Rockwell Automation (ROK) Beats on Q3 Earnings, Hikes '21 View

Rockwell Automation Inc. ROK reported adjusted earnings of $2.31 in third-quarter fiscal 2021 (ended Jun 30, 2021), beating the Zacks Consensus Estimate of $2.06. The bottom line jumped 75%, year over year, primarily on higher sales.

Including one-time items, the company’s earnings came in at $2.32 per share compared with the year-ago quarter’s $2.73.

Total revenues came in at $1,848 million, up 32.5% from the prior-year quarter. The top line also beat the Zacks Consensus Estimate of $1,796 million. Organic sales in the quarter were up 26.4%, currency translation had a positive impact of 5.1%. Further, acquisitions contributed 1.1% to sales.

Operational Update

Cost of sales increased 29% year over year to around $1,084 million. Gross profit climbed 38% year over year to $764 million. Selling, general and administrative expenses flared up 18.1% year over year to $437 million.

Consolidated segment operating income totaled $369 million, up 60.7% from the prior-year quarter. Total segment operating margin was 19.9% in the fiscal third quarter compared with the prior-year period’s 16.5%.

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Segment Results

Intelligent Devices: Net sales amounted to $883 million during the fiscal third quarter, reflecting year-over-year growth of 34%. Segment operating earnings totaled $194 million compared with the year-earlier quarter’s $112 million. Segment operating margin expanded to 21.9% in the quarter compared with the year-ago quarter’s 16.9%, chiefly on higher sales.

Software & Control: Net sales climbed 39.7% year over year to $509.6 million in the reported quarter. Segment operating earnings jumped 56% year over year to $128.3 million. Segment operating margin was 25.2% compared with the 22.5% recorded in the year-earlier quarter.

Lifecycle Services: Net sales for the segment amounted to $456 million in the reported quarter, reflecting year-over-year growth of 23.4%. Segment operating earnings totaled $47 million compared with the prior-year quarter’s $36 million. Segment operating margin was 10.3% in the reported quarter compared with the year-earlier quarter’s 9.7%.

Financials

As of end of third-quarter fiscal 2021, cash and cash equivalents were around $914 million compared with $705 million as of the end of fiscal 2020. As of Jun 30, 2021, total debt was around $2 billion, relatively flat as of Sep 30, 2020.

Cash flow from operations during the fiscal third quarter was $1,057 million compared with the prior-year quarter’s $795 million. Return on invested capital was 40.4% as of Jun 30, 2021, compared with 27.9% as of Jun 30, 2020.

During the reported quarter, Rockwell Automation repurchased 0.2 million shares for $60.5 million. As of the end of third-quarter fiscal 2021, $613.5 million was available under the existing share-repurchase authorization.

Upbeat Fiscal 2021 Guidance

The company witnessed record orders and organic sales improvement in the reported quarter, driven by growth in core automation and digital transformation solutions. Considering these, Rockwell Automation raised its adjusted earnings per share guidance for fiscal 2021 to the band of $9.10-$9.30 from the previous estimate of $8.95-$9.35. Organic sales growth is projected at 8%, up from the prior expectation of 5.5-8.5%. Reported sales growth is anticipated at 12%, compared to the previous guidance of 9¬-12%. Inorganic sales growth is projected to be 1.5% for the fiscal year.

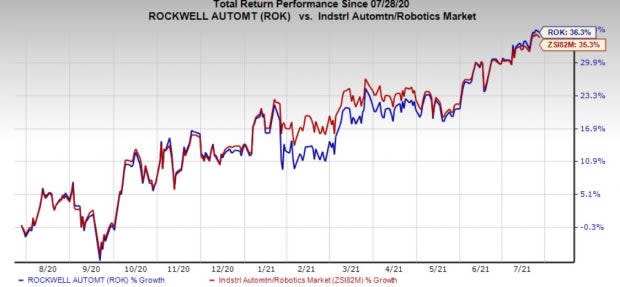

Share Price Performance

Over the past year, Rockwell Automation’s shares have appreciated 36.3% compared with the industry’s growth of 35.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the Industrial Products sector include Greif, Inc GEF, Lindsay Corporation LNN and Pentair plc PNR. All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Greif has an anticipated earnings growth rate of 47.2% for fiscal 2021. The company’s shares have gained around 29.3%, year to date.

Lindsay has an estimated earnings growth rate of 1% for the ongoing fiscal year. Year to date, the company’s shares have rallied 29.1%.

Pentair has a projected earnings growth rate of 26% for the current year. The stock has appreciated around 29%, so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Pentair plc (PNR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research