Is There Room Left for Janus Henderson to Run?

- By Nicholas Kitonyi

Shares of U.K.-based asset management company Janus Henderson Group PLC (NYSE:JHG) are up more than 38% since the start of November. This rally coincides with the company's announcement of its most recent quarterly results at the end of October.

The company has now gained more than 180% since bottoming in March amid the coronavirus pandemic, but it is only up 37% this year. The company manages several funds, including exchange-traded funds that are listed on U.S. stock exchanges, while others like the Henderson EuroTrust Plc (LSE:HNE) are listed on U.K. stock exchanges.

As of the end of the fiscal third quarter, Janus Henderson had $358.5 billion in assets under management. This makes it one of the world's largest asset managers.

Highlights from the recent quarter

In the most recent quarter, Janus Henderson posted adjusted diluted earnings of 70 cents per share, up 6 cents from 64 cents in the prior-year quarter. Revenue for the period came in at $568.5 million, up $32.5 million year over year.

The company is focusing on building organic growth despite the bottlenecks created by Covid-19. CEO Dick Weil said that Janus Henderson's "third-quarter results reflect solid long-term investment performance, improved flows, strong financials and a continuation of returning excess cash to shareholders."

The company paid 36 cents in dividend per share late last month for the quarter ended Sept. 30. It also bought back $50.2 million worth of shares during the quarter as part of the $200 million share repurchase program approved back in February.

Janus Henderson also said that its long-term investment funds continue to outperform the benchmark. They are now up 61% and 73% over the last three years and five years.

A look at some of the publicly listed funds

One of its best-performing funds, Henderson EuroTrust, is up 20% this year and more than 78% over the last five years cumulatively. The portfolio manager of the HNE fund, Jamie Ross, recently published a presentation to investors citing optimism going into next year. Ross expects the Henderson EuroTrust to continue to outperform the market over time as it focuses on both high growth and high quality opportunities.

Janus Henderson's other funds include the Janus Henderson Mortgage-Backed Securities ETF (JMBS), up 2.84% this year, Janus Henderson Small Cap Growth Alpha ETF (NASDAQ:JSML), up 27.6% year to date, and Janus Henderson Short Duration Income ETF (VNLA), up 1.71%, among others.

The Small-Cap Growth Alpha ETF appears to be among the best performers. It is clearly an aggressive growth portfolio, but when you compare it to the EuroTrust Fund, the latter is not far off, yet it is relatively balanced by adding high-quality investments. Therefore, for investors looking to invest in specific units of Janus Henderson, this could be a good suggestion.

Valuation

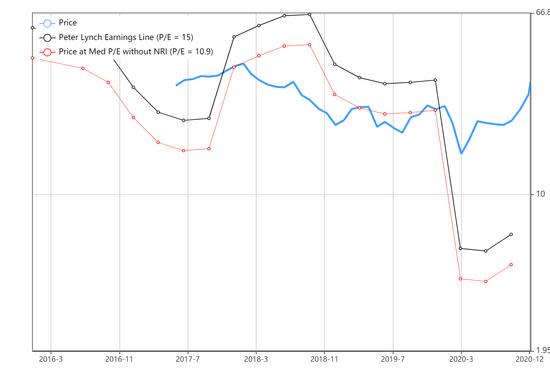

From a valuation perspective, shares of Janus Henderson trade at a trailing 12-month price-earnings ratio of 78.20, which compares to T. Rowe Price Group Inc.'s (NASDAQ:TROW) equivalent of 17.27. Invesco Ltd. (NYSE:IVZ) and Franklin Resources Inc. (NYSE:BEN) also trade at relatively low price-earnings ratios of 16.82 and 15.11.

However, when we factor in expected earnings growth for the next 12 months, Janus Henderson shares trade at a forward price-earnings ratio of 12.08, which is relatively better than T. Rowe Price's equivalent of 14.71. Invesco and Franklin Resources still trade at incredibly lower forward price-earnings ratios of 9.10 and 8.91.

In summary, Janus Henderson appears to be fairly valued based on expected earnings for the next 12 months. Its valuation based on the trailing 12-month period looks extremely high compared to peers.

Disclosure: No positions in the stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.