Rising Commercial Deliveries Aid Boeing (BA) in Q4 Earnings?

Increased 737 and 787 delivery figures are expected to have boosted The Boeing Company’s BA commercial airplanes business in the fourth quarter. However, its fourth-quarter 2022 earnings, scheduled for release on Jan 25, are projected to reflect some impacts of abnormal costs related to the 777-9 program.

Click here to know how the company’s overall Q4 performance is likely to have been.

Solid 737 & 787 Jet Deliveries to Boost Growth

Thanks to steadily recovering air traffic (both domestic and international), improved delivery figures for Boeing’s 737 and 787 jets were observed in the fourth quarter of 2022. Notably, the aerospace giant delivered 110 737 jets in the soon-to-be-reported quarter, reflecting quite a solid improvement of 31% from 84 units delivered in the year-ago quarter.

Moreover, Boeing delivered 22 787 Dreamliner jets in the fourth quarter of 2022, compared to none in the year-ago period, following this product line’s delivery resumption in the third quarter of 2022. This must have also boosted the Boeing Commercial Airplane (BCA) segment’s top-line performance.

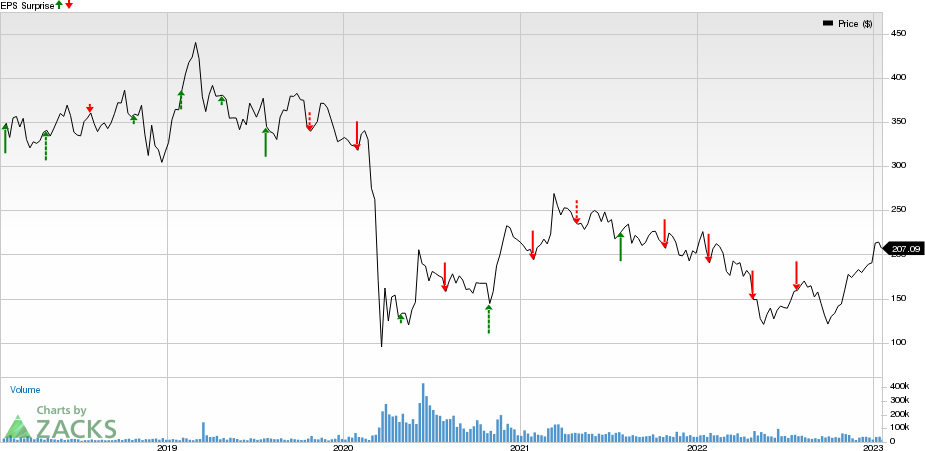

The Boeing Company Price and EPS Surprise

The Boeing Company price-eps-surprise | The Boeing Company Quote

In fact, such significant delivery figures of 737 and 787 primarily drove a surge of 53.5% in the company’s overall commercial deliveries. This, in turn, must have contributed to BCA segment’s revenues in the soon-to-be-reported quarter.

Currently, the Zacks Consensus Estimate for Boeing’s commercial business segment’s revenues, pegged at $8,145 million, indicates a solid 71.5% improvement from the year-ago quarter’s reported figure.

Earnings Expectation

On the cost front, the delivery resumption of the 787 product line is likely to have boosted BCA’s operating profit, thereby adding impetus to its quarterly earnings.

Moreover, improvements in the BCA segment's financial performance due to increasing 737 MAX and 787 deliveries and consistent efforts by the BCA team to manage costs through business transformation activities must have contributed to this unit’s bottom-line growth in the fourth quarter.

Further, a steady improvement in the company’s expenses is likely to have taken place in relation to the storage of the 737 aircraft as jets that were in the inventory are gradually getting delivered.

However, the production pause for the 777-9 program must have resulted in some abnormal costs for this segment, which in turn might have weighed on this unit’s Q4 bottom line.

So, the overall effect of the aforementioned factors on the BCA segment’s fourth-quarter earnings performance seems to have been favorable. Currently, the Zacks Consensus Estimate for Boeing’s commercial business segment is pegged at a loss of $291 million, indicating a solid improvement from the year-ago quarter’s reported loss of $4,454 million.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Boeing this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here.

Boeing has an Earnings ESP of -119.45% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Below are three defense stocks that have the right combination for an earnings beat:

Spirit AeroSystems SPR: It is scheduled to release its fourth-quarter results soon. SPR has an Earnings ESP of +93.75% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

SPR delivered a four-quarter average negative earnings surprise of 73.24%. The Zacks Consensus Estimate for Spirit AeroSystem’s fourth-quarter bottom line is pegged at a loss of 48 cents per share, which implies a solid improvement from a loss of 84 cents per share incurred in the fourth quarter of 2021.

Leidos Holdings LDOS: It is scheduled to release its fourth-quarter results on Feb 14. LDOS has an Earnings ESP of +1.19% and a Zacks Rank #3.

LDOS delivered a four-quarter average earnings surprise of 2.01%. The Zacks Consensus Estimate for Leidos’ fourth-quarter earnings, pegged at $1.61 per share, suggests an improvement of 3.2% from the fourth quarter of 2021.

Airbus Group EADSY is slated to report its fourth-quarter results soon. EADSY has an Earnings ESP of +6.25% and a Zacks Rank #2.

EADSY delivered a four-quarter average earnings surprise of 59.88%. The Zacks Consensus Estimate for EADSY’s fourth-quarter earnings, pegged at 48 cents per share, suggests a decline of 15.8% from the fourth quarter of 2021.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report