drop year over year. Iron production in the first half of this year was 150.3 Mt, 1% lower than the prior year. This was primarily due to the 6% decline reported in its first quarter production to 71.7 Mt. The company’s Pilbara operations had a challenging first quarter, as ongoing mine depletion was not offset by mine replacement projects. It was also impacted by delayed commissioning of Gudai-Darri and commissioning challenges at the Mesa A wet plant, which continued to impact production ramp-up at Robe Valley. COVID-19 constraints hampered labor supply.

RIO reported bauxite production of 14.1 million tons in the second quarter, which was 3% higher year on year, driven by a solid operational performance at Weipa as a result of improved plant reliability at Amrun. Aluminum production was down 10% to 0.7 million tons due to reduced capacity at Kitimat smelter in British Columbia, following the strike that commenced in July 2021. Production at Boyne smelter in Queensland was impacted due to COVID-19-related unplanned absences. Mined copper production improved 9% year on year to 126 thousand tons due to higher material movement and higher grades and recoveries at Kennecott and Escondida, partly offset by lower grades and recoveries at Oyu Tolgoi as a result of planned mine sequencing.

Guidance for 2022

Rio Tinto expects Pilbara iron ore shipments (100% basis) in the range of 320 to 335 Mt in 2022. The mid-point of the range indicates a year-over-year rise of 2%. Bauxite production is expected to be 54-57 Mt compared with 54 Mt in 2021. Alumina production is anticipated between 7.6 Mt and 7.8 Mt, down from its prior range of 8.0 Mt and 8.4 Mt. Aluminium production is expected in the band of 3-3.1 Mt compared with the previously provided range of 3.1 to 3.2 Mt. RIO had produced 7.9 Mt of Alumina and 3.2 Mt of aluminum in 2021.

Mined copper is forecast in the range of 500 kt to 575 kt for the year. The mid-point of the range indicates a 9% year-on-year growth. Refined copper is predicted between 230 kt and 290 kt, which indicates a 29% year-on-year growth at the mid-point. Diamonds production is projected to be 4.5-5.0 million carats, revised downward from the prior guidance of 5.0-6.0 million carats. Titanium dioxide slag production is expected to be 1.1-1.4 Mt.

Brazilian miner Vale S.A VALE iron ore production guidance is at 320-335 Mt for 2022. The mid-point of the range suggests year-on-year growth of 4%. Pellet production is projected between 34 Mt and 38 Mt. Vale is set to release its second-quarter production report on Jul 19, 2021.

BHP Group BHP expects to produce between 249 Mt and 259 Mt of iron ore in fiscal 2022. The mid-point of the range indicates in-line production from the prior-year levels.

Rio Tinto, Vale and BHP Group are expected to bear the brunt of the recent drop in iron ore prices. Iron ore prices have fallen below $110 per ton — a level not seen since last December. Rising concerns about weak demand from top consumer China due to the recurring COVID-19 outbreaks and low profitability at Chinese steel mills continued to overshadow reports of a massive stimulus package and policy support pledges from the government. Mounting fears about a potential global recession-driven demand downturn have been weighing on the steel-making ingredient.

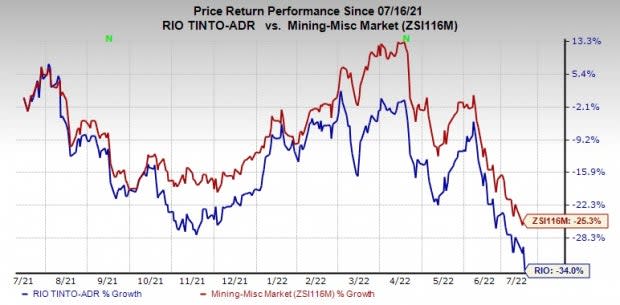

Price Performance

Image Source: Zacks Investment Research

In a year’s time, shares of Rio Tinto have fallen 34%, compared with the industry’s decline of 25.3%.

Zacks Rank & a Key Pick

Rio Tinto currently has a Zacks Rank #4 (Sell).

A better-ranked stock worth considering in the basic materials space is Kronos Worldwide KRO, which flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Kronos has a projected earnings growth rate of 110% for the current year. The Zacks Consensus Estimate for KRO's current-year earnings has been revised 61% upward in the past 60 days.

Kronos has a trailing four-quarter earnings surprise of 24%, on average. KRO has gained around 17% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

Kronos Worldwide Inc (KRO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research