Roku Options Volume Runs Quick After Bull Note

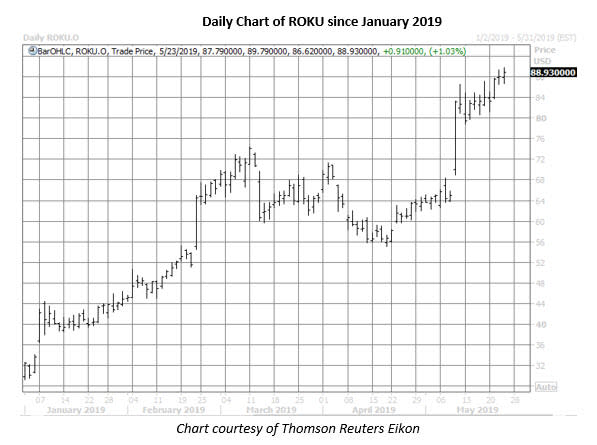

Roku Inc (NASDAQ:ROKU) stock is flexing its technical muscle today, up 1% at $88.93, fresh off a record high of $89.79, even as the broader equities market sells off. This upside comes courtesy of a price-target hike to $110 from $92 at D.A. Davidson -- a 25% premium to last night's close -- which said the streaming name's addition of Activation Insights could "serve as a catalyst" for ad sales.

Most analysts are already bullish on Roku, with nine of 16 maintaining a "buy" or better rating." However, the average 12-month price target of $79.24 is a nearly 11% discount to current trading levels, meaning more price-target hikes could be on the horizon for a stock that's nearly tripled on a year-to-date basis.

Elsewhere on Wall Street, skepticism has been ramping up, with short interest surging 24.1% in the April 15-May 1 reporting period. Not only does the 9.43 million shares sold short account for 11.6% of the security's available float, but Roku's ability to rally 12.5% over this same time period speaks to its underlying strength.

Options traders, meanwhile, have targeted ROKU puts at an accelerated clip. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 10-day put/call volume ratio of 0.68 ranks in the 70th annual percentile. So while calls have outnumbered puts on an absolute basis, the elevated ratio indicates the rate of put buying relative to call buying has been quicker than usual.

In today's trading, nearly 42,000 calls and 30,000 puts have crossed so far, 1.2 times the expected intraday amount. The weekly 5/24 90-strike call is most active, with 5,600 contracts on the tape, and new positions being initiated. Those buying the calls expect ROKU stock to break out above $90 by tomorrow's close, while those selling the calls think $90 will serve as a short-term ceiling.