Will Roper (ROP) Disappoint in Q3 Earnings on Cost Woes?

Roper Technologies, Inc. ROP is scheduled to release third-quarter 2022 results on Oct 26, before the market open.

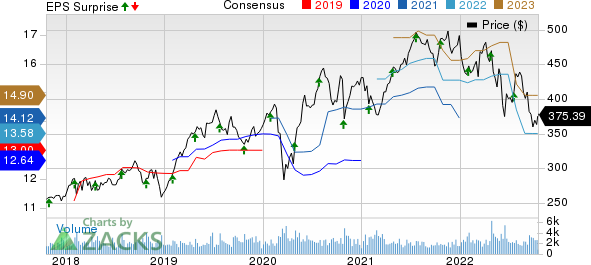

The Zacks Consensus Estimate for ROP’s third-quarter earnings has been revised downward by 13.2% in the past 90 days. However, the company has an impressive earnings surprise history, having outperformed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 2.2%.

Let’s see how things are shaping up for Roper this earnings season.

Factors to Note

Roper’s Application Software segment’s performance is expected to have gained from strength across its Deltek, Vertafore, Aderant, CliniSys and Data Innovations businesses. Strength in the recurring revenue stream, led by strong customer retention and continued migration to SaaS delivery models is likely to have driven the Application Software segment’s performance.

Our estimate for Application Software revenues in the third quarter indicates a 9.7% rise from the year-ago reported number. Our estimate for Application Software segment’s gross profit in the third quarter indicates an 8.7% rise from the year-ago reported number. The Zacks Consensus Estimate for the same indicates an 8.1% rise from the year ago figure.

In the third quarter, the Network Software segment is anticipated to have benefited from the strong performance of the U.S. and Canadian freight matching businesses and from strength across the Foundry business owing to solid innovation capability.

Our estimate for Network Software segment revenues in the third quarter indicates an 11.7% rise from the year-ago reported figure. For the third quarter, we expect the Network Software segment gross profit to climb 12.7% year over year. The consensus mark for third-quarter Network Software segment gross profit suggests a 6% increase from the year-ago reported number.

The company’s Neptune business is fueling the growth of its Technology Enabled Products segment. Roper’s Technology Enabled Products segment is anticipated to have benefited from strong ordering activity in the medical product business, including Verathon and Northern Digital.

Our estimate for Technology Enabled Products segment revenues in the to-be-reported quarter indicates a 9.9% rise from the year-ago reported figure. We expect gross profit in the Technology Enabled Products segment to inch up 3.8% year over year.

However, the rising cost of sales (due to raw material cost inflation) and selling, general and administrative expenses might have hurt Roper’s bottom line in the third quarter. Supply-chain constraints might have also negatively impacted its performance.

A strong U.S. dollar might have depressed Roper’s overseas business performance, given its international presence.

What Does the Zacks Model Say?

Our proven model does not conclusively predict an earnings beat for Roper this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates, which is not the case here, as elaborated below. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Roper has an Earnings ESP of +0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate is pegged at $3.45. You can uncover the best stocks with our Earnings ESP Filter.

Roper Technologies, Inc. Price, Consensus and EPS Surprise

Roper Technologies, Inc. price-consensus-eps-surprise-chart | Roper Technologies, Inc. Quote

Zacks Rank: Roper carries a Zacks Rank #3.

Highlights of Q2 Earnings

Roper’s second-quarter 2022 adjusted earnings (excluding $1.43 from non-recurring items) of $3.95 per share surpassed the Zacks Consensus Estimate of $3.82. On a year-over-year basis, earnings expanded 5.1% despite high costs.

Roper’s net revenues of $1,310.8 million missed the Zacks Consensus Estimate of $1,537 million. The top line decreased 17.4% year over year. Organic sales in the quarter increased 11%, owing to software recurring revenue growth of 12%. Acquisitions/divestitures boosted sales by 1%. However, movement in foreign currency translation had an adverse impact of 1%.

Stocks to Consider

Here are some other companies which, according to our model, have the right combination of elements to beat on earnings this reporting cycle.

Sonoco Products Company SON has an Earnings ESP of +4.20% and a Zacks Rank #3 at present. SON is slated to release third-quarter 2022 results on Oct 31.

Sonoco’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 4.1%.

Emerson Electric Co. EMR currently has an Earnings ESP of +1.08% and a Zacks Rank of 3. EMR is scheduled to release fourth-quarter fiscal 2022 (ended Sep 30, 2022) results on Nov 2.

Emerson’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 6%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Emerson Electric Co. (EMR) : Free Stock Analysis Report

Sonoco Products Company (SON) : Free Stock Analysis Report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research