Rockwell Automation (ROK) Plunges 43% YTD: Can It Bounce Back?

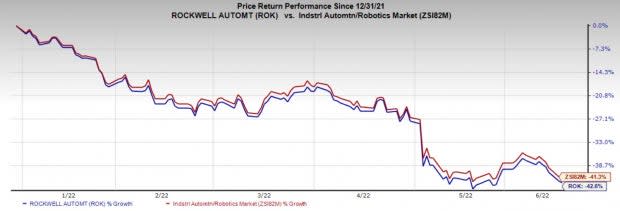

Rockwell Automation, Inc.’s ROK shares have lost 42.6% so far this year compared with the industry’s decline of 41.3%. Weaker-than-expected second-quarter fiscal 2022 results, escalating input costs and the unfavorable impact of component shortages owing to supply chain challenges are denting the stock’s performance.

Image Source: Zacks Investment Research

The company has a trailing four quarters earnings surprise of negative 0.21%, on average.

In the past 60 days, ROK’s earnings for fiscal 2022 have gone down by 12%, with nine estimates moving lower. Earnings estimates for fiscal 2022 are now pegged at $9.22 per share, indicating a year-over-year decline of 2.23%.

Factors Ailing the Stock

Rockwell Automation’s shares have fallen 6.3% since the company reported second-quarter fiscal 2022 earnings on May 3. Earnings and sales missed the Zacks Consensus Estimates, with the bottom line declining year over year. Higher input costs and escalating investment expenses impacted the bottom-line performance in the quarter.

Rockwell Automation’s top line is bearing the brunt of supply chain challenges and cost inflation. It anticipates supply chain constraints to continue in fiscal 2022. The manufacturing supply chain continues to be stressed by the sharp rise in demand and the ongoing shortages of electronic components along with pandemic-related and other global events that have put pressure on manufacturing output and freight lanes. Component shortages have unfavorably impacted the company’s shipments of hardware and software products, solutions and services. It is facing difficulty procuring components and materials necessary for hardware and software products, primarily for automation and e-commerce.

ROK’s business suspension in Russia and Belarus owing to the Russia-Ukraine conflict, volatility in the component supply and uncertain impact of the COVID-related shutdowns in China might impact Rockwell Automation’s sales performance for fiscal 2022.

Is Rebound Possible?

Rockwell Automation’s order levels have been improving in the past few quarters. In second-quarter fiscal 2022, total orders increased by 37% year over year, driven by robust demand for core automation and digital transformation solutions. Huge capital investments across many end markets coupled with higher automation and digital transformation will continue to support solid order levels across all segments.

Backed by strong demand for software and cyber security services and a record order backlog, Rockwell Automation expects total sales of around $7.8 billion to $8 billion in fiscal 2022, with expected sales growth of 11% to 15%. Organic sales growth is projected at 10-14% for fiscal 2022.

The company expects orders in fiscal 2022 to likely reach $10 billion. Improved material flow from key suppliers over the next couple of quarters will improve component shipments in the next few quarters. Moreover, price increase actions to mitigate the impacts of inflationary pressures will improve margin in the second half of fiscal 2022. Adjusted earnings per share guidance for fiscal 2022 is expected to be $9.20-$9.80, representing year-over-year growth of 1% at the mid-point.2

Given strong order wins from software and infrastructure services, Rockwell Automation continues to expect double-digit growth in both Core Automation and Information Solutions and Connected Services in fiscal 2022. It is poised to benefit from broadening the portfolio of hardware and software products, solutions and services while gaining traction from investments in the cloud. The company’s Intelligent devices continue to gain from significant strength across the automation portfolio and share gains in the Independent Cart Technology.

Rockwell Automation currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the Industrial Products sector are Graphic Packaging Holding Company GPK, Myers Industries MYE and Packaging Corporation of America PKG. All of these stocks sport a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Graphic Packaging has an estimated earnings growth rate of 86.8% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 7.6%.

Graphic Packaging pulled off a trailing four-quarter earnings surprise of 7.2%, on average. The company’s shares have appreciated 8% in the past six months.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 27% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Myers Industries’ shares have risen 25% over the last six months.

Packaging Corporation has an expected earnings growth rate of 16.2% for 2022. The Zacks Consensus Estimate for the current year’s earnings rose 4.2% in the past 60 days.

PKG has a trailing four-quarter earnings surprise of 19.6%, on average. Packaging Corporation’s shares have risen 16% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.