Ronald Muhlenkamp Gains 4 New Holdings, Sells 2 Others

- By Sydnee Gatewood

Ronald Muhlenkamp (Trades, Portfolio), the founder and portfolio manager of Muhlenkamp & Co. Inc., established four new holdings and exited two others in the final quarter of 2016.

Warning! GuruFocus has detected 3 Warning Sign with ORKLF. Click here to check it out.

The intrinsic value of FII

Muhlenkamp established his firm in 1977 in Wexford, Pennsylvania. The firm seeks to maximize total returns through capital appreciation and income from dividends and interest. He invests in highly profitable companies selling at a good value based on the price-earnings (P/E) ratio and return on equity (ROE).

The guru established holdings in Federated Investors Inc. (FII), GameStop Corp. (GME), Cameco Corp. (CCJ) and Energy Transfer Partners LP (ETP).

Muhlenkamp purchased 299,866 shares of Federated Investors for an average price of $27.7 per share. The trade impacted the portfolio by 2.7%.

Federated Investors provides investment management products and related financial services to its customers. The Pennsylvania-based company has a market cap of $2.7 billion; its shares were trading around $26.31 on Friday with a P/E ratio of 13.1, a forward P/E ratio of 13.2, a price-book (P/B) ratio of 4.5 and a price-sales (P/S) ratio of 2.3.

The Peter Lynch chart below shows the stock is trading below its fair value.

GuruFocus ranked the company's financial strength 6 of 10 and its profitability and growth 7 of 10. The stock's forward dividend yield is 3.9% and its trailing 12-month dividend yield is 3.8%. The company's average three-year EPS growth rate is 9.4% per year.

Among the gurus invested in Federated Investors, Chuck Royce (Trades, Portfolio) is the largest shareholder. He holds 4.44% of outstanding shares, which represents 0.88% of his total assets managed. In total, seven gurus hold positions.

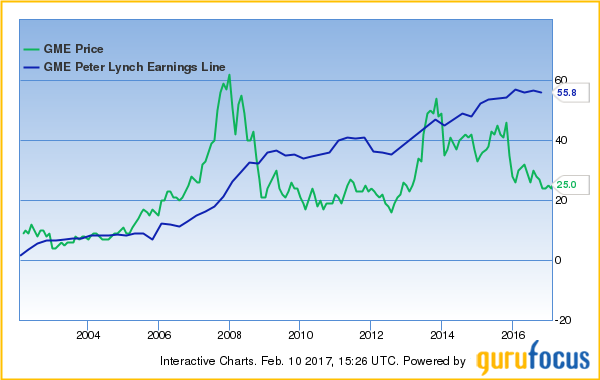

After previously selling out of GameStop in third-quarter 2011, the guru established a new stake of 263,124 shares. He paid an average price of $24.69 per share. The transaction had an impact of 2.1% on the portfolio.

GameStop sells video games, consumer electronics and other wireless services to consumers through its retail stores. The Texas-based company has a market cap of $2.6 billion; its shares were trading around $25.52 on Friday with a P/E ratio of 6.9, a forward P/E ratio of 6.6, a P/B ratio of 1.2 and a P/S ratio of 0.3.

The Peter Lynch chart below shows the stock is trading below its fair value.

The company's financial strength was ranked 6 of 10 while its profitability and growth was ranked 7 of 10 by GuruFocus. The stock's forward dividend yield is 5.9%, and its trailing 12-month dividend yield is 5.8%.

NWQ Managers (Trades, Portfolio) is GameStop's largest shareholder among the gurus with 1.9% of outstanding shares, which represents 0.8% of its total assets managed. Jim Simons (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Royce and David Dreman (Trades, Portfolio) also hold the stock.

Muhlenkamp bought 551,392 shares of Cameco for an average price of $9.03 per share. The trade expanded the portfolio by 1.8%.

Cameco is one of the world's largest producers of uranium. The Canadian company has a market cap of $4.4 billion; its shares were trading around $11.01 Friday with a P/E ratio of 79.7, a forward P/E ratio of 24.8, a P/B ratio of 1.03 and a P/S ratio of 2.3.

The Peter Lynch chart below shows the stock is trading above its fair value.

Cameco's financial strength was ranked 5 of 10 by GuruFocus and its profitability and growth was ranked 7 of 10. The stock's forward dividend yield is 2.8% and its trailing 12-month dividend yield is 2.7%. The company's average three-year EPS growth rate is -37% per year.

Manning & Napier Advisors Inc. is Cameco's largest guru investor. It holds 3.5% of outstanding shares, representing 0.9% of its total assets managed. In total, eight gurus hold shares.

After selling out of Energy Transfer Partners in first-quarter 2016, Muhlenkamp established a new holding of 11,440 shares for an average price of $35.66 per share. The transaction expanded the portfolio by 0.13%.

Energy Transfer Partners is an oil and gas midstream company engaged in transportation and storage. The Texas-based company has a market cap of $31.8 billion; its shares were trading around $38.36 Friday with a forward P/E ratio of 18.6, a P/B ratio of 1.07 and a P/S ratio of 0.9.

The Peter Lynch Chart below shows the stock is trading above its fair value.

GuruFocus ranked the company's financial strength 4 of 10. Its profitability and growth was ranked 7 of 10. The stock's forward dividend yield is 10.8% and its trailing 12-month dividend yield is 11.01%.

David Tepper (Trades, Portfolio) is the company's largest guru investor with 1.4% of outstanding shares. This represents 9.7% of his total assets managed. Simons and Leon Cooperman (Trades, Portfolio) also have positions in Energy Transfer Partners.

Muhlenkamp exited DoubleLine Income Solutions Fund (DSL) and Teekay Tankers Ltd. (TNK) during the quarter.

After establishing the stake in second-quarter 2016, he sold all 33,720 shares of DoubleLine for an average price of $18.57 per share. The divestiture had an impact of -0.24% on the portfolio.

The guru sold 55,090 shares of Teekay Tankers for an average price of $2.45 per share. He established the initial holding of 51,795 shares in fourth-quarter 2014. The sale had an impact of -0.05% on the portfolio.

Disclosure: I do not own any stocks mentioned in the article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with ORKLF. Click here to check it out.

The intrinsic value of FII