Rockwell Automation (ROK) Hits 52-Week High: What's Driving It?

Shares of Rockwell Automation, Inc. ROK scaled a fresh 52-week high of $279.88 during the trading session on Jun 9, before retracting a bit to close at $279.15. The company recently launched a new brand, LifecycleIQ Services that will help industrial companies work efficiently and innovate faster. Also, the company’s forecast-topping second-quarter fiscal 2021 results, strong growth in core automation platforms and information solutions, focus on investments and buyouts, as well as cost saving initiatives are driving the stock performance.

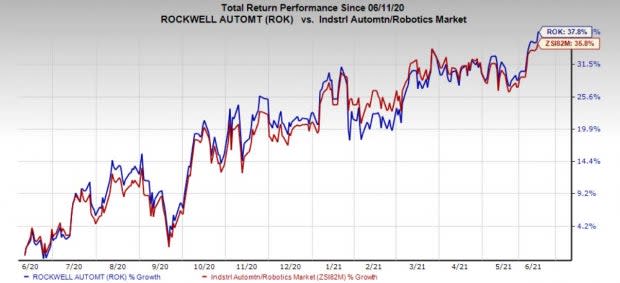

The stock has appreciated 37.8% over the past year, outperforming the industry’s growth of 35.8%.

Image Source: Zacks Investment Research

The company delivered adjusted earnings of $2.41 per share in second-quarter fiscal 2021, beating the Zacks Consensus Estimate of $2.15. Revenues of $1,776 million also surpassed the consensus mark of $1,703 million. Rockwell Automation has a trailing four-quarter earnings surprise of 13.5%, on average.

Driving Factors

Rockwell Automation has been witnessing increased order levels backed by growth in core automation platforms, Information Solutions & Connected Services (IS/CS), and buyouts. In the second-quarter fiscal 2021, order levels improved in double digits and crossed the threshold of $2 billion orders. In fact, the company raised its fiscal 2021 adjusted earnings per share guidance to the band of $8.95-$9.35 from the prior guidance of $8.70-$9.10 on solid order strength.

Given Rockwell Automation’s solid performance so far in fiscal 2021, the company is expecting sales of about $7.0 billion in fiscal 2021, up from the prior expectation of $6.9 billion. Reported sales growth is anticipated in the range of 9% to 12%, compared with its prior expectation of 8.5% to 11.5%. Organic sales growth is expected between 5.5% and 8.5%, higher than the prior expectation of 4.5% to 7.5%. Sales from IS/CS is anticipated to exceed $500 million in fiscal 2021.

The company is well-poised to benefit from its focus on broadening the portfolio of hardware and software products, solutions and services. Further, significant investments to globalize manufacturing, product development and customer-facing resources will drive growth. The company is likely to witness above-market growth by expanding its served markets and improve offerings. Moreover, higher levels of infrastructure spending and a growing middle-class population will fuel demand for consumer products in emerging markets. This will require manufacturing investment and provide the company with additional growth opportunities.

Further, Rockwell Automation continues to drive process improvement, functional streamlining, material cost savings and manufacturing productivity in an effort to drive earnings growth. It remains focused on buyouts that will augment its information solutions and high-value services offerings and capabilities while expanding global presence, or enhancing process expertise.

Positive Growth Projections

The Zacks Consensus Estimate for the company’s fiscal 2021 earnings is currently pegged at $9.21, suggesting year-over-year growth of 19.9%.

Zacks Rank & Stocks to Consider

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industrial products sector are Tennant Company TNC, Encore Wire Corporation WIRE and Arconic Corporation ARNC. All of these stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tennant has an expected earnings growth rate of 49.5% for the current fiscal year. The company’s shares have gained around 18% year to date.

Encore Wire has an estimated earnings growth rate of 49.5% for the current fiscal year. Year to date, the company’s shares have rallied nearly 36%.

Arconic has a projected earnings growth rate of 447% for the current fiscal year. The stock has appreciated around 21% so far this year.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

Arconic Corporation (ARNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research