Ron Muhlenkamp's Firm Starts 3 Positions in 3rd Quarter

Muhlenkamp & Co. Inc., the firm founded by Ronald Muhlenkamp (Trades, Portfolio), disclosed this week that its three new positions for the third quarter were in Berkshire Hathaway Inc. (NYSE:BRK.B), Lockheed Martin Corp. (NYSE:LMT) and CVS Health Corp. (NYSE:CVS).

The firm seeks long-term capital appreciation through stocks that have solid balance sheets and a return on equity of at least 15%. Muhlenkamp discussed in his shareholder letter several key market drivers during the second half of the year, including the U.S. - China trade war and the 2020 presidential elections. Given the potential for market volatility, Muhlenkamp reiterated his patient, defensive investing approach. The firm continues to evaluate its holdings "on an individual basis," selling the overvalued stocks and buying the undervalued stocks. Additionally, Muhlenkamp seeks to avoid cyclical stocks, those that are "particularly sensitive to the economic cycle."

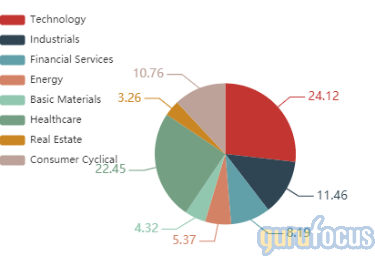

As of quarter-end, Muhlenkamp & Co's $205-million equity portfolio contains 34 stocks with a turnover ratio of 12%. The portfolio's top-three sectors in terms of weight are technology, health care and industrials.

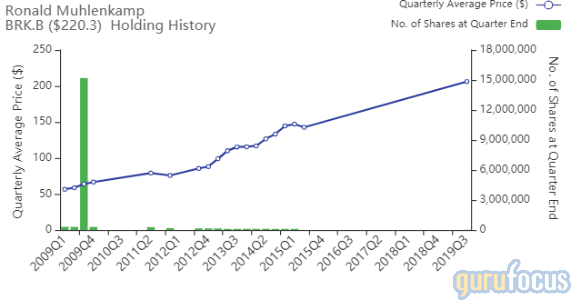

Berkshire Hathaway

Muhlenkamp's firm purchased 36,322 Class B shares of Berkshire Hathaway, giving the position 3.68% weight in the equity portfolio. Shares averaged $206.13 during the quarter.

Long-time Berkshire investor David Rolfe (Trades, Portfolio) closed his position in Warren Buffett (Trades, Portfolio)'s conglomerate, saying in Wedgewood's third-quarter shareholder letter that Berkshire's $125 billion cash pile hindered Wedgewood's goal of achieving a 10% growth rate.

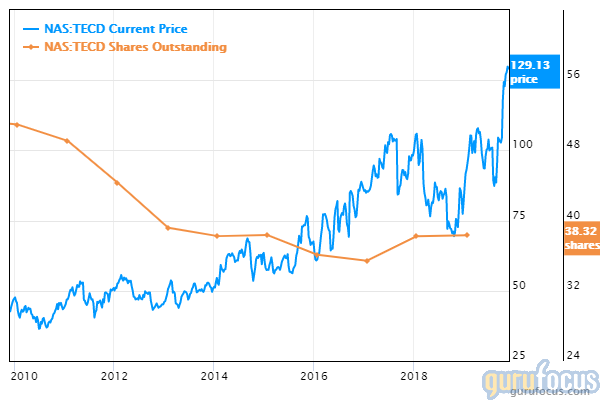

On Friday, Tech Data Corp. (NASDAQ:TECD) announced it has agreed to allow Tiger Midco, LLC, an affiliate of funds managed by private-equity company Apollo Global Management Inc. (NYSE:APO), to acquire all shares of the Clearwater, Florida-based computer hardware company in a transaction valued at approximately $6 billion.

CNBC columnist Becky Quick said Berkshire, whose cash pile soared over $128 billion according to its latest quarterly report, announced an offer of $140 per share for Tech Data, a transaction valued at approximately $5 billion excluding debt. Apollo then sweetened its offer to $145 per share; Tech Data agreed to the revised offer while Buffett's conglomerate backed away.

According to stock picks statistics, Berkshire's new positions for the quarter are Occidental Petroleum Corp. (NYSE:OXY) and RH (NYSE:RH).

Lockheed Martin

The firm purchased 18,888 shares of Lockheed Martin, giving the position 3.59% weight in the equity portfolio. Shares averaged $376.12 during the quarter.

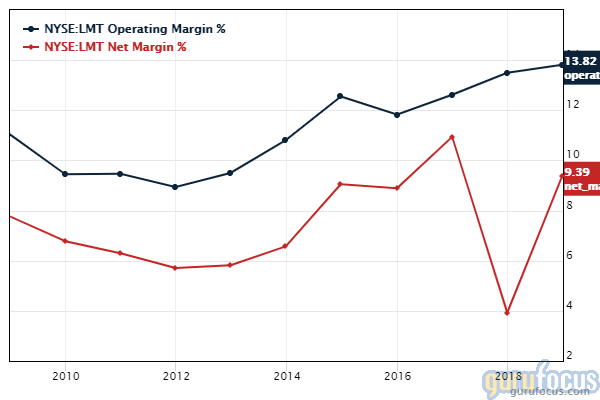

The Bethesda, Maryland-based company operates defense contracts like the F-35. GuruFocus ranks Lockheed Martin's profitability 9 out of 10 on several positive investing signs, which include a perfect Piotroski F-score of 9 and operating margins that have increased approximately 4.40% per year on average over the past five years and are outperforming 80.67% of global competitors.

Other gurus with holdings in Lockheed Martin include Joel Greenblatt (Trades, Portfolio) and Ken Heebner (Trades, Portfolio).

CVS

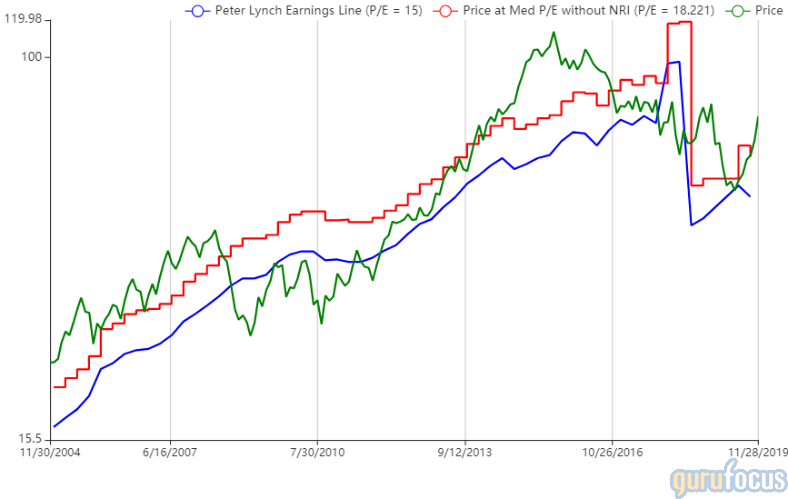

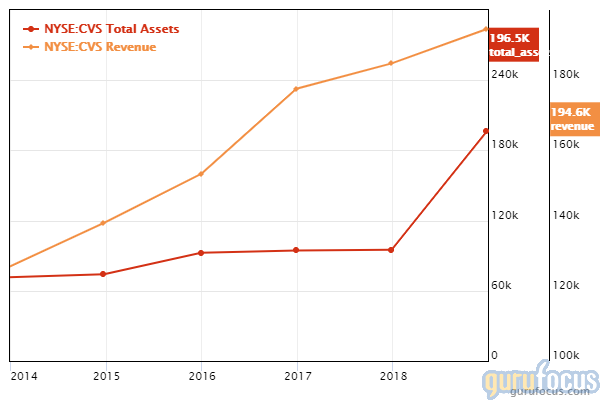

The firm purchased 70,035 shares of CVS, giving the position 2.15% weight in the equity portfolio. Shares averaged $59.22 during the quarter.

The Woonsocket, Rhode Island-based company operates a retail pharmacy chain that processes over 1.3 million prescriptions per year. GuruFocus ranks CVS's profitability 8 out of 10 primarily on the heels of the company's 4.5-star business predictability rank even though operating margins are near a 10-year low of 5% and underperforming 52.94% of global competitors. Warning signs include declining profit margins and higher asset growth compared to revenue growth.

Disclosure: No positions.

Read more here:

Top 5 Holdings of Al Gore's Generation Investment Management

Top 5 Buys of Steve Mandel's Lone Pine

Louis Moore Bacon's Top 6 Buys in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.