Robert Karr Adds 5 Stocks to Portfolio in 1st Quarter

- By Sydnee Gatewood

Robert Karr (Trades, Portfolio), founder of New York-based Joho Capital, disclosed five new positions in his first-quarter portfolio, which was released earlier this month.

A former protege of Tiger Management's Julian Robertson (Trades, Portfolio), the guru, who now manages a family office, focuses on a concentrated number of investments and specializes in online media stocks. He also has a very low portfolio turnover rate of 17% as of the most recent quarter.

Based on these criteria, Karr's new buys for the quarter were Ceridian HCM Holding Inc. (NYSE:CDAY), Amphenol Corp. (NYSE:APH), Autodesk Inc. (NASDAQ:ADSK), Uber Technologies Inc. (NYSE:UBER) and Simon Property Group Inc. (NYSE:SPG).

Ceridian HCM

After previously exiting a position in Ceridian HCM (NYSE:CDAY) in the fourth quarter of 2020, the guru entered a new 185,037-share holding, dedicating it to 2.42% of the equity portfolio. It is now his seventh-largest investment. The stock traded for an average price of $93.51 per share during the quarter.

The Minneapolis-based software company, which provides payroll processing and human capital management solutions, has a $13.19 billion market cap; its shares were trading around $88.37 on Wednesday with a price-book ratio of 6.09 and a price-sales ratio of 15.45.

The GF Value Line suggests the stock is significantly overvalued based on its historical ratios, past performance and future earnings projections.

GuruFocus rated Ceridian's financial strength 3 out of 10. In addition to weak debt ratios, the low Altman Z-Score of 1.53 warns the company could be at risk of bankruptcy if it does not improve its liquidity.

The company's profitability fared slightly better, scoring a 4 out of 10 rating. Ceridian is being weighed down by negative margins and returns that underperform over half of its competitors as well as a low Piotroski F-Score of 3, which indicates its operations are in poor shape. It has also recorded a slowdown in revenue per share growth over the past 12 months.

Of the gurus invested in Ceridian, Ron Baron (Trades, Portfolio) has the largest stake with 2.01% of outstanding shares. Pioneer Investments (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies and Ray Dalio (Trades, Portfolio) also own the stock.

Amphenol

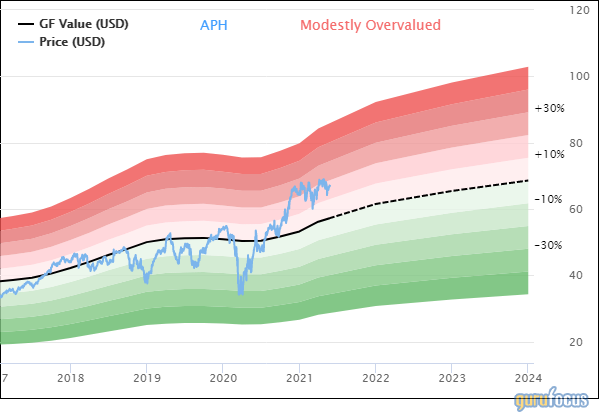

Karr picked up 52,940 shares of Amphenol (NYSE:APH), allocating 0.54% of the equity portfolio to the position. During the quarter, shares traded for an average price of $65.01 each.

The manufacturer of electronic and fiber optic connectors, cables and interconnect systems, which is headquartered in Wallingford, Connecticut, has a market cap of $40.02 billion; its shares were trading around $66.96 on Wednesday with a price-earnings ratio of 32.04, a price-book ratio of 7.35 and a price-sales ratio of 4.54.

According to the GF Value Line, the stock is modestly overvalued.

The valuation rank of 2 out of 10 also points to overvaluation since the share price and price ratios are approaching 10-year highs.

Amphenol's financial strength was rate 6 out of 10 by GuruFocus. Although it has issued approximately $1.3 billion in new long-term debt over the past three years, it is still at a manageable level as a result of adequate interest coverage. The robust Altman Z-Score of 5.04 indicates the company is in good standing even though assets are building up faster than revenue is growing.

The company's profitability scored a 9 out of 10 rating, driven by strong margins and returns that outperform a majority of industry peers, a moderate Piotroski F-Score of 4, indicating operations are stable, and consistent earnings and revenue growth. Amphenol also has a predictability rank of five out of five stars. GuruFocus says companies with this rank return an average of 12.1% annually over a 10-year period.

With a 1.31% stake, Pioneer is the company's largest guru shareholder. Baron, Simons' firm, Jones, Joel Greenblatt (Trades, Portfolio) and Ken Fisher (Trades, Portfolio) also have positions in the stock.

Autodesk

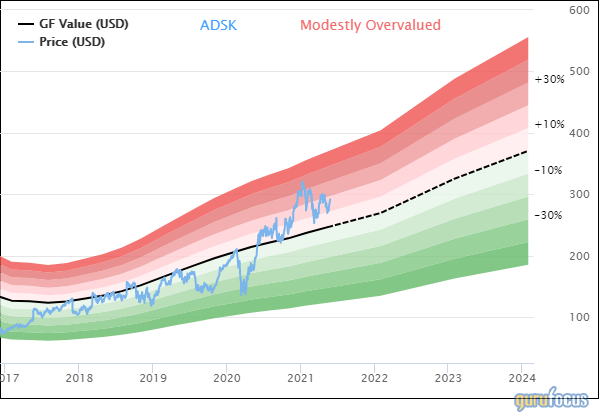

The investor entered a 6,470-share holding in Autodesk (NASDAQ:ADSK), giving it 0.28% space in the equity portfolio. The stock traded for an average per-share price of $288.65 during the quarter.

The San Rafael, California-based software company, which provides design solutions to the architecture, engineering, construction, manufacturing, media, education and entertainment industries, has a $64.27 billion market cap; its shares were trading around $291.58 on Wednesday with a price-earnings ratio of 53.79, a price-book ratio of 66.42 and a price-sales ratio of 17.1.

Based on the GF Value Line, the stock appears to be modestly overvalued currently.

The GuruFocus valuation rank of 1 out of 10 supports this assessment.

GuruFocus rated Autodesk's financial strength 5 out of 10, driven by adequate interest coverage and a high Altman Z-Score of 6.47. The return on invested capital also surpasses the return on invested capital, indicating good value creation as the company grows.

The company's profitability scored a 6 out of 10 rating on the back of strong margins and returns that outperform a majority of competitors, a high Piotroski F-Score of 8 and a one-star predictability rank. According to GuruFocus, companies with this rank return an average of 1.1% annually.

Pioneer is Autodesk's largest guru shareholder with a 0.37% holding. PRIMECAP Management (Trades, Portfolio), Fisher, Simons' firm, Steven Cohen (Trades, Portfolio), Catherine Wood (Trades, Portfolio), Jerome Dodson (Trades, Portfolio), Jones, Greenblatt, First Pacific Advisors (Trades, Portfolio) and Mairs and Power (Trades, Portfolio) are also invested in the stock.

Uber

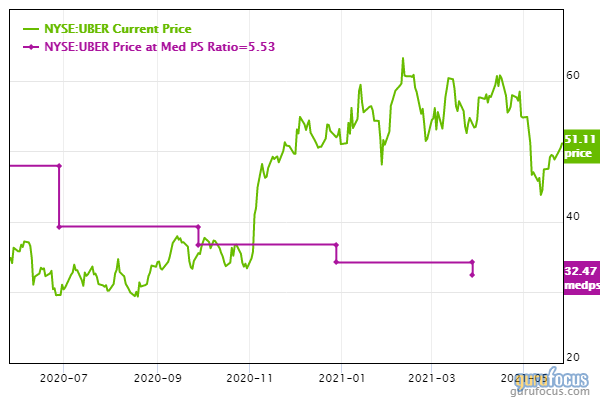

Karr purchased 20,950 shares of Uber Technologies (NYSE:UBER), giving the position 0.18% space in the equity portfolio. During the quarter, the stock traded for an average price of $55.88 per share.

The ridesharing company headquartered in San Francisco, which also offers food and package delivery services, has a market cap of $95.35 billion; its shares were trading around $50.87 on Wednesday with a price-book ratio of 6.98 and a price-sales ratio of 8.68.

The median price-sales ratio chart suggests the stock is overvalued currently.

GuruFocus rated Uber's financial strength 4 out of 10. As a result of issuing approximately $4.7 billion in new long-term debt over the past three years, the company has poor interest coverage. The low Altman Z-Score of 1.76 also warns it could be at risk of going bankrupt if it does not improve its liquidity.

The company's profitability did not fare as well, scoring a 1 out of 10 rating on the back of negative margins and returns that underperform a majority of industry peers. Uber has a low Piotroski F-Score of 2. The company has also recorded losses in operating income as well as declines in revenue per share over the past several years.

Frank Sands (Trades, Portfolio) is Uber's largest guru shareholder with a 1.79% stake. Chase Coleman (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Philippe Laffont (Trades, Portfolio), Cohen, Daniel Loeb (Trades, Portfolio) and Lee Ainslie (Trades, Portfolio) also have significant investments in the stock.

Simon Property Group

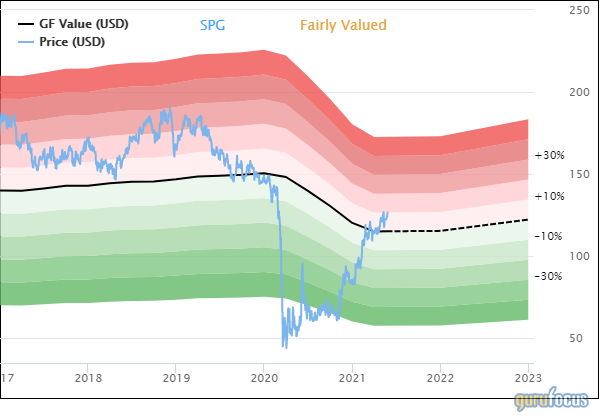

The investor bought 8,100 shares of Simon Property Group (NYSE:SPG), dedicating 0.14% of the equity portfolio to the holding. Shares traded for an average price of $104.39 each during the quarter.

The Indianapolis-based real estate investment trust, which focuses on shopping malls, has a $41.57 billion market cap; its shares were trading around $126.54 on Wednesday with a price-earnings ratio of 35.84, a price-book ratio of 13.76 and a price-sales ratio of 8.86.

According to the GF Value Line, the stock is fairly valued currently.

The valuation rank of 7 out of 10, however, leans more toward undervaluation even though the share price and price-sales ratio are approaching multiyear highs.

Simon Property Group's financial strength was rated 3 out of 10 by GuruFocus. Due to increasing long-term debt by $2.6 billion over the past three years, the company has weak interest coverage. The low Altman Z-Score of 0.84 warns it could be at risk of bankruptcy if it does not improve its liquidity. The WACC also eclipses the ROIC, indicating struggles with creating value.

The REIT's profitability scored a 7 out of 10 rating. Despite having a declining operating margin, the company is supported by strong returns that outperform a majority of competitors as well as a moderate Piotroski F-Score of 4. As a result of revenue per share declining over the past five years, Simon Property Group's one-star predictability rank is on watch.

The Smead Value Fund (Trades, Portfolio) is the REIT's largest guru shareholder with a 0.15% stake. Other top guru investors are Pioneer, Baron, Ken Heebner (Trades, Portfolio), Chris Davis (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Mark Hillman (Trades, Portfolio), Dalio, Greenblatt, Jones and Mario Gabelli (Trades, Portfolio).

Additional trades and portfolio composition

During the quarter, Karr also boosted quite a few holdings, including Global Payments Inc. (NYSE:GPN), Dynatrace Inc. (NYSE:DT), Euronet Worldwide Inc. (NASDAQ:EEFT), Performance Food Group Co. (NYSE:PFGC) and Constellation Brands Inc. (NYSE:STZ).

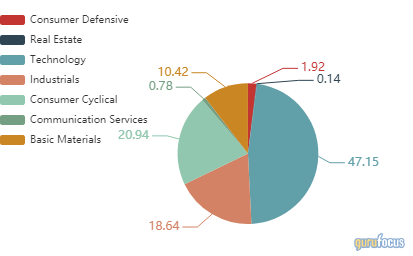

The guru's $644 million equity portfolio, which is composed of 21 stocks, is most heavily invested in the technology sector.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.