With An ROE Of 14.81%, Has Tetra Tech Inc’s (NASDAQ:TTEK) Management Done Well?

I am writing today to help inform people who are new to the stock market and want to begin learning the link between Tetra Tech Inc (NASDAQ:TTEK)’s return fundamentals and stock market performance.

Tetra Tech Inc (NASDAQ:TTEK) outperformed the Environmental and Facilities Services industry on the basis of its ROE – producing a higher 14.81% relative to the peer average of 12.02% over the past 12 months. Superficially, this looks great since we know that TTEK has generated big profits with little equity capital; however, ROE doesn’t tell us how much TTEK has borrowed in debt. Today, we’ll take a closer look at some factors like financial leverage to see how sustainable TTEK’s ROE is. See our latest analysis for Tetra Tech

What you must know about ROE

Return on Equity (ROE) weighs Tetra Tech’s profit against the level of its shareholders’ equity. It essentially shows how much the company can generate in earnings given the amount of equity it has raised. While a higher ROE is preferred in most cases, there are several other factors we should consider before drawing any conclusions.

Return on Equity = Net Profit ÷ Shareholders Equity

Returns are usually compared to costs to measure the efficiency of capital. Tetra Tech’s cost of equity is 8.59%. Given a positive discrepancy of 6.22% between return and cost, this indicates that Tetra Tech pays less for its capital than what it generates in return, which is a sign of capital efficiency. ROE can be dissected into three distinct ratios: net profit margin, asset turnover, and financial leverage. This is called the Dupont Formula:

Dupont Formula

ROE = profit margin × asset turnover × financial leverage

ROE = (annual net profit ÷ sales) × (sales ÷ assets) × (assets ÷ shareholders’ equity)

ROE = annual net profit ÷ shareholders’ equity

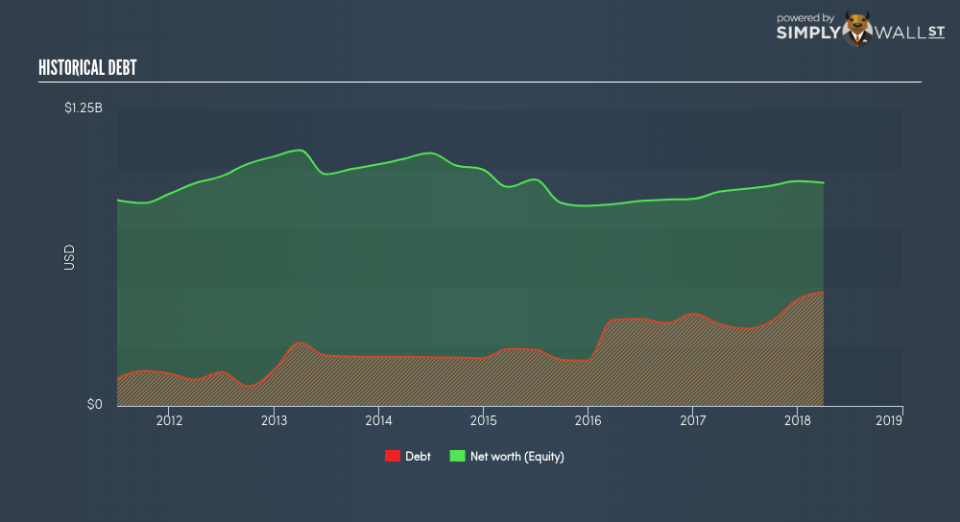

Basically, profit margin measures how much of revenue trickles down into earnings which illustrates how efficient the business is with its cost management. Asset turnover reveals how much revenue can be generated from Tetra Tech’s asset base. Finally, financial leverage will be our main focus today. It shows how much of assets are funded by equity and can show how sustainable the company’s capital structure is. Since ROE can be inflated by excessive debt, we need to examine Tetra Tech’s debt-to-equity level. Currently the debt-to-equity ratio stands at a reasonable 50.95%, which means its above-average ROE is driven by its ability to grow its profit without a significant debt burden.

Next Steps:

ROE is one of many ratios which meaningfully dissects financial statements, which illustrates the quality of a company. Tetra Tech exhibits a strong ROE against its peers, as well as sufficient returns to cover its cost of equity. ROE is not likely to be inflated by excessive debt funding, giving shareholders more conviction in the sustainability of high returns. Although ROE can be a useful metric, it is only a small part of diligent research.

For Tetra Tech, I’ve put together three pertinent aspects you should further examine:

Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

Valuation: What is Tetra Tech worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether Tetra Tech is currently mispriced by the market.

Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Tetra Tech? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.