Roper Technologies (ROP) Prices $1.5B Senior Notes Offering

Roper Technologies, Inc. ROP, on Aug 14, priced an offering of $1.5 billion of its senior unsecured notes, including $700 million of 3.650% senior notes due to expire on Sep 15, 2023, and $800 million of 4.20% senior notes due to expire on Sep 15, 2028. Subject to customary closing conditions, this offering is anticipated to close on Aug 28, 2018.

As communicated by the company, notes due to expire in 2023 have been priced at 99.838% of the principal amount while that set to expire in 2028 has been offered to the public at 99.892% of the principal amount. Interest rates on the notes will be paid semi-annually on Mar 15 and Sep 15, starting from Mar 15, 2019.

Ratings of the issuance are expected to be ‘Baa3 (stable)’ by Moody's Investors Service and ‘BBB+ (stable)’ by Standard & Poor’s Ratings Services.

This machinery company intends on using the funds for redeeming $500 million of 6.25% senior notes, due to expire in 2019. Moreover, the proceeds will be utilized for satisfying general corporate purposes and repaying 2016 credit facility (unsecured).

Exiting second-quarter 2018, Roper Technologies had long-term debt of approximately $4,821.7 million, up from $4,354.6 million recorded at the end of 2017, and had total debt/total equity of 77% versus 75.1% at the end of 2017. During the first half of 2018, the company raised $465 million from fresh debt issuances. We believe, if unchecked, huge debt levels are likely to increase the company’s financial burden and prove detrimental to the profitability.

With a market capitalization of $30.3 billion, Roper Technologies presently carries a Zacks Rank #3 (Hold). It recorded a 7.05% earnings surprise in the second quarter of 2018 while the bottom line exceeded the year-ago tally by 29%.

For 2018, the company has increased its earnings guidance from $11.08-$11.32 to $11.40-$11.56 per share. Highly engineered products, unique asset-light business model and improving balance sheet are aiding the company. However, rising cost of goods sold remains a concern.

Over the past three months, Roper Technologies’ shares have rallied 6.6%, outperforming 2.2% increase recorded by the industry.

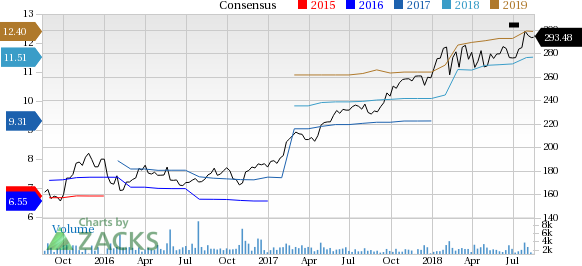

Furthermore, the stock’s earnings estimates are currently pegged at $11.51 for 2018 and $12.40 for 2019, reflecting growth of 2.1% from the respective 30-day-ago tallies.

Roper Technologies, Inc. Price and Consensus

Roper Technologies, Inc. Price and Consensus | Roper Technologies, Inc. Quote

Stocks to Consider

Some better-ranked stocks in the industry are Altra Industrial Motion Corp. AIMC, Colfax Corporation CFX and DXP Enterprises, Inc. DXPE. All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates on these three stocks improved for the current year and the next year. Furthermore, earnings surprise for the last four quarters was a positive 4.01% for Altra Industrial, 7.9% for Colfax and 101.32% for DXP Enterprises.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research