Rockwell Automation (ROK) Beats on Q3 Earnings, Trims View

Rockwell Automation Inc. ROK delivered adjusted earnings of $2.40 in third-quarter fiscal 2019 (ended Jun 30, 2019), which surpassed the Zacks Consensus Estimate of $2.29 and improved 11% from the prior-year quarter figure of $2.16. Lower incentive compensation expense, higher organic sales, and lower share count, partially offset by higher net interest expense led to the bottom-line improvement.

Including one-time items, the company reported earnings of $2.20 per share compared with $1.58 reported in the year-ago quarter.

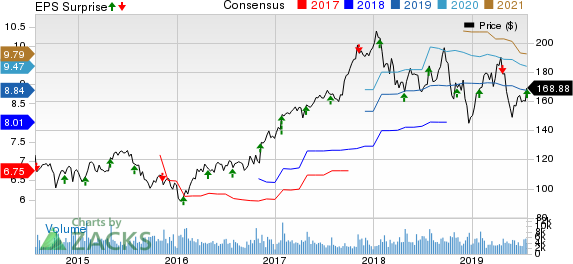

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Total revenues came in at $1,665 million, down 2% year over year, falling short of the Zacks Consensus Estimate of $1,728 million. Organic sales growth in the quarter was 0.5% while foreign currency translations had a negative impact of 2.5%. During the quarter, heavy industries, including oil and gas, pulp and paper, and mining, and life sciences, witnessed double-digit growth while automotive, semiconductor, and food and beverage displayed sluggishness.

Operational Update

Cost of sales decreased 2% year over year to $935 million. Gross profit decreased 2% to $730 million from $745 million reported in the year-ago quarter. Selling, general and administrative expenses declined 10% year over year to $362 million.

Consolidated segment operating income totaled $396 million, up 4% from the prior-year quarter’s figure of $383 million. Segment operating margin was 23.8% in the fiscal third quarter, up 125 basis points from the year-earlier quarter aided by lower incentive compensation expense, partially offset by higher investment spending.

Segment Results

Architecture & Software: Net sales dropped 5% year over year to $748 million in the third quarter. While organic sales were down 1.9%, currency translation had a negative impact of 2.8%. However, acquisition contributed 0.1%. Segment operating earnings came in at $2237 million compared with $239 million reported in the prior-year quarter. Segment operating margin was 29.8% in the reported quarter compared with 30.4% in the prior-year quarter.

Control Products & Solutions: Net sales improved 0.2% year over year to $917 million in the reported quarter. Organic sales increased 2.7% while currency translation reduced sales by 2.5%. Segment operating earnings advanced 20% to $173 million from $144 million in the year-ago quarter. Segment operating margin came in at 18.5% compared with 15.7% in the prior-year quarter.

Financials

As of Jun 30, 2018, cash and cash equivalents totaled $789 million, up from $619 million as of Sep 30, 2018. As of Jun 30, 2018, total debt was $2,240 million, up from $1,776 million as of Sep 30, 2018.

Cash flow from operations in the nine months ended Jun 30, 2019 was $707 million lower than the $937 million in the comparable prior-year period. Return on invested capital was 39% as of Jun 30, 2019 compared with 43.8% as of Jun 30, 2018.

During the reported quarter, Rockwell Automation repurchased 1.5 million shares for $246 million. As of the quarter end, $333 million was available under the existing share-repurchase authorization. The company’s board also authorized an additional $1.0 billion for share repurchases.

Guidance Trimmed

Uncertainty with respect to global trade is influencing customers’ investment decisions, particularly those related to the timing of capital investments. Moreover, considering the year-to-date results, the company now anticipates earnings per share in fiscal 2019 in the band of $8.50-$8.70, down from the prior $8.85-$9.15. Organic sales growth is guided at 1.5% year over year, down from the prior 3.7-5.3%.

Share Price Performance

In a year’s time, Rockwell Automation’s shares have fallen 7.9% compared with the industry’s decline of 9.5%.

Zacks Rank & Stocks to Consider

Rockwell Automation carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the Industrial Productssector are Roper Technologies, Inc. ROP, John Bean Technologies Corp. JBT and CECO Environmental Corp. CECE, each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here

Roper Technologies has an estimated earnings growth rate of 9.8% for the ongoing year. The company’s shares have gained 29.8% in the past year.

John Bean Technologies has an expected earnings growth rate of 5.9% for the current year. The stock has appreciated 36.4% in a year’s time.

CECO Environmental has an impressive projected earnings growth rate of 84.8% for 2019. The company’s shares have rallied 33.2% over the past year.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

CECO Environmental Corp. (CECE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research