Rockwell Automation (ROK) Q4 Earnings Beat Estimates, Down Y/Y

Rockwell Automation Inc. ROK reported adjusted earnings of $1.87 in fourth-quarter fiscal 2020 (ended Sep 30, 2020), beating the Zacks Consensus Estimate of $1.77. However, the bottom line declined 7% year over year, primarily due to lower sales.

Including one-time items, the company’s earnings was $2.25 per share, reflecting a significant improvement from the 7 cents in the year-ago quarter.

Total revenues were $1,570 million, down 9.3% from the prior-year quarter. The top line also missed the Zacks Consensus Estimate of $1,573 million. While organic sales in the quarter were down 12.1%, currency translation had a negative impact of 0.3 percentage points. However, acquisitions contributed 3.1 percentage points.

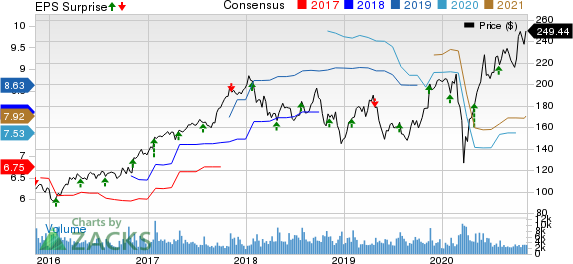

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Operational Update

Cost of sales decreased 7.6% year over year to $9318 million. Gross profit declined 12% year over year to $639 million. Selling, general and administrative expenses slumped 12% year over year to $354 million.

Consolidated segment operating income totaled $318 million, down 9% from the prior-year quarter. Segment operating margin was 20.2% in the fiscal fourth quarter, flat compared with the prior-year quarter.

Segment Results

Architecture & Software: Net sales amounted to $703 million in the fiscal fourth quarter, reflecting year-over-year decline of 10%. Segment operating earnings totaled $191 million compared with the $205 million reported in the prior-year quarter. Segment operating margin contracted to 27.2% in the quarter compared with the year-ago quarter’s 26.2%.

Control Products & Solutions: Net sales declined 9% year over year to $867 million in the reported quarter. Segment operating earnings decreased 12% year over year to $127 million. Segment operating margin was 14.6%, compared with 15.2% in the year-earlier quarter.

Financials

As of fiscal 2020-end, cash and cash equivalents were around $705 million, down from $1,018.4 million as of fiscal 2019 end. As of Sep 30, 2020, total debt was around $2 billion, down from $2.3 billion as of Sep 30, 2019.

Cash flow from operations for fiscal 2020 was $1.12 billion compared with $1.18 billion generated in the prior fiscal. Return on invested capital was 35.7% as of Sep 30, 2020, compared with 27% as of Sep 30, 2019.

During fiscal 2020, Rockwell Automation repurchased 1.4 million shares for $254.7 million. As of the end of the fiscal, $853.7 million was available under the existing share-repurchase authorization.

Fiscal 2020 Performance

For fiscal 2020, Rockwell Automation’s adjusted earnings was $7.68 that surpassed the Zacks Consensus Estimate of $7.57 but was 11% lower than the prior fiscal. Including one-time items, the company’s earnings came in at $8.77 per share compared with $5.83 in fiscal 2019.

Total revenues were down 5.5% year over year to $6.33 billion, which missed the Zacks Consensus Estimate of $6.34 billion.

Fiscal 2021 Guidance

The company anticipates fiscal 2021 adjusted earnings per share in the band of $8.45-$8.85. Organic sales growth is expected between 3.5% to 6.5%. Reported sales growth is anticipated in the range of 6% to 9%. Inorganic sales growth is projected to be 1-1.5% for the fiscal year.

Share Price Performance

Over the past six months, Rockwell Automation’s shares have appreciated 31.7%, outperforming the industry’s growth of 28.4%.

Zacks Rank & Stocks to Consider

Rockwell currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Crown Holdings, Inc. CCK, iRobot Corporation IRBT and SiteOne Landscape Supply, Inc. SITE. While Crown Holdings and iRobot sport a Zacks Rank #1 (Strong Buy), SiteOne Landscape carries a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Crown Holdings has a projected earnings growth rate of 11.7% for fiscal 2020. Over the past year, the company’s shares have appreciated 50% over the past six months.

iRobot has an estimated earnings growth rate of 18.8% for the ongoing year. The company’s shares have gained 12% in the past six months.

SiteOne Landscape has an expected earnings growth rate of 28.6% for 2020. Over the past six months, the stock has climbed 36%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

Crown Holdings, Inc. (CCK) : Free Stock Analysis Report

iRobot Corporation (IRBT) : Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research