Rite Aid Shares Jump on Solid 2nd-Quarter Results

Shares of drugstore chain Rite Aid Corp. (NYSE:RAD) rose 9% in premarket trading on Thursday after reporting second-quarter 2020 financial results.

Under the leadership of new CEO Heyward Donigan, the Camp Hill, Pennsylvania-based company posted adjusted earnings of 12 cents per share, topping Refinitiv's estimates of 7 cents. Revenue of $5.37 billion, however, fell short of expectations of $5.41 billion and declined from $5.42 billion in the prior-year quarter.

By segment, sales in the Retail Pharmacy division decreased 1.6% from the year-ago quarter to $3.85 billion. In the Pharmacy Services business, sales increased 1.1% to $1.58 billion.

Same-store sales for the Retail Pharmacy segment grew 0.4%, while Front-End same-store sales, which exclude cigarettes and tobacco products, declined 0.6%.

Driven by its focus on clinical services, Rite Aid also said same-store prescription volume grew 2.7% during the quarter.

In a statement, Donigan, who has only been CEO since August, expressed her optimism about the company's future as she "believe[s] in the Rite Aid brand and the opportunity [they] have to deliver innovative experiences as a health and wellness destination."

"I'm also encouraged by the market opportunities for EnvisionRxOptions as health plans and employers rethink their pharmacy services partnerships," she added. "In talking with many associates during my first 45 days, we know there is important work in front of us, and we are acting with urgency to finalize a strategic plan that positions our company to meet its full potential."

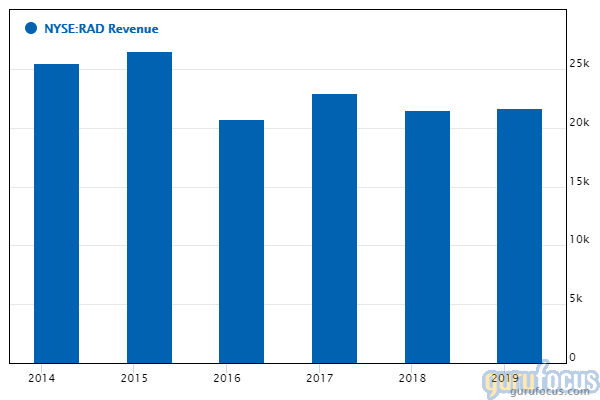

Rite Aid also updated its full-year guidance. While it reiterated its revenue forecast of between $21.5 billion and $21.9 billion, it now expects to lose between $235 million and $275 million in fiscal 2020. It narrowed its earnings outlook to range from zero to 56 cents per share. It previously projected an earnings loss of 14 cents per share to a gain of 72 cents.

"I look forward to working closely with our team to deliver a solid finish to our fiscal year and position Rite Aid as an innovative leader in our industry," Donigan said.

With a market cap of $413.77 million, shares of Rite Aid were up more than 22% at $9.36 after the opening bell. GuruFocus estimates the stock has tumbled 31% year to date.

Disclosure: No positions.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.