Ronald Muhlenkamp Buys 5 Stocks in 1st Quarter

- By James Li

Ronald Muhlenkamp (Trades, Portfolio), founder and president of Muhlenkamp & Co. Inc., disclosed this week he established five new positions during the first quarter: Broadcom Inc. (AVGO), Cigna Corp. (CI), Westinghouse Air Brake Technologies Corp. (WAB), Enterprise Products Partners LP (EPD) and Morgan Stanley (MS).

Muhlenkamp seeks companies with strong balance sheets and high returns on equity. The guru believes that over time, stock prices reflect the companies' underlying value and that the long-term business of investing offers a higher chance of profitability and reliability.

As of quarter-end, Muhlenkamp's $211 million equity portfolio contained 33 stocks, of which five were new holdings. The portfolio's top three sectors in terms of weight were technology, health care and basic materials.

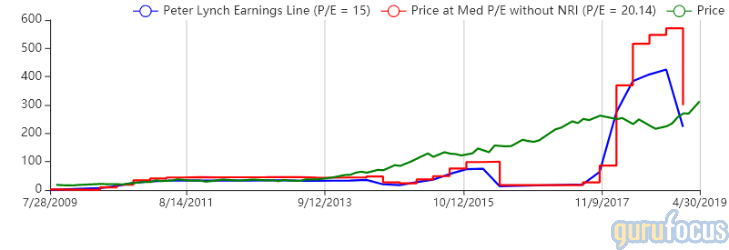

Broadcom

Muhlenkamp purchased 26,747 shares of Broadcom, giving the position 3.81% weight in the equity portfolio. Shares averaged $270.85 during the first quarter.

On Thursday, the Dow Jones Industrial Averaged closed just 286.14 points lower despite trading over 400 points below Wednesday's close of 25,776.61 at the intraday low. CNBC columnist Fred Imbert said Wall Street is starting to realize the U.S.-China trade war can last "longer than previously expected." JPMorgan Chase & Co. (JPM) Executive Director Adam Crisafulli added that the trade landscape looks "bleaker" than it was before.

Although Intel Corp. (INTC) closed 1.2% higher, paring the Dow's losses, other semiconductor stocks like Broadcom and major David Tepper (Trades, Portfolio) and Mohnish Pabrai (Trades, Portfolio) holding Micron Technology Inc. (MU) declined nearly 3%.

GuruFocus ranks the San Jose, California-based semiconductor company's profitability 8 out of 10 on several positive indicators, which include a Joel Greenblatt (Trades, Portfolio) return on capital and three-year revenue growth rate that outperforms over 90% of global competitors. Broadcom's return on invested capital of 20.20% exceeds its weighted average cost of capital, suggesting capital creation.

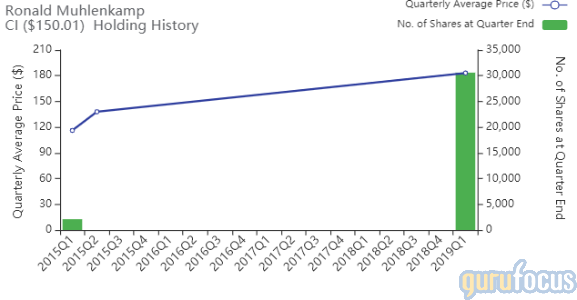

Cigna

Muhlenkamp purchased 30,600 shares of Cigna, giving the position 2.33% portfolio equity space. Shares averaged $183.17 during the quarter.

The Bloomfield, Connecticut-based company provides a wide range of health care plans through the group employer market. GuruFocus ranks Cigna's financial strength 4 out of 10: Although the company's debt-to-equity ratio of 0.96 outperforms 68.42% of global competitors, its cash-debt ratio of 0.12 underperforms 67.86% of global competitors.

Larry Robbins (Trades, Portfolio) and Dodge & Cox also purchased shares of Cigna during the quarter.

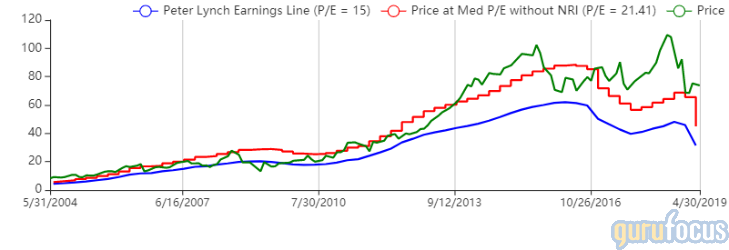

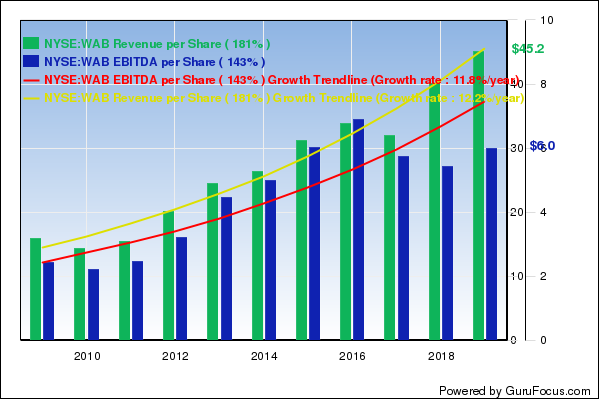

Westinghouse Air Brake

Muhlenkamp purchased 52,695 shares of Westinghouse Air Brake, giving the position 1.84% equity portfolio space. Shares averaged $72.15 during the quarter.

The Wilmerding, Pennsylvania-based company provides value-added, technology-based products and services for the rail industry. GuruFocus ranks Westinghouse's profitability 7 out of 10: Even though the company's three-year Ebitda growth rate underperforms 70% of global competitors, its Greenblatt return on capital is outperforming 91.72% of global competitors.

Enterprise Products

Muhlenkamp purchased 25,184 shares of Enterprise Products, giving the position 0.35% equity portfolio space. Shares averaged $27.88 during the quarter.

The Houston-based energy midstream company transports and processes natural gas, natural gas liquids, crude oil, refined products and petrochemicals. GuruFocus ranks the company's profitability 6 out of 10: Although it has a strong Piotroski F-score of 8 and a 19.47% return on equity, Enterprise Products' operating margin is underperforming 62.96% of global competitors.

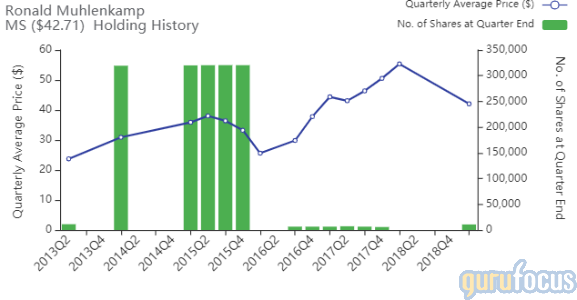

Morgan Stanley

Muhlenkamp purchased 10,805 shares of Morgan Stanley, giving the position 0.22% equity portfolio space. Shares averaged $42.07 during the quarter.

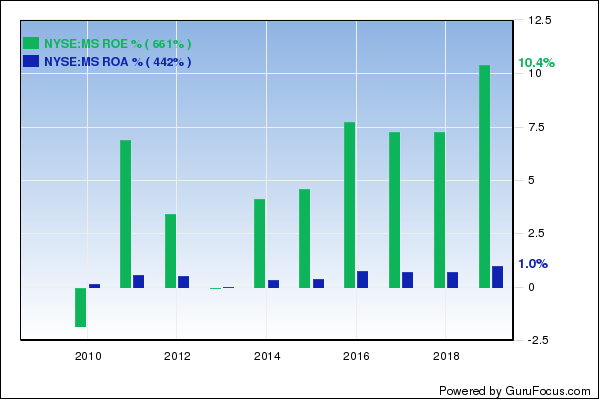

The New York-based investment bank operates business segments like institutional securities, wealth management and asset management. GuruFocus ranks the bank's profitability 4 out of 10: Although the 10.06% return on equity outperforms 61.40% of global competitors, Morgan Stanley's 0.98% return on assets underperforms 64.05% of global competitors.

Disclosure: No positions.

Read more here:

5 Stocks Robertson's Tiger Cubs Agree On

Al Gore's Generation Investment Buys Nutanix in May and 2 Stocks in 1st Quarter

Larry Robbins' Top 6 Buys of the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.